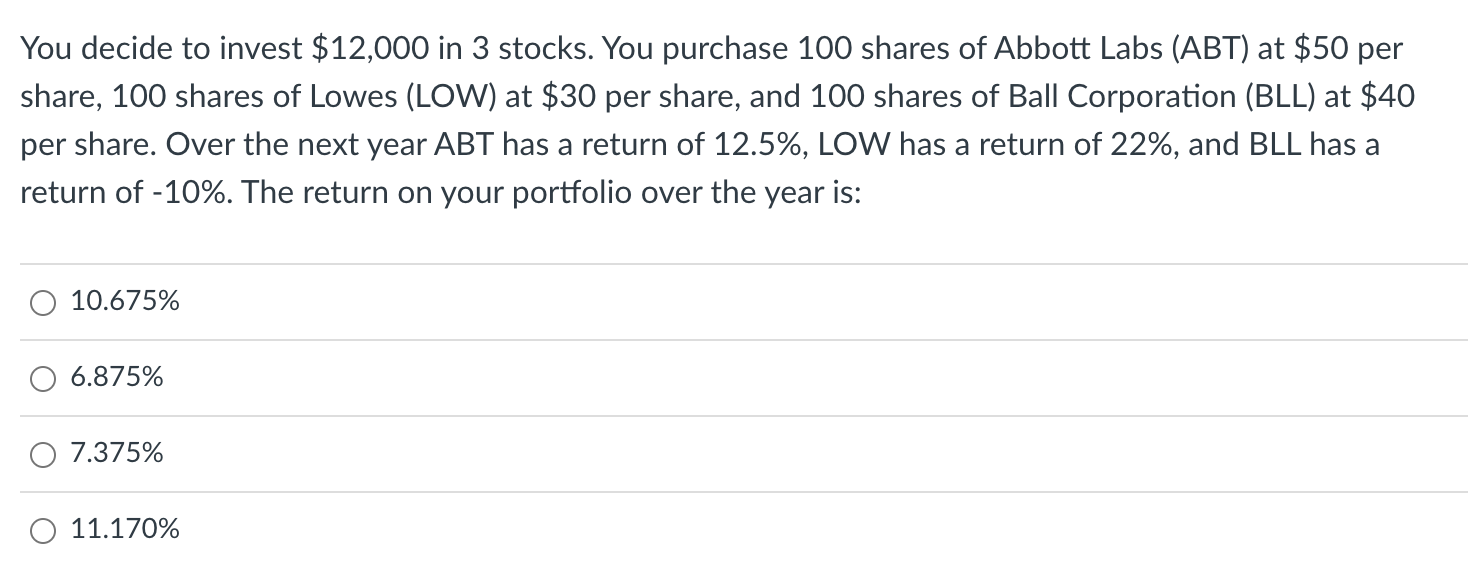

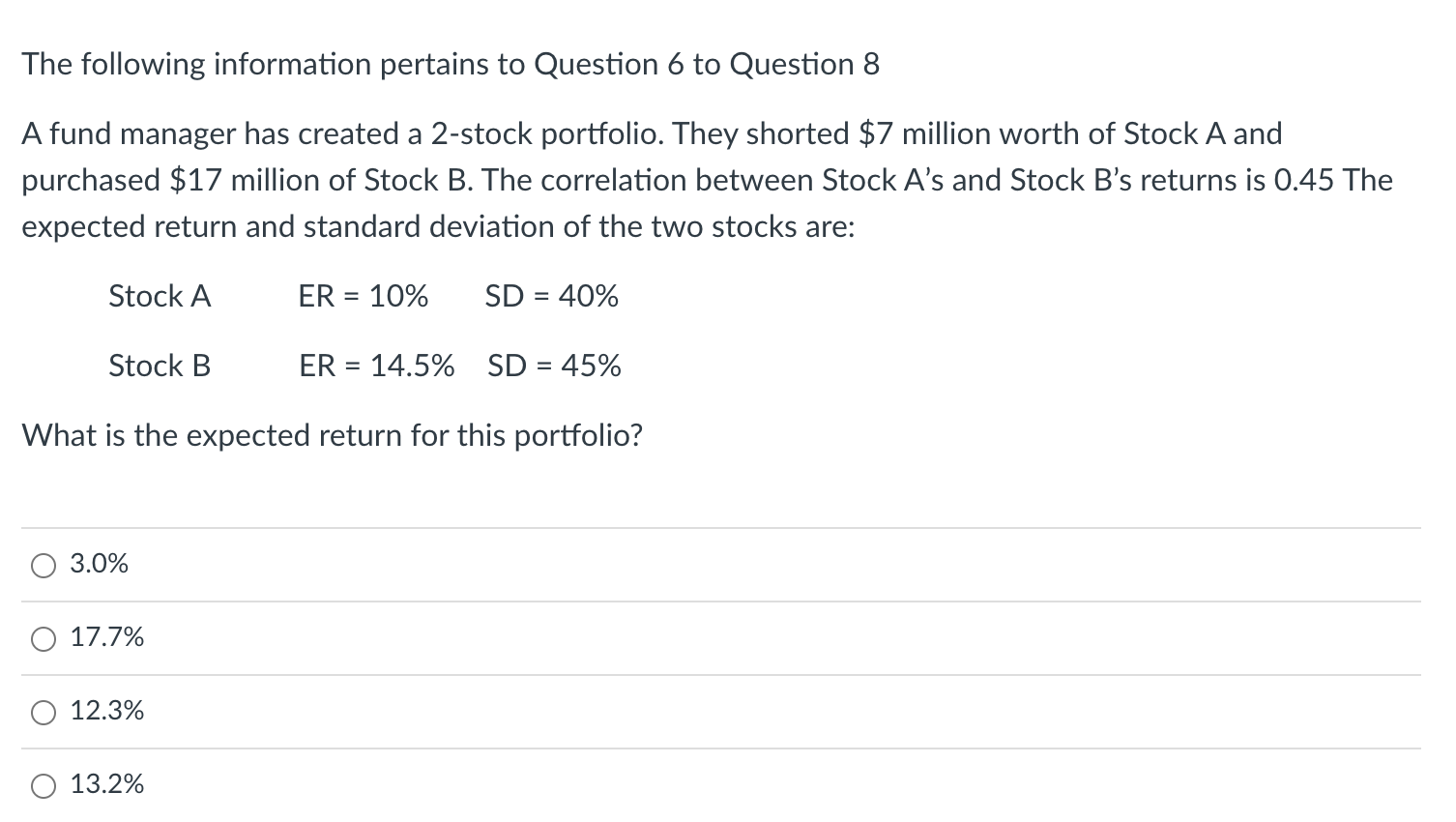

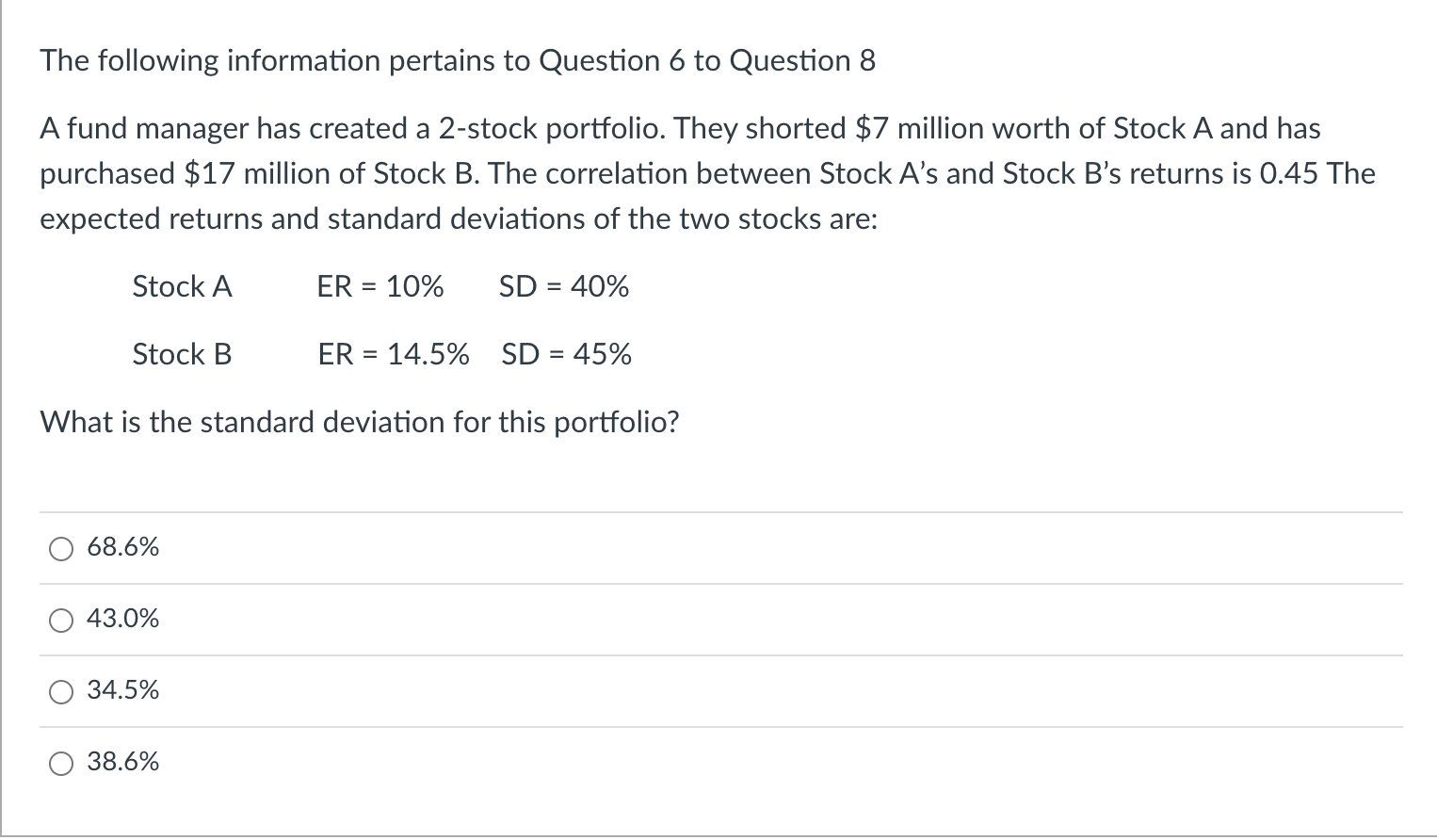

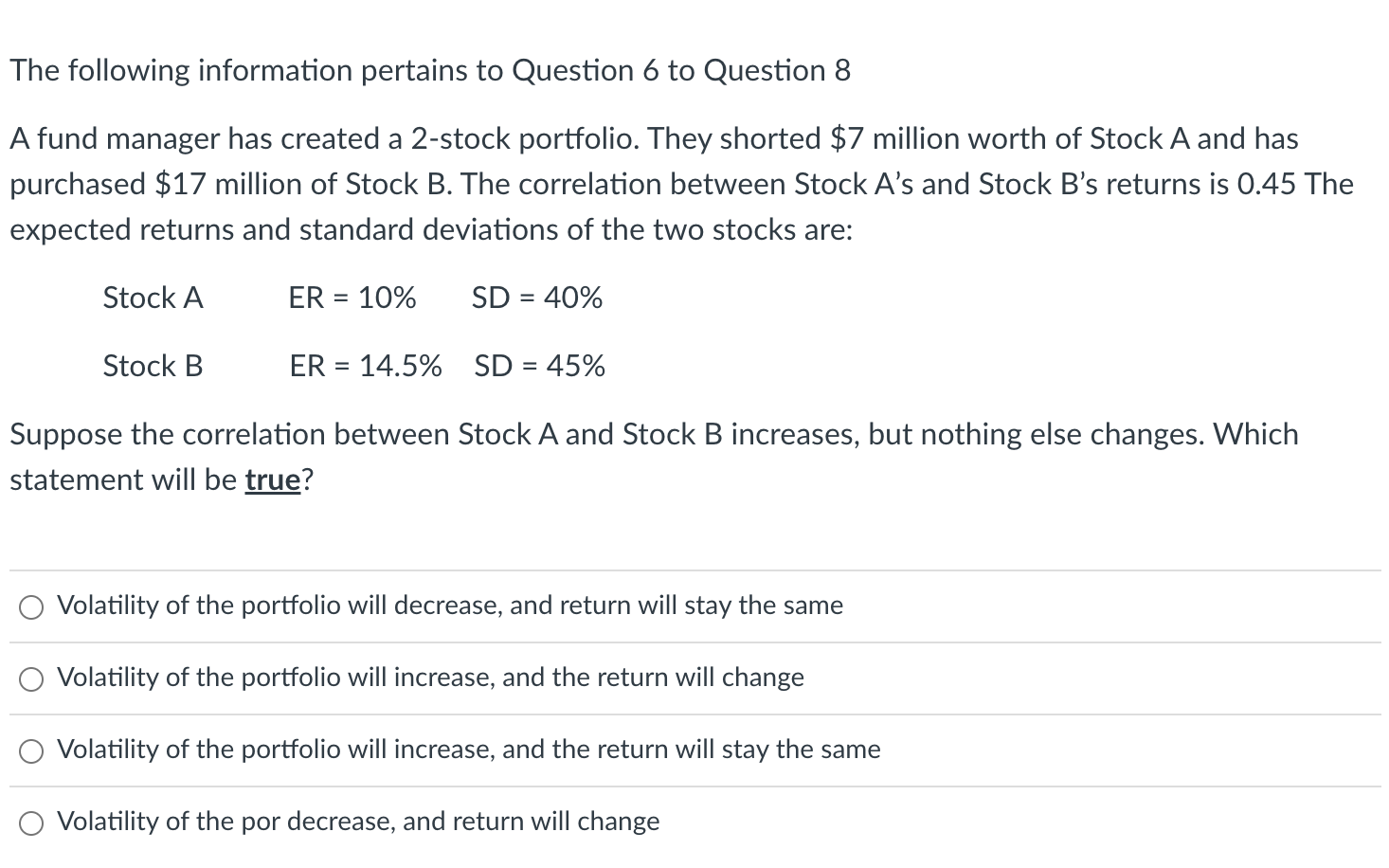

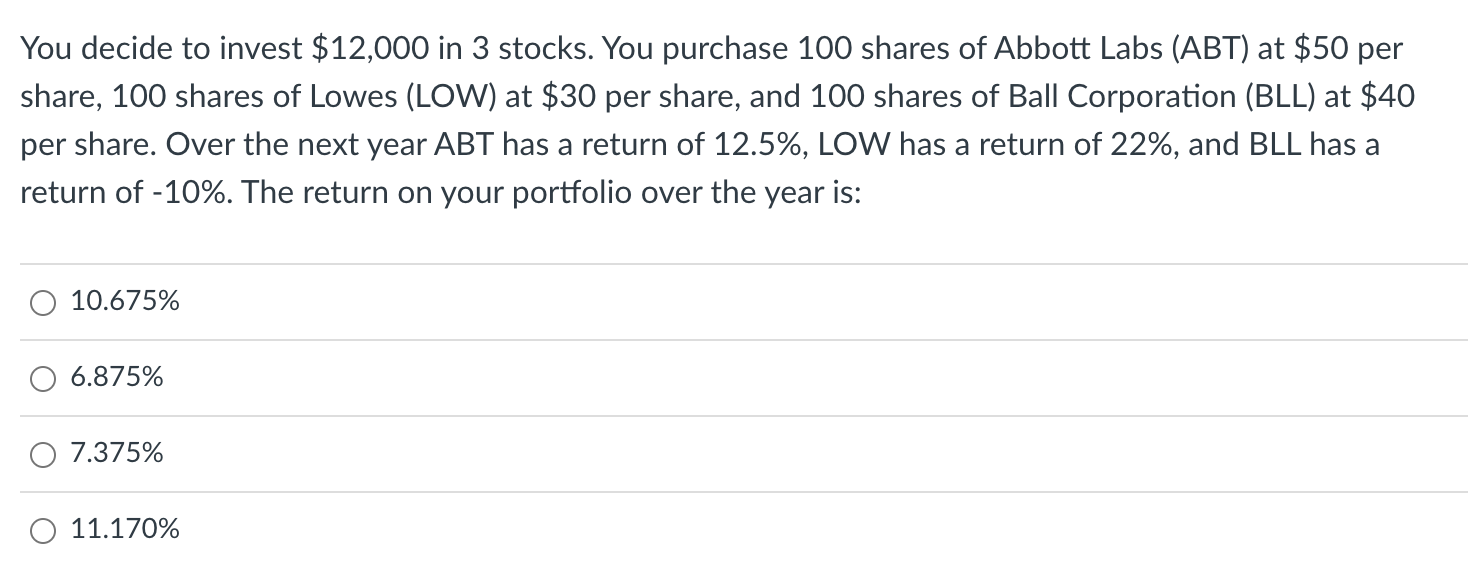

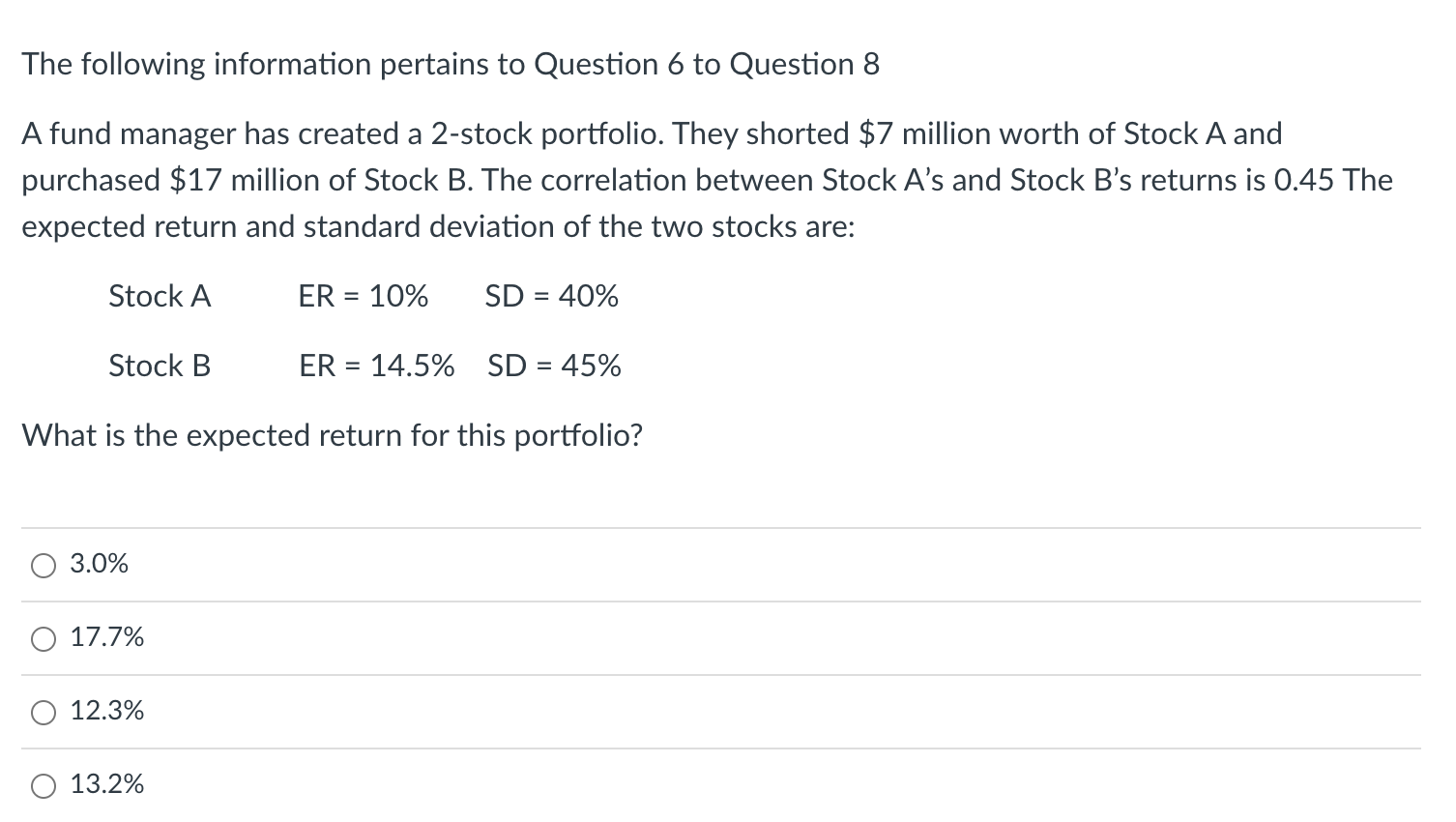

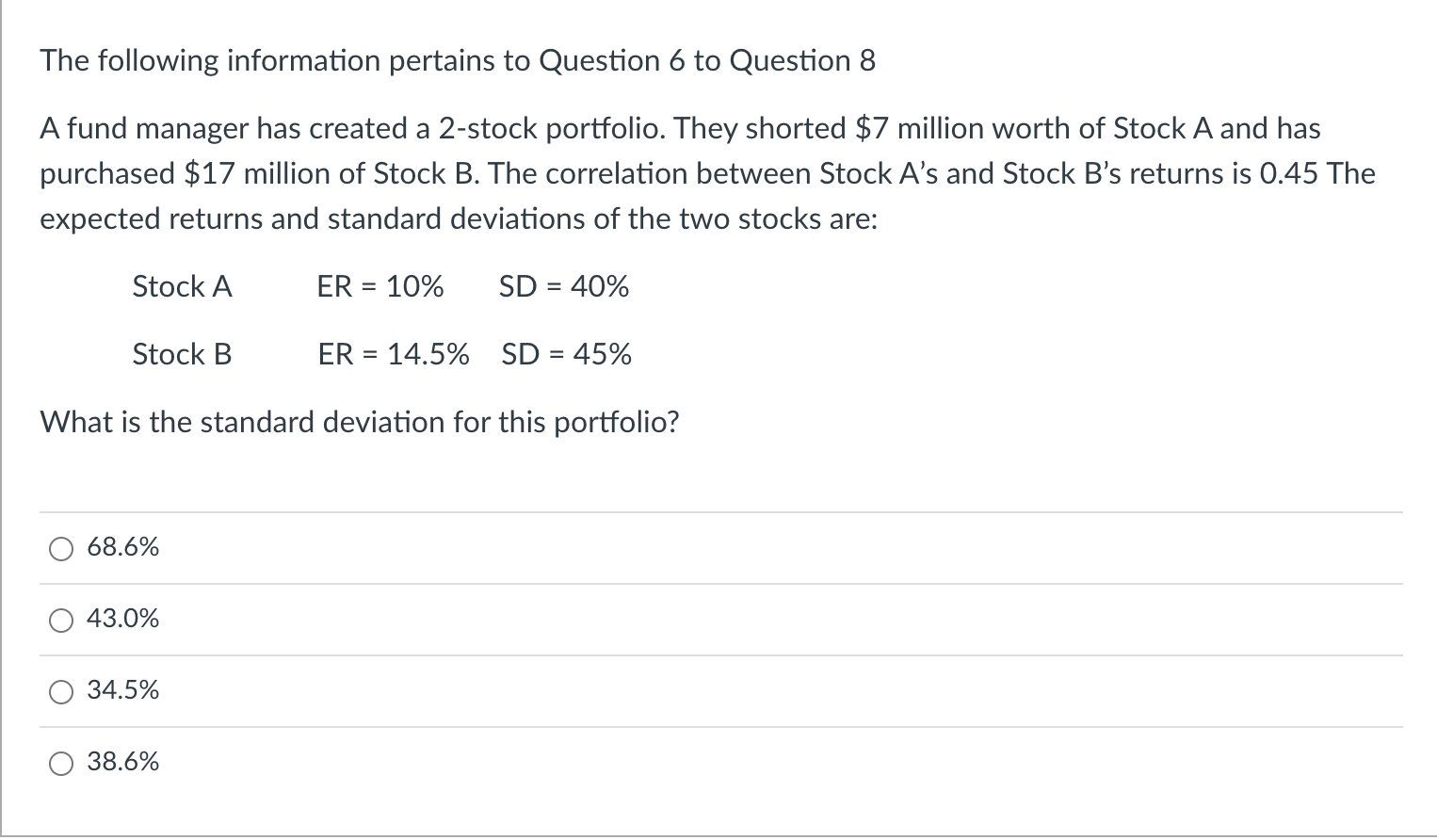

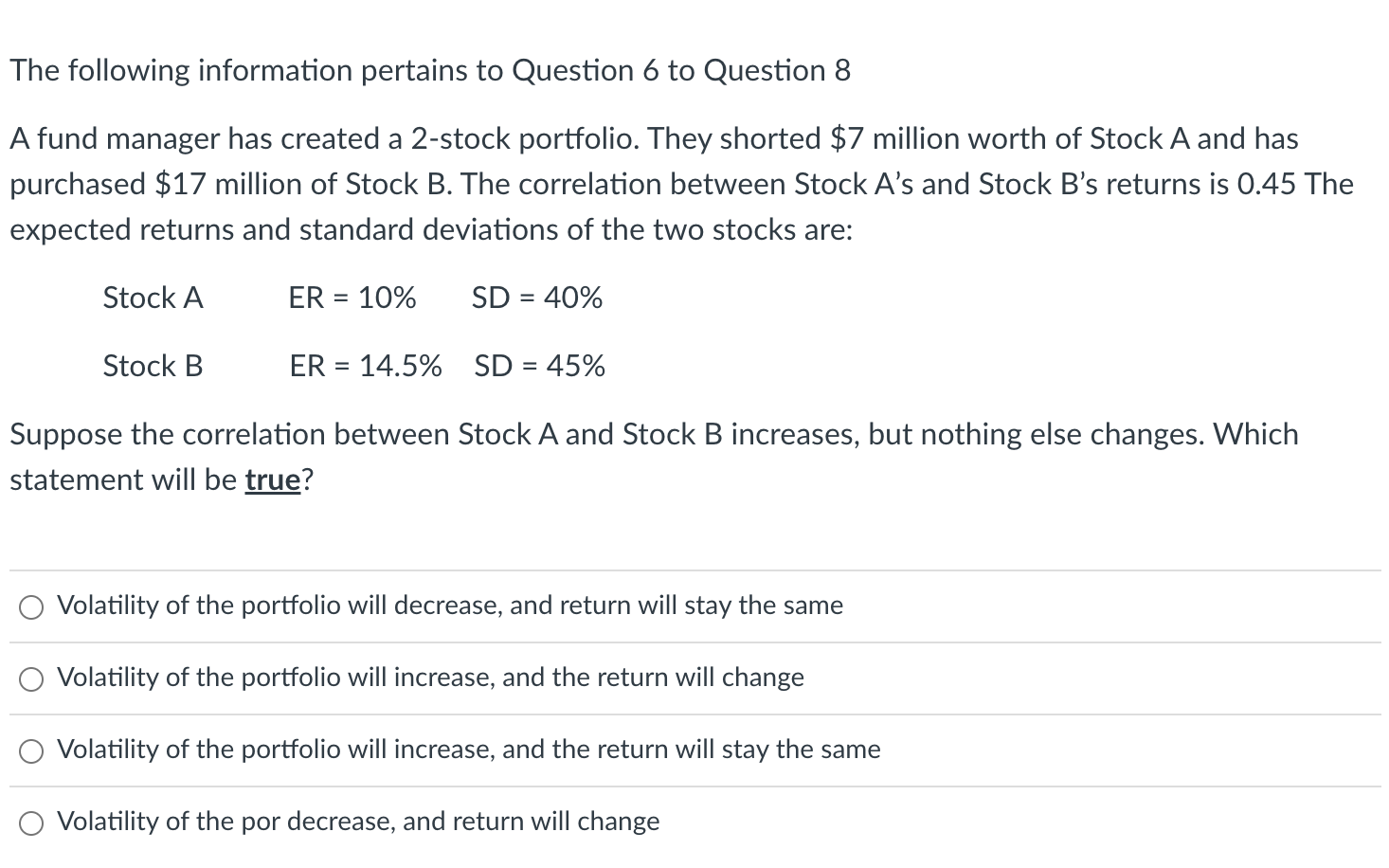

You decide to invest $12,000 in 3 stocks. You purchase 100 shares of Abbott Labs (ABT) at $50 per share, 100 shares of Lowes (LOW) at $30 per share, and 100 shares of Ball Corporation (BLL) at $40 per share. Over the next year ABT has a return of 12.5%, LOW has a return of 22%, and BLL has a return of 10%. The return on your portfolio over the year is: \begin{tabular}{c} \hline 10.675% \\ \hline 6.875% \\ \hline 7.375% \\ \hline 11.170% \end{tabular} The following information pertains to Question 6 to Question 8 A fund manager has created a 2-stock portfolio. They shorted \$7 million worth of Stock A and purchased \$17 million of Stock B. The correlation between Stock A's and Stock B's returns is 0.45 The expected return and standard deviation of the two stocks are: Stock AER=10%SD=40% Stock B ER=14.5%SD=45% What is the expected return for this portfolio? \begin{tabular}{|} \hline 3.0% \\ \hline 17.7% \\ \hline 12.3% \\ \hline 13.2% \end{tabular} The following information pertains to Question 6 to Question 8 A fund manager has created a 2-stock portfolio. They shorted \$7 million worth of Stock A and has purchased $17 million of Stock B. The correlation between Stock A's and Stock B's returns is 0.45 The expected returns and standard deviations of the two stocks are: Stock AER=10%SD=40% Stock BER=14.5%SD=45% What is the standard deviation for this portfolio? \begin{tabular}{|} \hline 68.6% \\ \hline 43.0% \\ \hline 34.5% \\ \hline 38.6% \end{tabular} The following information pertains to Question 6 to Question 8 A fund manager has created a 2-stock portfolio. They shorted \$7 million worth of Stock A and has purchased \$17 million of Stock B. The correlation between Stock A's and Stock B's returns is 0.45 The expected returns and standard deviations of the two stocks are: Stock AER=10%SD=40% Stock B ER=14.5%SD=45% Suppose the correlation between Stock A and Stock B increases, but nothing else changes. Which statement will be true? Volatility of the portfolio will decrease, and return will stay the same Volatility of the portfolio will increase, and the return will change Volatility of the portfolio will increase, and the return will stay the same Volatility of the por decrease, and return will change