Question

You decided to first value the company using the WACC approach and target D/V ratio of 0.4. 1. Estimate the WACC for the company. (Use

You decided to first value the company using the WACC approach and target D/V ratio of 0.4.

1. Estimate the WACC for the company. (Use 5-digit rounding to get an exact answer).

(a) 7.354%

(b) 7.595%

(c) 6.856%

(d) 6.054%

(e) 7.108%

2. Based on the WACC approach, estimate the firm value (Use 5-digit rounding to get an exact answer):

(a) 7,500

(b) 7,945

(c) 8,328

(d) 9,445

(e) 9,122

A fellow analyst suggested valuing the company based on the APV approach.

3. Estimate the discount rate you should use the value the firms free cash flows based on the APV approach. (Use 5-digit rounding to get an exact answer).

(a) 7.622%

(b) 7.304%

(c) 7.905%

(d) 9.408%

(e) 9.102%

4. Based on the APV approach, estimate the firm value. (Assume that the only effect of leverage on firm value is through Interest tax shields and that those are discounted at the cost of debt). (Use 5-digit rounding to get an exact answer).

(a) 7,845

(b) 8,500

(c) 9,225

(d) 8,125

(e) 7,445

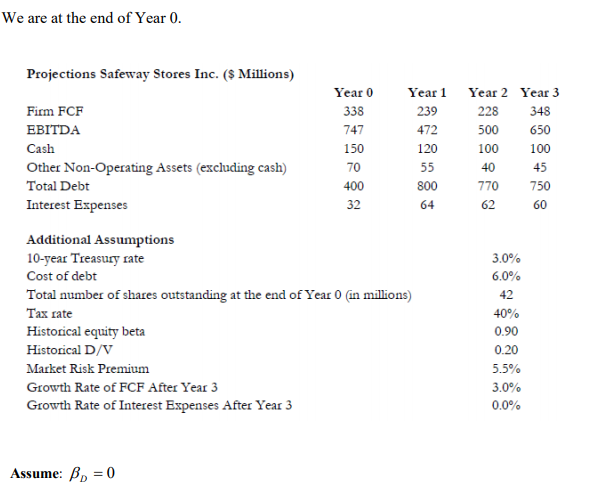

We are at the end of Year 0. Projections Safeway Stores Inc. ($ Millions) Year 0 338 747 Year 1 239 472 120 Year 2 Year 3 228 348 500 650 100 Firm FCF EBITDA Cash Other Non-Operating Assets (excluding cash) Total Debt Interest Expenses 400 32 800 7 70 750 6462 60 3.0% 6.0% Additional Assumptions 10-year Treasury rate Cost of debt Total number of shares outstanding at the end of Year 0 (in millions) Tax rate Historical equity beta Historical D/V Market Risk Premium Growth Rate of FCF After Year 3 Growth Rate of Interest Expenses After Year 3 40% 0.90 0.20 5.5% 3.0% 0.0% Assume: B) = 0 We are at the end of Year 0. Projections Safeway Stores Inc. ($ Millions) Year 0 338 747 Year 1 239 472 120 Year 2 Year 3 228 348 500 650 100 Firm FCF EBITDA Cash Other Non-Operating Assets (excluding cash) Total Debt Interest Expenses 400 32 800 7 70 750 6462 60 3.0% 6.0% Additional Assumptions 10-year Treasury rate Cost of debt Total number of shares outstanding at the end of Year 0 (in millions) Tax rate Historical equity beta Historical D/V Market Risk Premium Growth Rate of FCF After Year 3 Growth Rate of Interest Expenses After Year 3 40% 0.90 0.20 5.5% 3.0% 0.0% Assume: B) = 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started