Answered step by step

Verified Expert Solution

Question

1 Approved Answer

you dont need the selling price buddy Intro Your company is bidding on a contract to supply 150,000 earphones per year for 6 years. Fixed

you dont need the selling price buddy

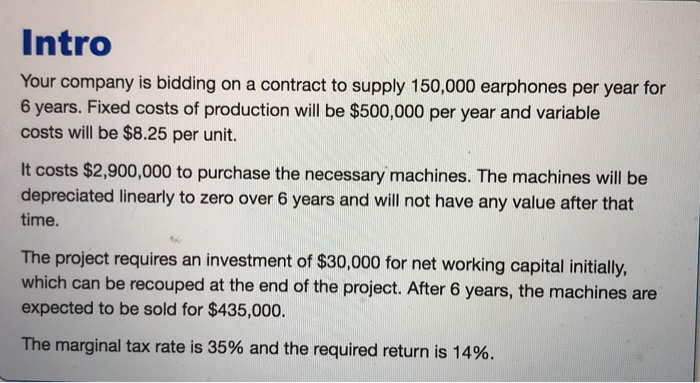

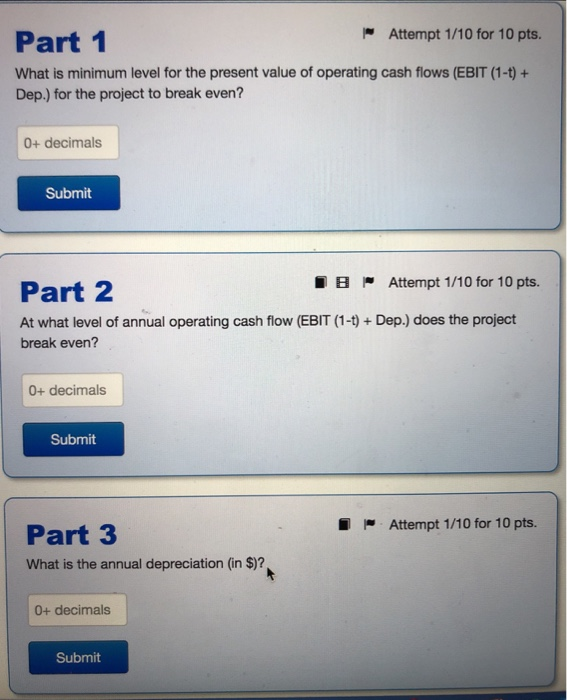

Intro Your company is bidding on a contract to supply 150,000 earphones per year for 6 years. Fixed costs of production will be $500,000 per year and variable costs will be $8.25 per unit. It costs $2,900,000 to purchase the necessary machines. The machines will be depreciated linearly to zero over 6 years and will not have any value after that time. The project requires an investment of $30,000 for net working capital initially, which can be recouped at the end of the project. After 6 years, the machines are expected to be sold for $435,000. The marginal tax rate is 35% and the required return is 14%. Part 1 Attempt 1/10 for 10 pts. What is minimum level for the present value of operating cash flows (EBIT (1-1) + Dep.) for the project to break even? 0+ decimals Submit Part 2 IB Attempt 1/10 for 10 pts. At what level of annual operating cash flow (EBIT (1-t) + Dep.) does the project break even? 0+ decimals Submit Attempt 1/10 for 10 pts. Part 3 What is the annual depreciation (in $)? 0+ decimals Submit IB Part 4 Attempt 1/10 for 10 pts. What is the minimum bid price for the contract (in $ per unit)? 1+ decimals Submit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started