Answered step by step

Verified Expert Solution

Question

1 Approved Answer

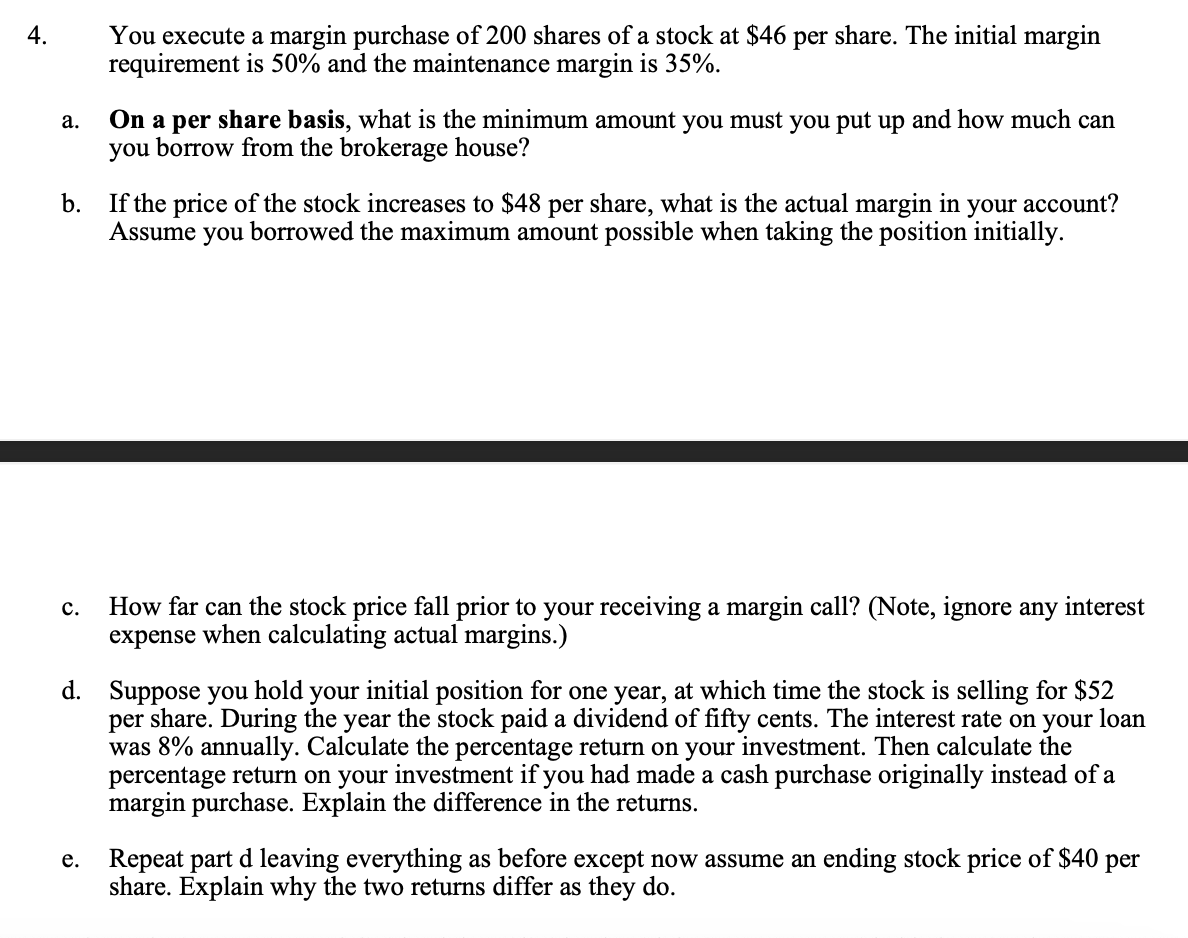

You execute a margin purchase of 2 0 0 shares of a stock at $ 4 6 per share. The initial margin requirement is 5

You execute a margin purchase of shares of a stock at $ per share. The initial margin

requirement is and the maintenance margin is

a On a per share basis, what is the minimum amount you must you put up and how much can

you borrow from the brokerage house?

b If the price of the stock increases to $ per share, what is the actual margin in your account?

Assume you borrowed the maximum amount possible when taking the position initially.

c How far can the stock price fall prior to your receiving a margin call? Note ignore any interest

expense when calculating actual margins.

d Suppose you hold your initial position for one year, at which time the stock is selling for $

per share. During the year the stock paid a dividend of fifty cents. The interest rate on your loan

was annually. Calculate the percentage return on your investment. Then calculate the

percentage return on your investment if you had made a cash purchase originally instead of a

margin purchase. Explain the difference in the returns.

e Repeat part d leaving everything as before except now assume an ending stock price of $ per

share. Explain why the two returns differ as they do

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started