Question

You expect that your cost of goods sold will amount to 60% of your revenue, and that you will extend a 30 day grace period

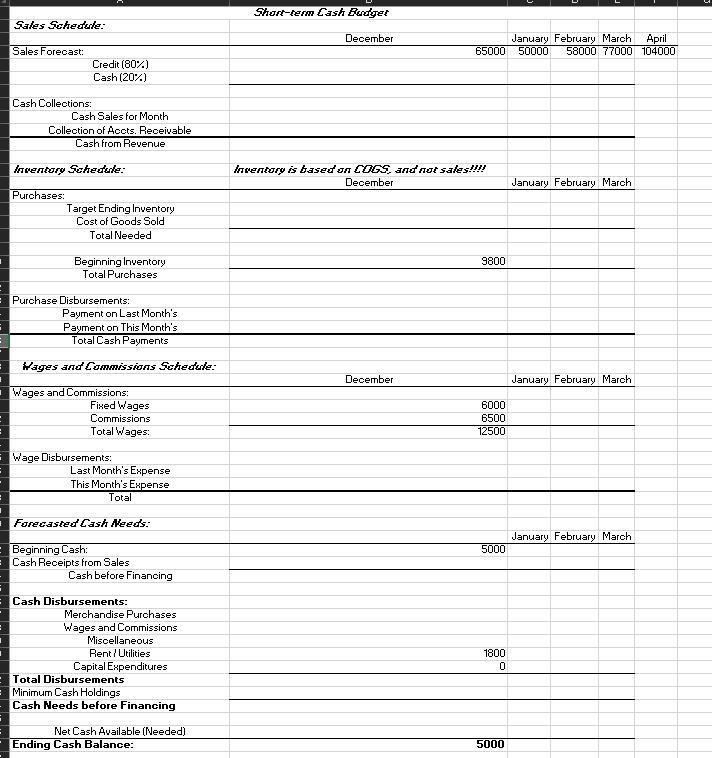

You expect that your cost of goods sold will amount to 60% of your revenue, and that you will extend a 30 day grace period on your accounts receivables. Of your revenue, 20% will be paid in cash, with the other 80% going onto your receivables. At the end of every month, you want to hold 20% of next months revenue in inventory, with a base of $2,000 in inventory on top of that. So your inventory will be $2,000 plus the expected cost of inventory needed to meet 20% of next months sales. For purchases, you will have a 15 day grace period from your vendors, so half of your expenses each month will be paid in the following month. This is similar to your wages, where you have $6,000 in fixed salary each month, with 10% of revenue paid out as commissions to your employees. Because your employees will be paid twice a month, half of the salary incurred in any month will get paid out in the following month. You will pay $1,800 in rent and utilities each month with an additional 3% of sales going to miscellaneous expenses that arise. To keep up with growing revenue, you will need to spend $2,000 in capital expenditures in March. Finally, to meet the terms of an open line of credit, you will need to have at least 5,000 in cash at the beginning of any month, and all excess cash will be retained in your cash balance for the following month.

Shurt-term Cash Blovet Sales Sohedule: Sales Foreoast: Credit (80\%) Cash (20%) Cash Collections: Cash Sales for Month Collection of Acots. Receivable Cash from Revenue havotery Sohedwe: hrentury is based un DG s. and ret salestll Purchases: December January February March Target Ending lnwentory Cost of Goods Sold Total Needed Beginning lnventory \begin{tabular}{r|} \hline 9800 \\ \hline \end{tabular} Total Purchases Purchase Disbursements: Payment on Last Month's Payment on This Month's Total Cash Payments Hayes ared Cummissions Seheefole: Wages and Commissions: January February March \begin{tabular}{l|r|r|} Fired Wages & 6000 & 6 \\ \hline Commissions & 6500 & 12500 \\ \hline Total Wages: & & \end{tabular} Wage Disbursements: Last Month's Expense This Month's Expense Total Fureeasted Cash Meeds: Beginning Cash: January February March Cash Receipts from Sales Cash before Financing Cash Disbursements: Merchandise Purchases Wages and Commissions Miscellaneous Rent i Urilities Capital Expenditures 5000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started