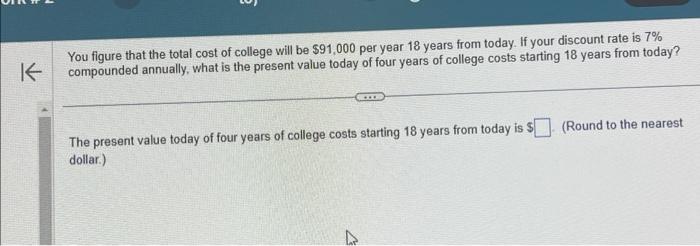

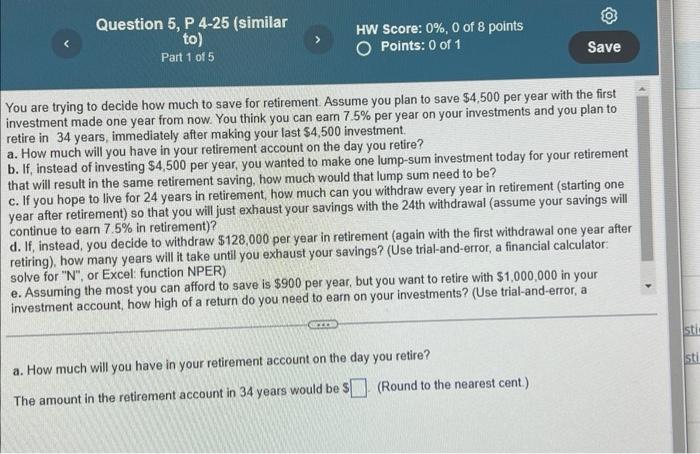

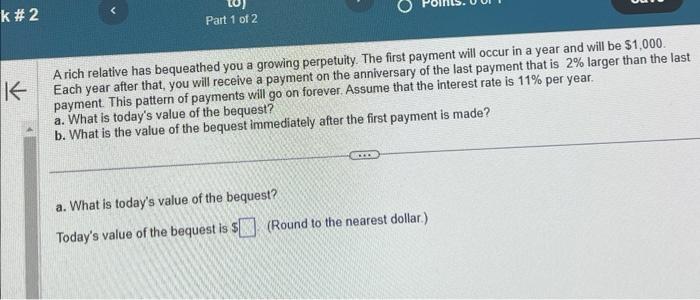

You figure that the total cost of college will be $91,000 per year 18 years from today. If your discount rate is 7% compounded annually, what is the present value today of four years of college costs starting 18 years from today? The present value today of four years of college costs starting 18 years from today is $ (Round to the nearest dollar.) You are trying to decide how much to save for retirement. Assume you plan to save $4,500 per year with the first investment made one year from now. You think you can earn 7.5% per year on your investments and you plan to retire in 34 years, immediately after making your last $4,500 investment. a. How much will you have in your retirement account on the day you retire? b. If, instead of investing $4,500 per year, you wanted to make one lump-sum investment today for your retirement that will result in the same retirement saving, how much would that lump sum need to be? c. If you hope to live for 24 years in retirement, how much can you withdraw every year in retirement (starting one year after retirement) so that you will just exhaust your savings with the 24th withdrawal (assume your savings will continue to eam 7.5% in retirement)? d. If, instead, you decide to withdraw $128,000 per year in retirement (again with the first withdrawal one year after retiring), how many years will it take until you exhaust your savings? (Use trial-and-error, a financial calculatorsolve for "N", or Excel: function NPER) e. Assuming the most you can afford to save is $900 per year, but you want to retire with $1,000,000 in your investment account, how high of a return do you need to earn on your investments? (Use trial-and-error, a a. How much will you have in your retirement account on the day you retire? The amount in the retirement account in 34 years would be $ (Round to the nearest cent.) Arich relative has bequeathed you a growing perpetuity. The first payment will occur in a year and will be $1,000. Each year after that, you will receive a payment on the anniversary of the last payment that is 2% larger than the last payment. This pattern of payments will go on forever. Assume that the interest rate is 11% per year. a. What is today's value of the bequest? b. What is the value of the bequest immediately after the first payment is made? a. What is today's value of the bequest? Today's value of the bequest is $ (Round to the nearest dollar.)