Question

You finally graduated from college, landed a great job, and youre ready to buy your first home. Youve spent several years saving up, and you

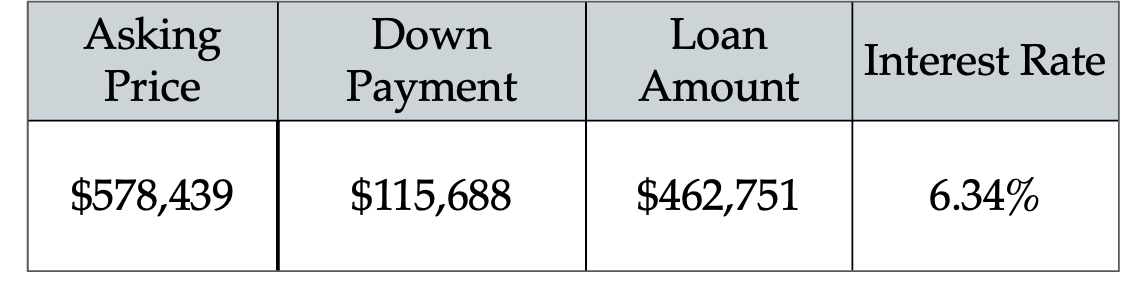

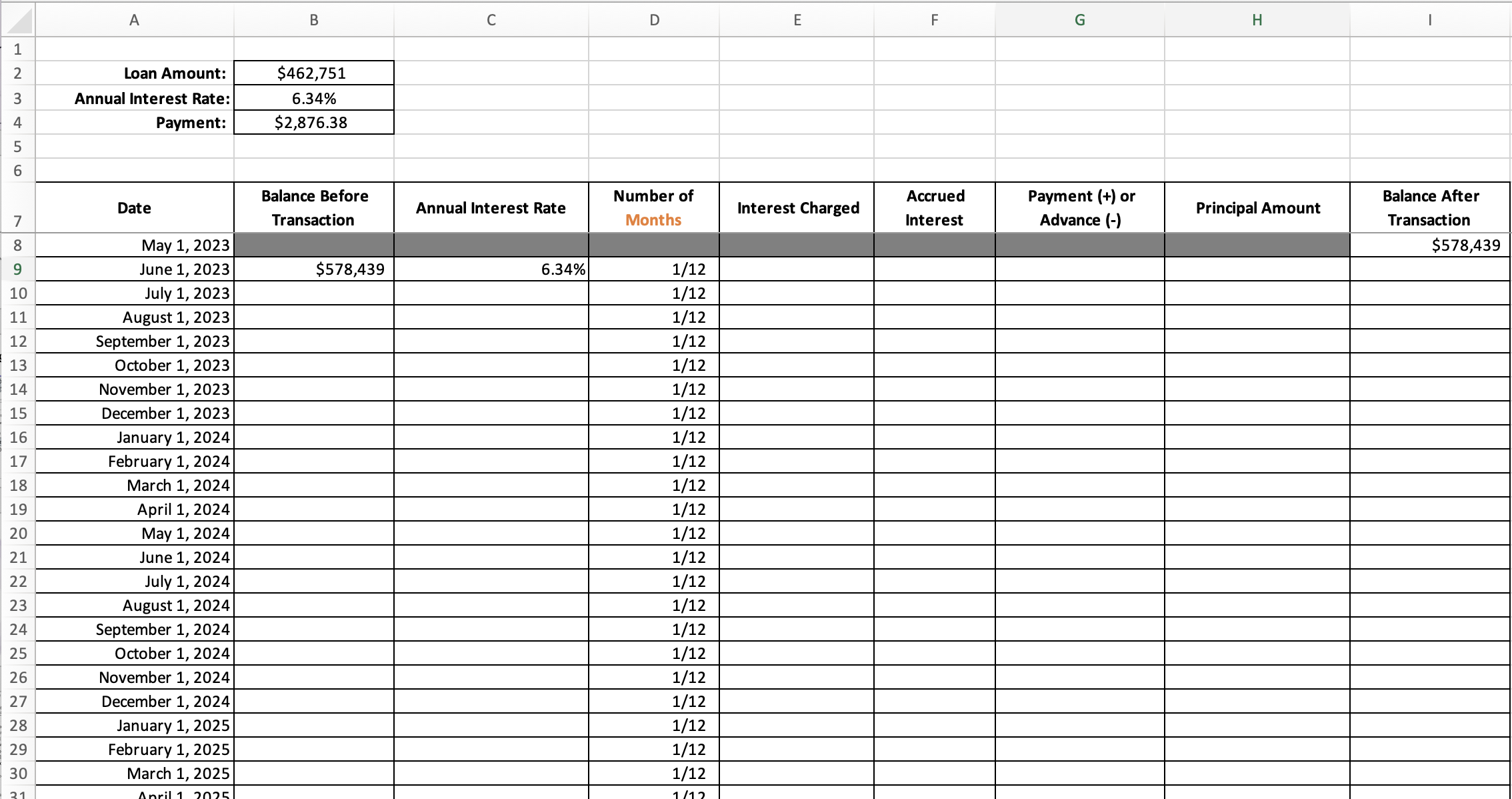

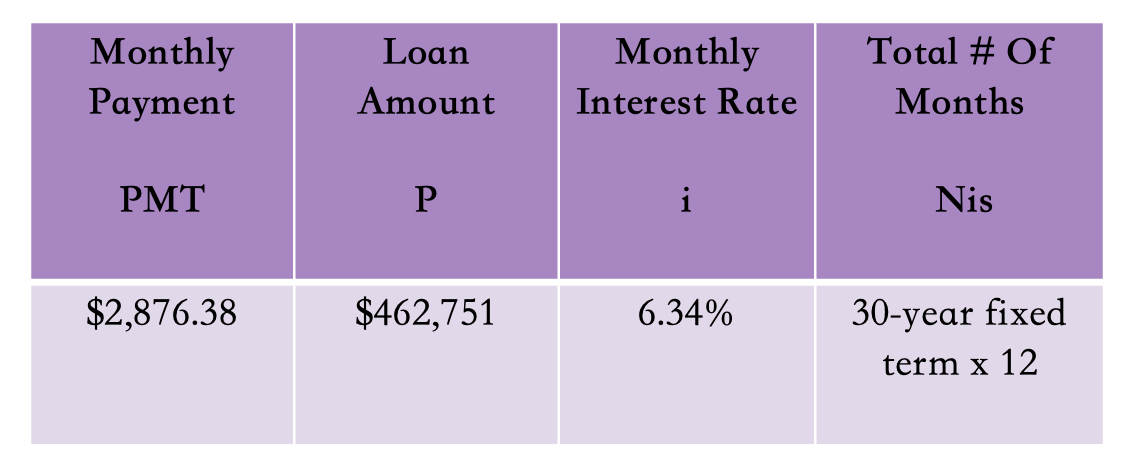

You finally graduated from college, landed a great job, and youre ready to buy your first home. Youve spent several years saving up, and you now have enough for a standard 20% down payment on a house, but youll have to apply for a loan to cover the remaining cost. Youll need to determine the loan amount, interest rate, and your monthly mortgage payment, then use this information to complete an amortization schedule (see the template included in the Project 2 folder) to pay off your loan in 30 years.

Suppose you want to try and pay off your loan in less than 30 years. Many lenders allow you to do so, with no pre-payment penalty. You decide to pay an extra 10% on your payment each month, increasing each monthly payment by 10%). You should notice that something interesting happens toward the end of the 30-year period.

The dates are as followed May 1st 2023-May 1st 2053

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started