Answered step by step

Verified Expert Solution

Question

1 Approved Answer

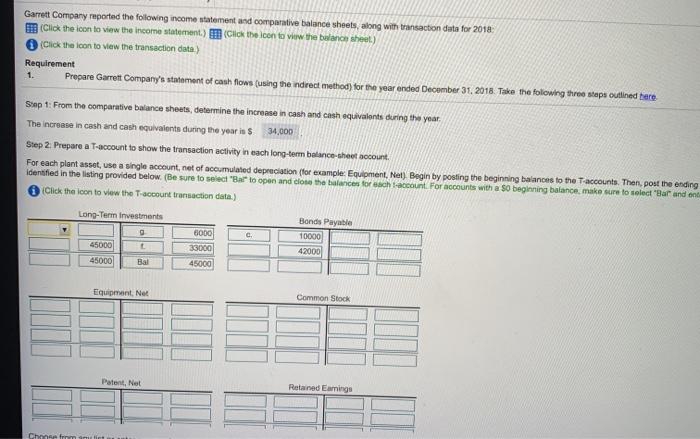

Garrett Company reported the following income statement and comparative balance sheets, along with transaction data for 2018: (Click the icon to view the income

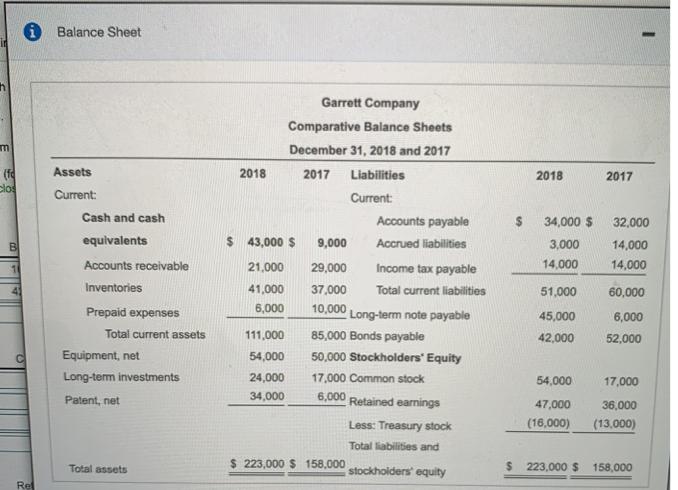

Garrett Company reported the following income statement and comparative balance sheets, along with transaction data for 2018: (Click the icon to view the income statement.) (Click the icon to view the balance sheet) (Click the lcon to view the transaction data) Requirement 1. Prepare GarrettCompany's statement of cash flows (using the indrect method) for the year ended December 31. 2018. Take the folowing three steps outlined tere Step 1: From the comparative balance sheets, determine the increase in cash and cash equivalents during the year The increase in cash and cash equivalents during the year is $ 34,000 Step 2: Prepare a T-account to show the transaction activity in each long-term balance-sheet account For each plant asset, use a single account, net of accumulated depreciation (for example: Equipment, Net). Begin by posting the beginning balances to the Taccounts. Then, post the ending identified in the listing provided below (Be sure to select "Ba to open and close the balances for each account. For accounts with a $0 beginning balance, make sure to select "Bar and ent (Click the lcon to view the T-account transaction data) Long-Term Investments Bonds Payable 10000 42000 C. 45000 33000 45000 45000 Bal Equipment, Net Common Stock Patent, Net Retained Eamings Chonse fom amu liet 1 Income Statement %3D Garrett Company Income Statement Year Ended December 31, 2018 Sales revenue $ 654,000 fo Cost of goods sold 538,000 Gross profit 116,000 Operating expenses Salary expenses 49,000 Depreciation expense-equipment 12,000 Amortization expense-patent 5,000 Rent expense 3,000 Total operating expenses 69,000 Income from operations 47,000 Other items: Loss on sale of equipment (7,000) Income before income tax 40,000 Income tax expense 12,000 Net income %24 28,000 gs Balance Sheet Garrett Company Comparative Balance Sheets December 31, 2018 and 2017 (f clos Assets 2018 2017 Liabilities 2018 2017 Current: Current: Cash and cash Accounts payable %24 34,000 $ 32,000 equivalents $ 43,000 $ 9,000 Accrued liabilities 3,000 14,000 Accounts receivable 21,000 29,000 Income tax payable 14,000 14,000 Inventories 41,000 37,000 Total current liabilities 51,000 60,000 Prepaid expenses 6,000 10,000 Long-term note payable 45,000 6,000 Total current assets 111,000 85,000 Bonds payable 42,000 52,000 Equipment, net 54,000 50,000 Stockholders' Equity Long-term investments 24,000 17,000 Common stock 54,000 17,000 Patent, net 34,000 6,000 Retained earnings 47,000 36,000 Less: Treasury stock (16,000) (13,000) Total liabilities and Total assets $ 223,000 $ 158,000 stockholders' equity $ 223,000 $ 158,000 Re 1 Transaction Data Transaction Data for 2018: Purchase of equipment with cash 99,000 Issuance of long-term note payable Payment of cash dividends 17,000 to purchase patent 33,000 Issuance of common stock to Issuance of long-lerm note payable to retire bonds payable... 10,000 borrow cash 6,000 Purchase of long-term investment Issuance of common stock for cash. 27,000 with cash 7,000 Proceeds from sale of equipment Purchase of treasury stock. (book value, $83,000) 3,000 76,000 Print Done

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started