Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You get a loan of $10,000 for your startup today. You are expected to pay 24 equal monthly installments (SA per month) at APR

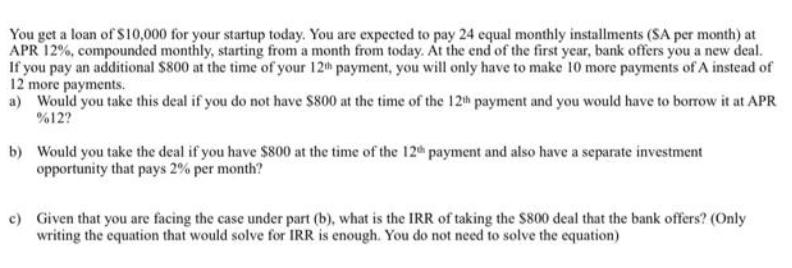

You get a loan of $10,000 for your startup today. You are expected to pay 24 equal monthly installments (SA per month) at APR 12%, compounded monthly, starting from a month from today. At the end of the first year, bank offers you a new deal. If you pay an additional $800 at the time of your 12th payment, you will only have to make 10 more payments of A instead of 12 more payments. a) Would you take this deal if you do not have $800 at the time of the 12th payment and you would have to borrow it at APR %12? b) Would you take the deal if you have $800 at the time of the 12th payment and also have a separate investment opportunity that pays 2% per month? c) Given that you are facing the case under part (b), what is the IRR of taking the $800 deal that the bank offers? (Only writing the equation that would solve for IRR is enough. You do not need to solve the equation)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a No I would not take the deal if I do not have 800 at the time of the 12th payment and I would have ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started