Answered step by step

Verified Expert Solution

Question

1 Approved Answer

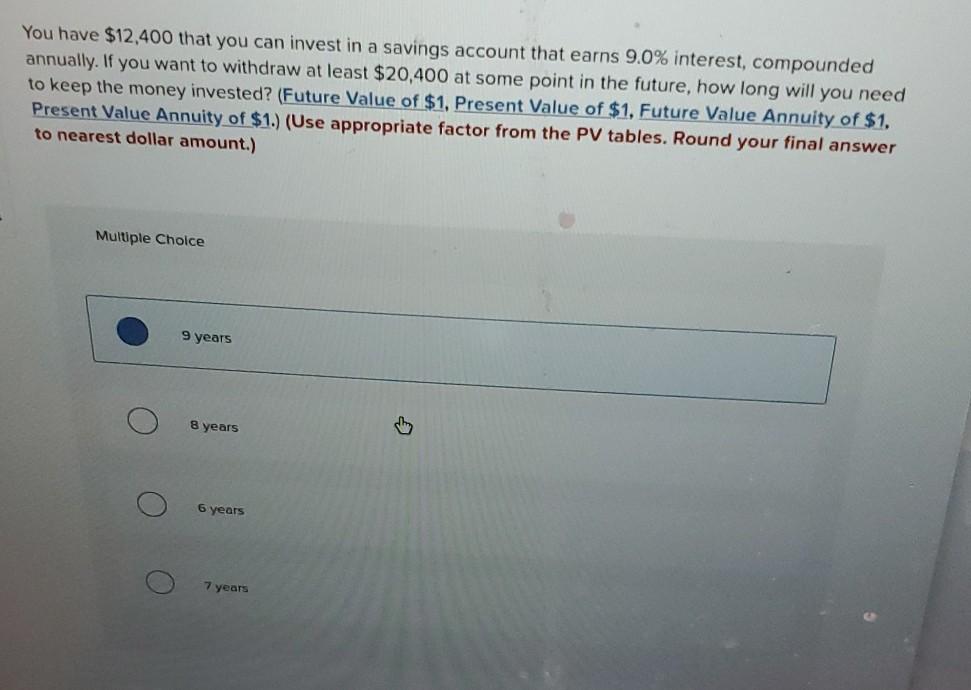

You have $12,400 that you can invest in a savings account that earns 9.0% interest, compounded annually. If you want to withdraw at least $20,400

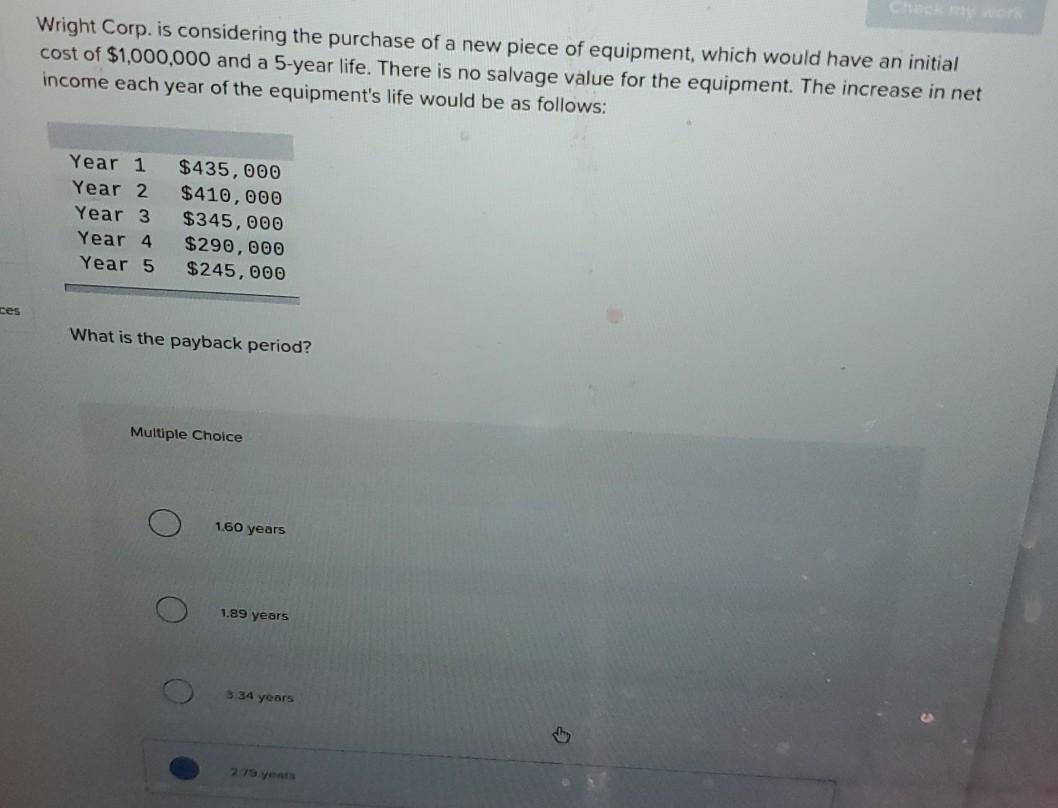

You have $12,400 that you can invest in a savings account that earns 9.0% interest, compounded annually. If you want to withdraw at least $20,400 some point in the future, how long will you need to keep the money invested? (Future Value of $1. Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor from the PV tables. Round your final answer to nearest dollar amount.) Multiple Choice 9 years 8 years O 6 years 7 years O Wright Corp. is considering the purchase of a new piece of equipment, which would have an initial cost of $1,000,000 and a 5-year life. There is no salvage value for the equipment. The increase in net income each year of the equipment's life would be as follows: Year 1 Year 2 Year 3 Year 4 Year 5 $435,000 $410,000 $345,000 $290,000 $245,000 ces What is the payback period? Multiple Choice 1.60 years 1.89 years 3.34 years ab 2.73

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started