Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have $15,000 to invest but need the funds available within a year. Your bank offers a 210-day short-term GIC at 0.56% and a

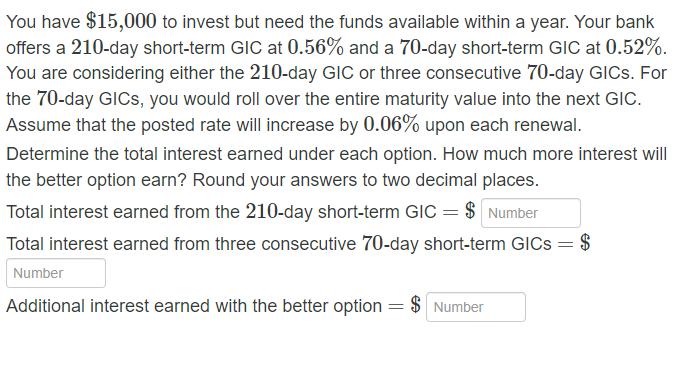

You have $15,000 to invest but need the funds available within a year. Your bank offers a 210-day short-term GIC at 0.56% and a 70-day short-term GIC at 0.52%. You are considering either the 210-day GIC or three consecutive 70-day GICS. For the 70-day GICS, you would roll over the entire maturity value into the next GIC. Assume that the posted rate will increase by 0.06% upon each renewal. Determine the total interest earned under each option. How much more interest will the better option earn? Round your answers to two decimal places. Total interest earned from the 210-day short-term GIC = $ Number Total interest earned from three consecutive 70-day short-term GICs = $ Number Additional interest earned with the better option = $ Number

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided in the image you have 15000 to invest either in a 210day Guaranteed Investment Certificate GIC at 056 interest or th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started