Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have $250,000 after cashing the mutual funds in your account and transfer them into a self-directed RSP account. After doing a lot of

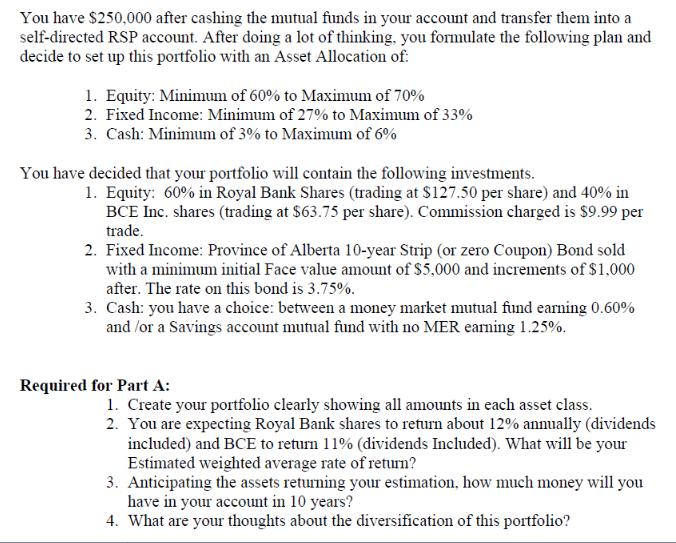

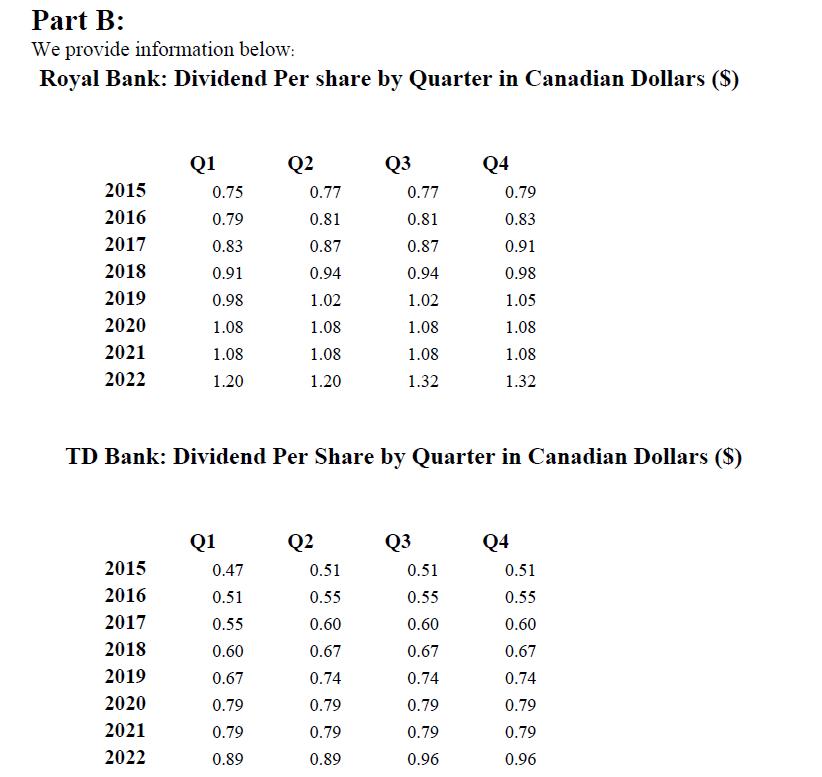

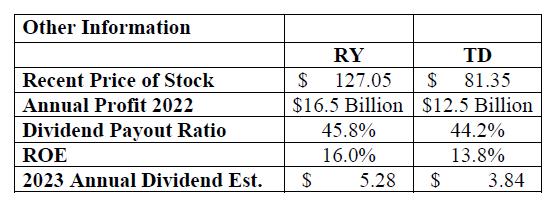

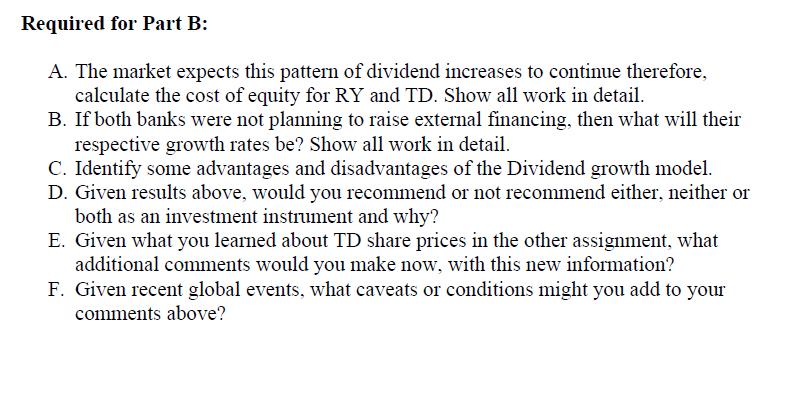

You have $250,000 after cashing the mutual funds in your account and transfer them into a self-directed RSP account. After doing a lot of thinking, you formulate the following plan and decide to set up this portfolio with an Asset Allocation of: 1. Equity: Minimum of 60% to Maximum of 70% 2. Fixed Income: Minimum of 27% to Maximum of 33% 3. Cash: Minimum of 3% to Maximum of 6% You have decided that your portfolio will contain the following investments. 1. Equity: 60% in Royal Bank Shares (trading at $127.50 per share) and 40% in BCE Inc. shares (trading at $63.75 per share). Commission charged is $9.99 per trade. 2. Fixed Income: Province of Alberta 10-year Strip (or zero Coupon) Bond sold with a minimum initial Face value amount of $5,000 and increments of $1,000 after. The rate on this bond is 3.75%. 3. Cash: you have a choice: between a money market mutual fund earning 0.60% and /or a Savings account mutual fund with no MER earning 1.25%. Required for Part A: 1. Create your portfolio clearly showing all amounts in each asset class. 2. You are expecting Royal Bank shares to return about 12% annually (dividends included) and BCE to return 11% (dividends Included). What will be your Estimated weighted average rate of return? 3. Anticipating the assets returning your estimation, how much money will you have in your account in 10 years? 4. What are your thoughts about the diversification of this portfolio? Part B: We provide information below: Royal Bank: Dividend Per share by Quarter in Canadian Dollars ($) 2015 2016 2017 2018 2019 2020 2021 2022 Q1 2015 2016 2017 2018 2019 2020 2021 2022 0.75 0.79 0.83 0.91 0.98 1.08 1.08 1.20 Q1 Q2 0.47 0.51 0.55 0.60 0.67 0.79 0.79 0.89 0.77 0.81 0.87 0.94 1.02 1.08 1.08 1.20 TD Bank: Dividend Per Share by Quarter in Canadian Dollars ($) Q2 Q3 0.51 0.55 0.60 0.67 0.74 0.79 0.79 0.89 0.77 0.81 0.87 0.94 1.02 1.08 1.08 1.32 Q3 Q4 0.51 0.55 0.60 0.67 0.74 0.79 0.79 0.96 0.79 0.83 0.91 0.98 1.05 1.08 1.08 1.32 Q4 0.51 0.55 0.60 0.67 0.74 0.79 0.79 0.96 Other Information Recent Price of Stock Annual Profit 2022 Dividend Payout Ratio ROE 2023 Annual Dividend Est. RY 127.05 $ $16.5 Billion 45.8% 16.0% $ 5.28 TD $ 81.35 $12.5 Billion $ 44.2% 13.8% 3.84 Required for Part B: A. The market expects this pattern of dividend increases to continue therefore, calculate the cost of equity for RY and TD. Show all work in detail. B. If both banks were not planning to raise external financing, then what will their respective growth rates be? Show all work in detail. C. Identify some advantages and disadvantages of the Dividend growth model. D. Given results above, would you recommend or not recommend either, neither or both as an investment instrument and why? E. Given what you learned about TD share prices in the other assignment, what additional comments would you make now, with this new information? F. Given recent global events, what caveats or conditions might you add to your comments above?

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started