Question

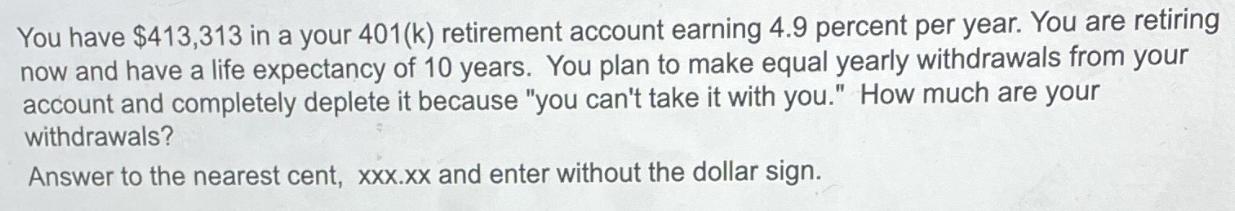

You have $413,313 in a your 401(k) retirement account earning 4.9 percent per year. You are retiring now and have a life expectancy of

You have $413,313 in a your 401(k) retirement account earning 4.9 percent per year. You are retiring now and have a life expectancy of 10 years. You plan to make equal yearly withdrawals from your account and completely deplete it because "you can't take it with you." How much are your withdrawals? Answer to the nearest cent, xxx.xx and enter without the dollar sign.

Step by Step Solution

3.38 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Present value of annuityAnnuity11i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Foundations of Finance The Logic and Practice of Financial Management

Authors: Arthur J. Keown, John D. Martin, J. William Petty

8th edition

132994879, 978-0132994873

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App