Question

You have $94,000 you would like to invest in three different stocks: MarkyB Inc., JohnJohn Ltd., and Garretts Spaghetti House. You would like to

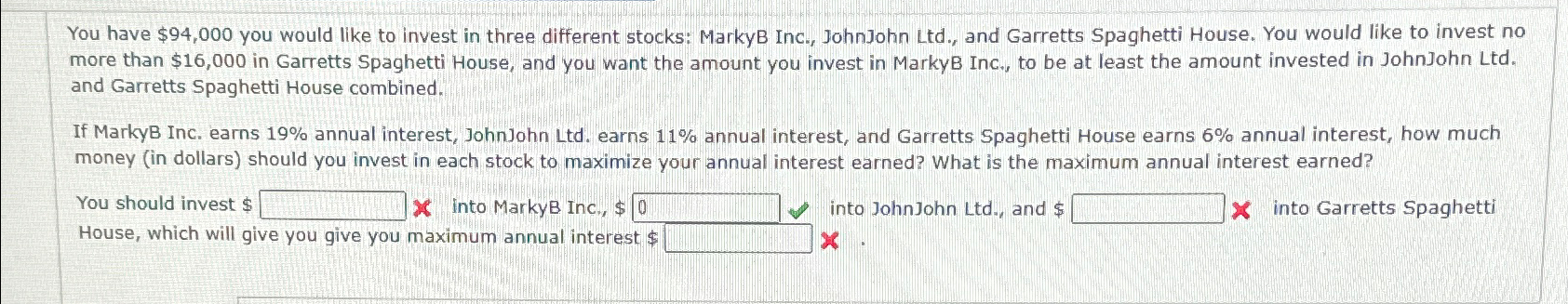

You have $94,000 you would like to invest in three different stocks: MarkyB Inc., JohnJohn Ltd., and Garretts Spaghetti House. You would like to invest no more than $16,000 in Garretts Spaghetti House, and you want the amount you invest in MarkyB Inc., to be at least the amount invested in JohnJohn Ltd. and Garretts Spaghetti House combined. If MarkyB Inc. earns 19% annual interest, John John Ltd. earns 11% annual interest, and Garretts Spaghetti House earns 6% annual interest, how much money (in dollars) should you invest in each stock to maximize your annual interest earned? What is the maximum annual interest earned? You should invest $ X into MarkyB Inc., $ 0 House, which will give you give you maximum annual interest $ into John John Ltd., and $ X Xinto Garretts Spaghetti

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting and Reporting a Global Perspective

Authors: Michel Lebas, Herve Stolowy, Yuan Ding

4th edition

978-1408066621, 1408066629, 1408076861, 978-1408076866

Students also viewed these Mathematics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App