Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a $50,000 salary and you save 5% a month. What is your monthly savings and how much will you save each year,

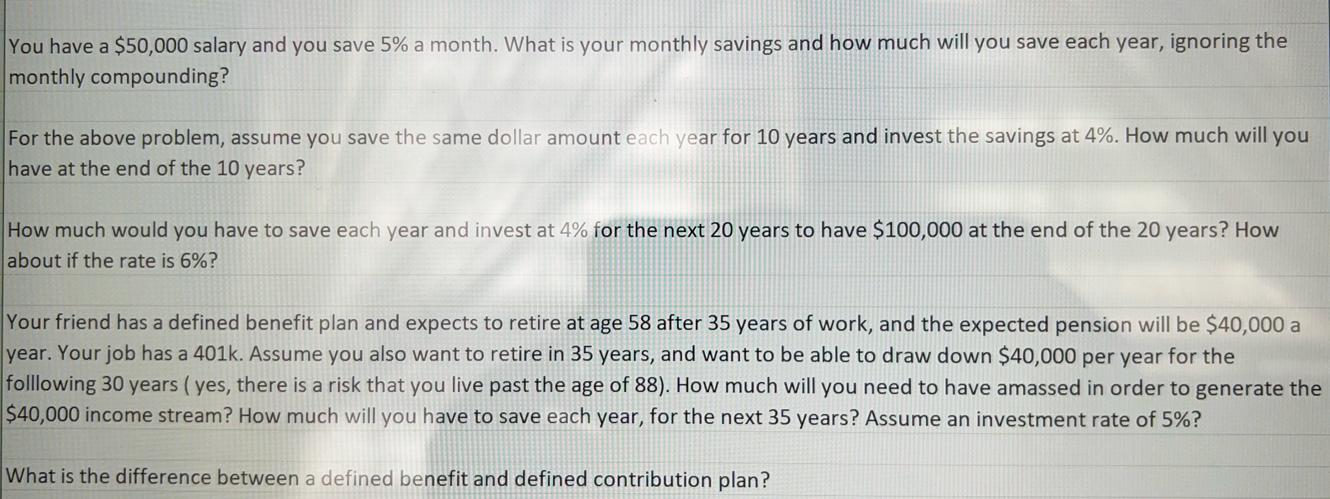

You have a $50,000 salary and you save 5% a month. What is your monthly savings and how much will you save each year, ignoring the monthly compounding? For the above problem, assume you save the same dollar amount each year for 10 years and invest the savings at 4%. How much will you have at the end of the 10 years? How much would you have to save each year and invest at 4% for the next 20 years to have $100,000 at the end of the 20 years? How about if the rate is 6%? Your friend has a defined benefit plan and expects to retire at age 58 after 35 years of work, and the expected pension will be $40,000 a year. Your job has a 401k. Assume you also want to retire in 35 years, and want to be able to draw down $40,000 per year for the folllowing 30 years (yes, there is a risk that you live past the age of 88). How much will you need to have amassed in order to generate the $40,000 income stream? How much will you have to save each year, for the next 35 years? Assume an investment rate of 5%? What is the difference between a defined benefit and defined contribution plan?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Monthly savings 5 of 50000 2500 per year 12 months 20833 per month Annual savings 2500 2 To calculate the future value of the savings at the end of 10 years we can use the formula FV PV x 1 rn Where ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started