Question

You have a bond that pays a $3 coupon in 1 year and a $3 coupon in two years and a $3 coupon in three

You would like would like to swap the uneven payments (note that the payments are $3 in year 1, $3 in year 2, and $103 in year 3) associated with the bond described above for payments of equal amounts in 1 year, in 2 years, and in 3 years. Assuming you can find a swap counterparty who offers you a fair deal (and that interest rates are unchanged from those described above, what is closest to the swap rate amounts will you receive in each year as a result of the swap?

The price of a 1-year zero coupon bond is 0.97. The price of a 2-year zero coupon bond is 0.93. The price of a 3-year zero coupon bond is 0.85. The price of a 4-year zero coupon bond is 0.78. You are a borrower who anticipates needing to borrow $100,000 for one year at the end of year 3 and would like to guarantee the rate on your upcoming loan (i.e., after 3 years you will need a $100,000 loan which will last for one year). Which is closest to the interest rate you will be able to guarantee if there are no transactions costs and you get a fair deal in the interest rate forward market?

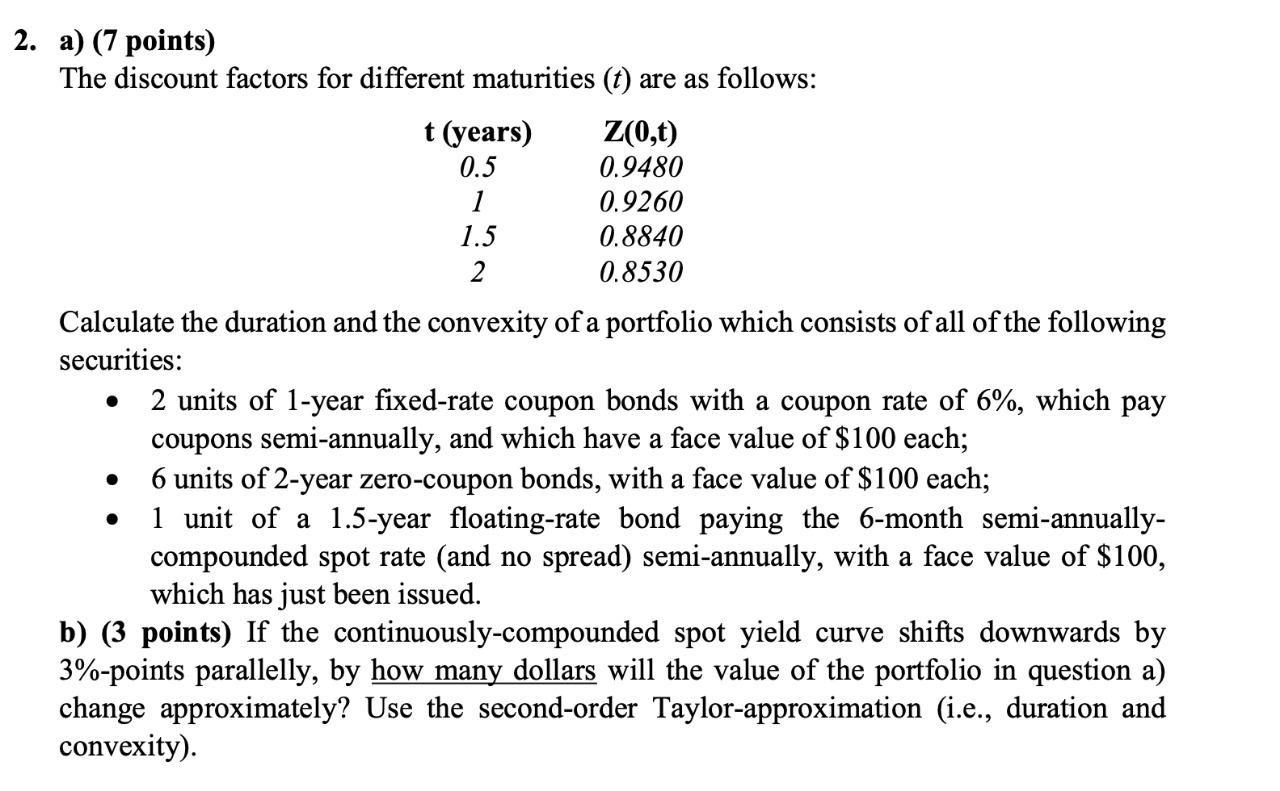

2. a) (7 points) The discount factors for different maturities (t) are as follows: t (years) 0.5 1.5 2 Z(0,t) 0.9480 0.9260 0.8840 0.8530 Calculate the duration and the convexity of a portfolio which consists of all of the following securities: 2 units of 1-year fixed-rate coupon bonds with a coupon rate of 6%, which pay coupons semi-annually, and which have a face value of $100 each; 6 units of 2-year zero-coupon bonds, with a face value of $100 each; 1 unit of a 1.5-year floating-rate bond paying the 6-month semi-annually- compounded spot rate (and no spread) semi-annually, with a face value of $100, which has just been issued. b) (3 points) If the continuously-compounded spot yield curve shifts downwards by 3%-points parallelly, by how many dollars will the value of the portfolio in question a) change approximately? Use the second-order Taylor-approximation (i.e., duration and convexity).

Step by Step Solution

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Answer since there is a downward shif...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started