Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a choice between a mortgage with a fixed payment each period versus a balloon mortgage. You are borrowing $200,000 for 4 periods. In

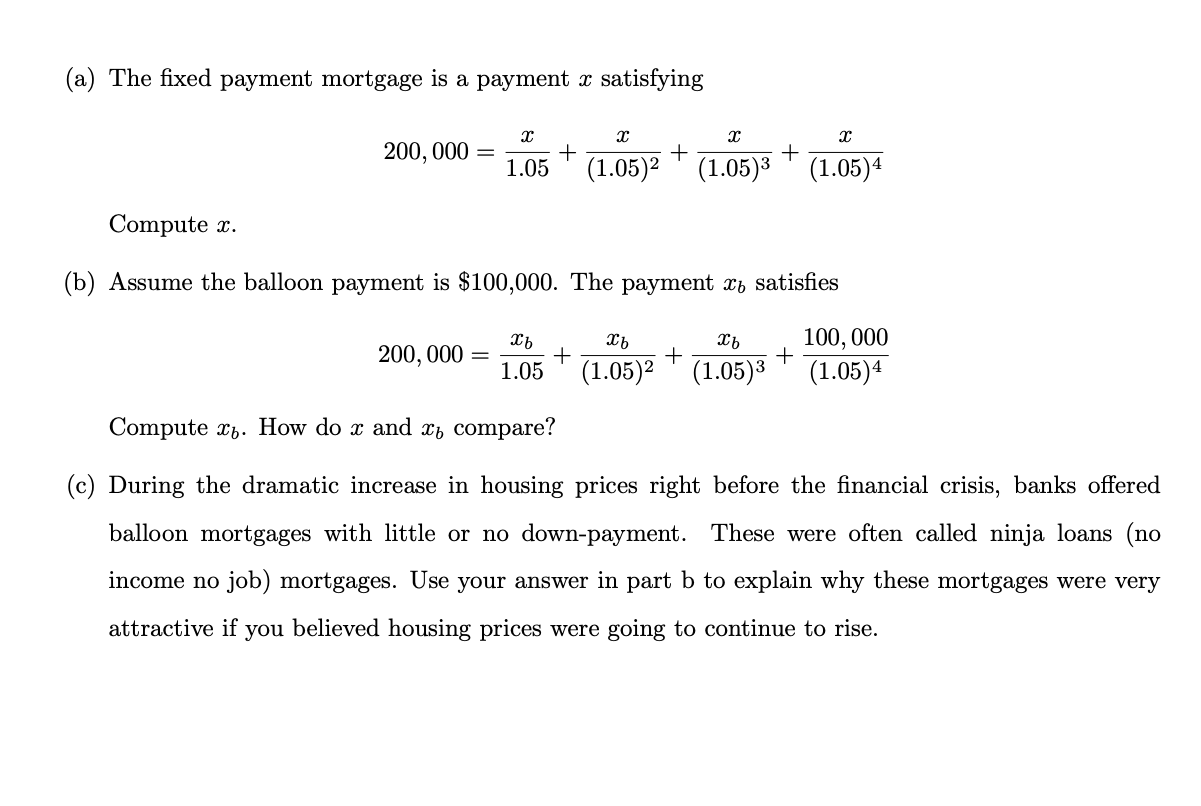

You have a choice between a mortgage with a fixed payment each period versus a balloon mortgage. You are borrowing $200,000 for 4 periods. In both cases, the yield to maturity is 5%.

(a) The fixed payment mortgage is a payment x satisfying 200,000=1.05x+(1.05)2x+(1.05)3x+(1.05)4x Compute x. (b) Assume the balloon payment is $100,000. The payment xb satisfies 200,000=1.05xb+(1.05)2xb+(1.05)3xb+(1.05)4100,000 Compute xb. How do x and xb compare? (c) During the dramatic increase in housing prices right before the financial crisis, banks offered balloon mortgages with little or no down-payment. These were often called ninja loans (no income no job) mortgages. Use your answer in part b to explain why these mortgages were very attractive if you believed housing prices were going to continue to rise

(a) The fixed payment mortgage is a payment x satisfying 200,000=1.05x+(1.05)2x+(1.05)3x+(1.05)4x Compute x. (b) Assume the balloon payment is $100,000. The payment xb satisfies 200,000=1.05xb+(1.05)2xb+(1.05)3xb+(1.05)4100,000 Compute xb. How do x and xb compare? (c) During the dramatic increase in housing prices right before the financial crisis, banks offered balloon mortgages with little or no down-payment. These were often called ninja loans (no income no job) mortgages. Use your answer in part b to explain why these mortgages were very attractive if you believed housing prices were going to continue to rise Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started