Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a gathered data on a series of ten different $1,000 par value Treasury bonds maturing at different times. All of these bonds

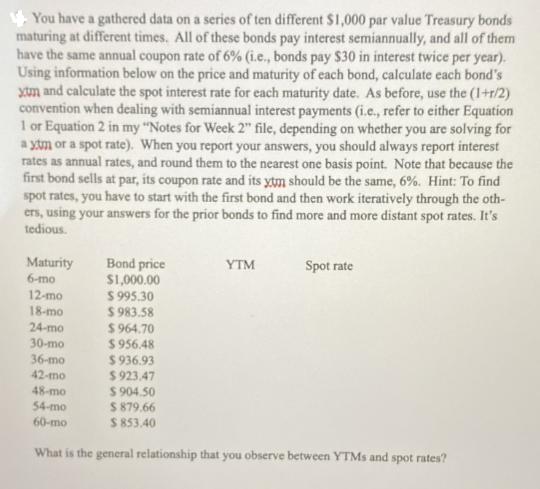

You have a gathered data on a series of ten different $1,000 par value Treasury bonds maturing at different times. All of these bonds pay interest semiannually, and all of them have the same annual coupon rate of 6% (i.e., bonds pay $30 in interest twice per year). Using information below on the price and maturity of each bond, calculate each bond's xum and calculate the spot interest rate for each maturity date. As before, use the (1+r/2) convention when dealing with semiannual interest payments (i.e., refer to either Equation 1 or Equation 2 in my "Notes for Week 2" file, depending on whether you are solving for ayam or a spot rate). When you report your answers, you should always report interest rates as annual rates, and round them to the nearest one basis point. Note that because the first bond sells at par, its coupon rate and its yum should be the same, 6%. Hint: To find spot rates, you have to start with the first bond and then work iteratively through the oth- ers, using your answers for the prior bonds to find more and more distant spot rates. It's tedious. Maturity 6-mo 12-mo 18-mo 24-mo 30-mo 36-mo 42-mo 48-mo 54-mo 60-mo Bond price $1,000.00 $995.30 $983.58 $964.70 $956.48 $936.93 $923.47 $904.50 $879.66 $853.40 YTM Spot rate What is the general relationship that you observe between YTMs and spot rates?

Step by Step Solution

★★★★★

3.31 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given data we can calculate the spot rates for each maturity date using an iterative pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started