Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a great idea and want to form a corporation to produce and sell hot air balloons. You think this is the next

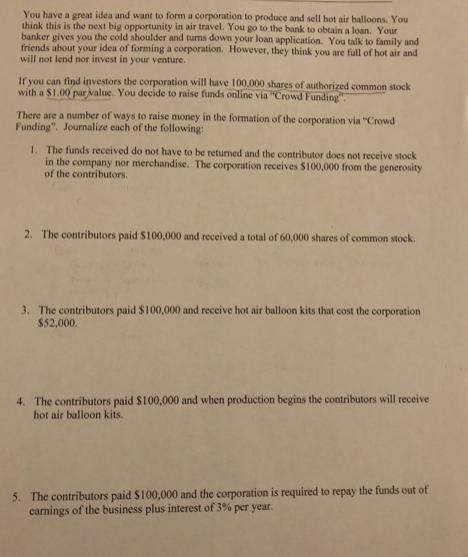

You have a great idea and want to form a corporation to produce and sell hot air balloons. You think this is the next big opportunity in air travel. You go to the bank to obtain a loan. Your banker gives you the cold shoulder and turns down your loan application. You talk to family and friends about your idea of forming a corporation. However, they think you are full of hot air and will not lend nor invest in your venture. If you can find investors the corporation will have 100,000 shares of authorized common stock with a $1.00 par value. You decide to raise funds online via "Crowd Funding There are a number of ways to raise money in the formation of the corporation via "Crowd Funding". Journalize each of the following: 1. The funds received do not have to be returned and the contributor does not receive stock in the company nor merchandise. The corporation receives $100,000 from the generosity of the contributors. 2. The contributors paid $100,000 and received a total of 60,000 shares of common stock. 3. The contributors paid $100,000 and receive hot air balloon kits that cost the corporation $52,000. 4. The contributors paid $100,000 and when production begins the contributors will receive hot air balloon kits. 5. The contributors paid $100,000 and the corporation is required to repay the funds out of earnings of the business plus interest of 3% per year.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Heres how you would journalize each of the scenarios The funds received do not have to be returned a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started