Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a new client who has hired you to make recommendations after you have reviewed the following current information about their current situation and

You have a new client who has hired you to make recommendations after you have reviewed the following current information about their current situation and their objectives.

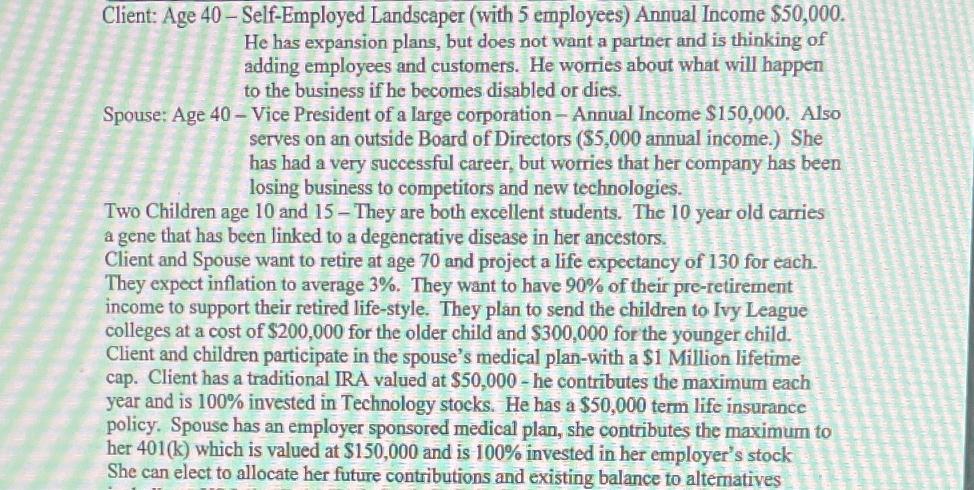

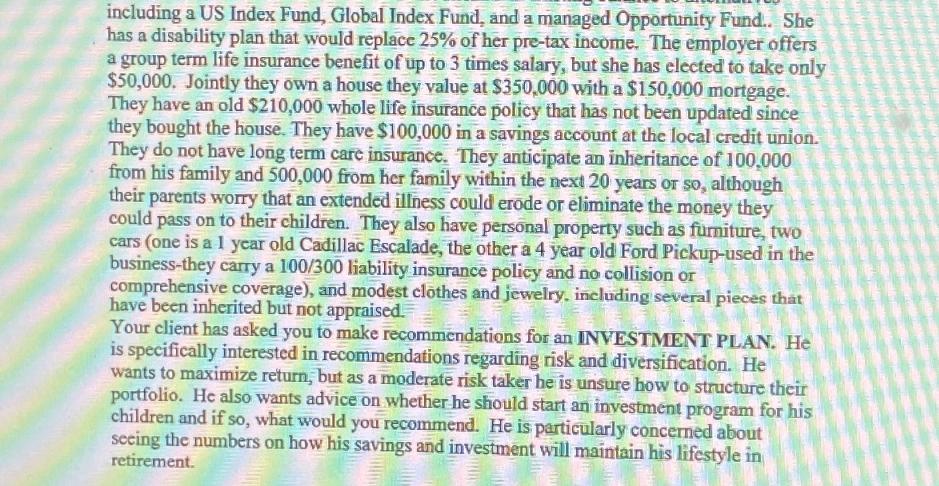

Client: Age 40-Self-Employed Landscaper (with 5 employees) Annual Income $50,000. He has expansion plans, but does not want a partner and is thinking of adding employees and customers. He worries about what will happen to the business if he becomes disabled or dies. Spouse: Age 40- Vice President of a large corporation - Annual Income $150,000. Also serves on an outside Board of Directors ($5,000 annual income.) She has had a very successful career, but worries that her company has been losing business to competitors and new technologies. Two Children age 10 and 15- They are both excellent students. The 10 year old carries a gene that has been linked to a degenerative disease in her ancestors. Client and Spouse want to retire at age 70 and project a life expectancy of 130 for each. They expect inflation to average 3%. They want to have 90% of their pre-retirement income to support their retired life-style. They plan to send the children to Ivy League colleges at a cost of $200,000 for the older child and $300,000 for the younger child. Client and children participate in the spouse's medical plan-with a $1 Million lifetime cap. Client has a traditional IRA valued at $50,000 - he contributes the maximum each year and is 100% invested in Technology stocks. He has a $50,000 term life insurance policy. Spouse has an employer sponsored medical plan, she contributes the maximum to her 401(k) which is valued at $150,000 and is 100% invested in her employer's stock She can elect to allocate her future contributions and existing balance to alternatives

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Emergency Fund Before diving into investments ensure that you have an emergency fund in place This fund should cover at least 36 months of living expenses You can use a portion of the 100000 in the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started