Question

You have a portfolio made up of three stocks. Tesla is 60% of the portfolio, IBM is 20%, and GE is 20%. There are

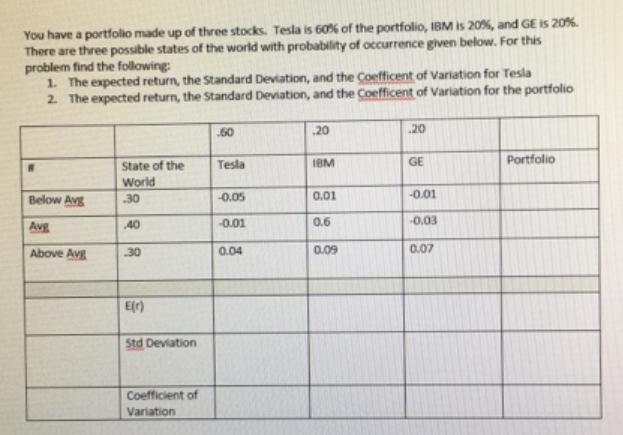

You have a portfolio made up of three stocks. Tesla is 60% of the portfolio, IBM is 20%, and GE is 20%. There are three possible states of the world with probability of occurrence given below. For this problem find the following: 1. The expected return, the Standard Deviation, and the Coefficent of Variation for Tesla 2. The expected return, the Standard Deviation, and the Coefficent of Variation for the portfolio 20 20 60 IBM GE Portfolio State of the World Tesla Below Avg 30 -0.05 0.01 -0.01 Avg 40 0.01 0.6 0.03 Above Avg 30 0.04 0.09 0.07 E(r) Std Deviation Coefficient of Variation

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Solution Eacepected reluan 03 X005 t 04 x6 01o3Xo04 007 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Principles and Applications

Authors: Sheridan Titman, Arthur Keown, John Martin

12th edition

133423824, 978-0133423822

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App