Question

You have a portfolio of 15 stocks, and currently the market value of each group of stocks is exactly $15,000 (i.e., the current market

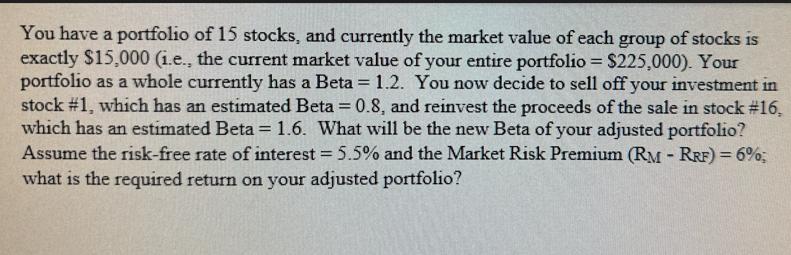

You have a portfolio of 15 stocks, and currently the market value of each group of stocks is exactly $15,000 (i.e., the current market value of your entire portfolio = $225,000). Your portfolio as a whole currently has a Beta = 1.2. You now decide to sell off your investment in stock #1, which has an estimated Beta = 0.8, and reinvest the proceeds of the sale in stock #16, which has an estimated Beta = 1.6. What will be the new Beta of your adjusted portfolio? Assume the risk-free rate of interest = 5.5% and the Market Risk Premium (RM - RRF) = 6%; what is the required return on your adjusted portfolio?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Original portfolio had 15 stocks each worth 15000 for a total value of 225000 Original ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

International Accounting

Authors: Timothy Doupnik, Hector Perera

3rd Edition

978-0078110955, 0078110955

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App