Answered step by step

Verified Expert Solution

Question

1 Approved Answer

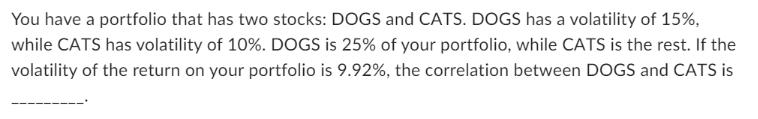

You have a portfolio that has two stocks: DOGS and CATS. DOGS has a volatility of 15%, while CATS has volatility of 10%. DOGS

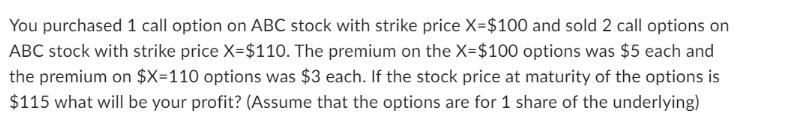

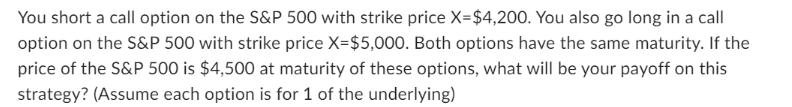

You have a portfolio that has two stocks: DOGS and CATS. DOGS has a volatility of 15%, while CATS has volatility of 10%. DOGS is 25% of your portfolio, while CATS is the rest. If the volatility of the return on your portfolio is 9.92%, the correlation between DOGS and CATS is You purchased 1 call option on ABC stock with strike price X=$100 and sold 2 call options on ABC stock with strike price X=$110. The premium on the X=$100 options was $5 each and the premium on $X=110 options was $3 each. If the stock price at maturity of the options is $115 what will be your profit? (Assume that the options are for 1 share of the underlying) You short a call option on the S&P 500 with strike price X=$4,200. You also go long in a call option on the S&P 500 with strike price X=$5,000. Both options have the same maturity. If the price of the S&P 500 is $4,500 at maturity of these options, what will be your payoff on this strategy? (Assume each option is for 1 of the underlying)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Find the profit from this option strategy Given that you purchased 1 call option with a strike price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started