Answered step by step

Verified Expert Solution

Question

1 Approved Answer

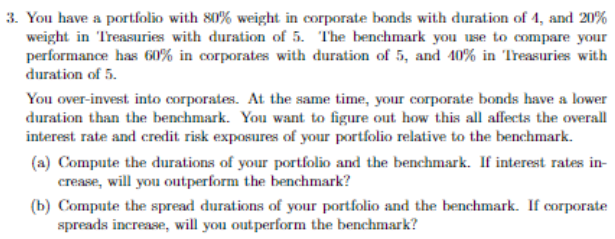

You have a portfolio with 8 0 % weight in corporate bonds with duration of 4 , and 2 0 % weight in Treasuries with

You have a portfolio with weight in corporate bonds with duration of and weight in Treasuries with duration of The benchmark you use to compare your performance has in corporates with duration of and in Treasuries with

duration of

You overinvest into corporates. At the same time, your corporate bonds have a lower duration than the benchmark. You want to figure out how this all affects the overall interest rate and credit risk exposures of your portfolio relative to the benchmark.

a Compute the durations of your portfolio and the benchmark. If interest rates increase, will you outperform the benchmark?

b Compute the spread durations of your portfolio and the benchmark. If corporate spreads increase, will you outperform the benchmark?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started