Question: You have a portfolio with three assets. The forecasted inputs are showed in following table: a. Calculate expected marginal contribution to total risk (MCTR) and

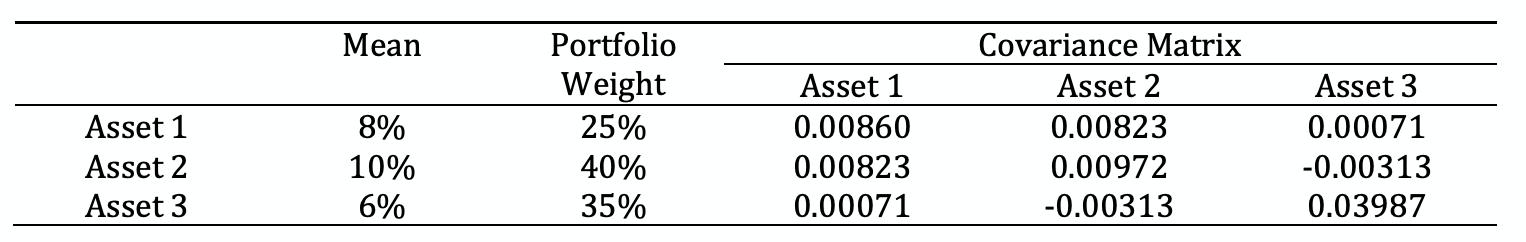

You have a portfolio with three assets. The forecasted inputs are showed in following table:

a. Calculate expected marginal contribution to total risk (MCTR) and absolute contribution to total risk (ACTR) of each asset.

b. You also have benchmark weight, which is 35% in Asset 1, 40% in Asset 2, 25% in Asset 3.

Calculate marginal contribution to tracking error (MCTE) and absolute contribution to tracking error (ACTE). Specify which method do you use and the pros and cons of that method in the context of this question.

Asset 1 Asset 2 Asset 3 Mean 8% 10% 6% Portfolio Weight 25% 40% 35% Asset 1 0.00860 0.00823 0.00071 Covariance Matrix Asset 2 0.00823 0.00972 -0.00313 Asset 3 0.00071 -0.00313 0.03987

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

a To calculate the expected marginal contribution to total risk MCTR and absolute contribution to total risk ACTR of each asset we can use the followi... View full answer

Get step-by-step solutions from verified subject matter experts