Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have a total of $1,000 to invest and would like an expected return of 9% with as little risk (standard deviation) as possible. How

b.) In this market what is the smallest amount of standard deviation you can achieve while maintaining an expected return of 9%? Round to the nearest percentage point.

c.) Now suppose your investment opportunity was restricted. Specifically, you can invest in the risk-free asset and only ONE of the risky assets. Which risky asset would you choose (A, B, C or D) and why?

d.) Suppose the Capital Asset Pricing Model (CAPM) holds. Do you have enough information to determine which risky asset (A, B, C or D) has the highest beta? If so, name the asset with the highest beta. If not, explain what information you are missing.

e.) Continue to assume that the Capital Asset Pricing Model (CAPM) holds. Specifically, assume every investor in the market performs the same analysis you complete and arrive at the same tangency portfolio. Do you have enough information to determine which risky asset (A, B, C or D) has the highest market capitalization (i.e. price per share x number of shares)? If so, name the asset with the highest market capitalization. If not, explain what information you are missing.

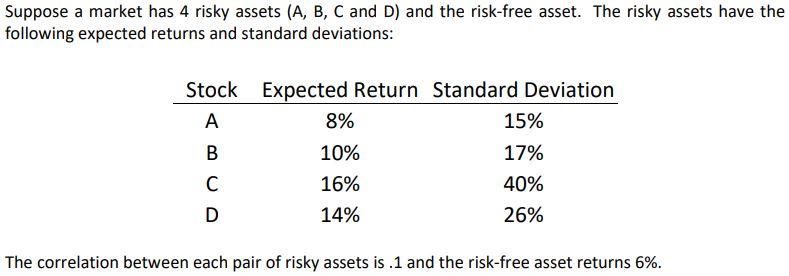

Suppose a market has 4 risky assets (A, B, C and D) and the risk-free asset. The risky assets have the following expected returns and standard deviations: Stock Expected Return Standard Deviation A BUD C 8% 10% 16% 14% 15% 17% 40% 26% The correlation between each pair of risky assets is .1 and the risk-free asset returns 6%.

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To determine the optimal allocation of funds we can use the concept of the tangency portfolio which is the portfolio that lies on the efficient frontier and is tangent to the capital market line The t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started