Question

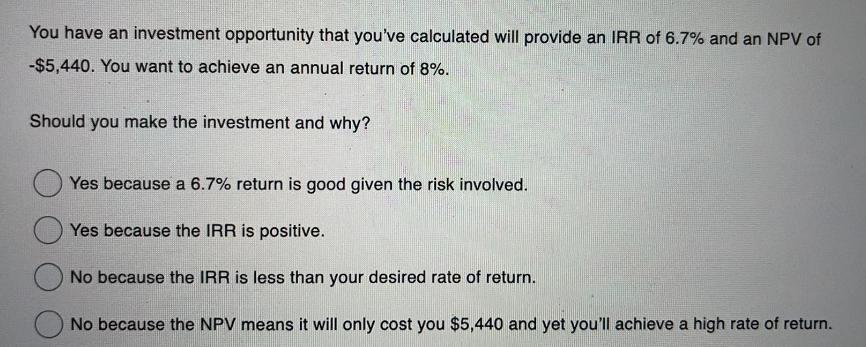

You have an investment opportunity that you've calculated will provide an IRR of 6.7% and an NPV of -$5,440. You want to achieve an

You have an investment opportunity that you've calculated will provide an IRR of 6.7% and an NPV of -$5,440. You want to achieve an annual return of 8%. Should you make the investment and why? Yes because a 6.7% return is good given the risk involved. Yes because the IRR is positive. No because the IRR is less than your desired rate of return. No because the NPV means it will only cost you $5,440 and yet you'll achieve a high rate of return.

Step by Step Solution

3.54 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Given Information IRR 67 Net present va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Berk, DeMarzo, Harford

2nd edition

132148234, 978-0132148238

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App