Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been appointed an investment adviser with one of the investment banking firms in Wonderland. Your main role is to advise clients as

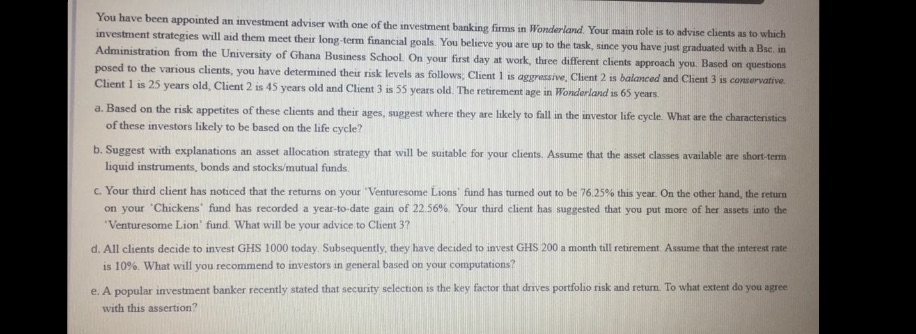

You have been appointed an investment adviser with one of the investment banking firms in Wonderland. Your main role is to advise clients as to which investment strategies will aid them meet their long-term financial goals. You believe you are up to the task, since you have just graduated with a Bsc. in Administration from the University of Ghana Business School. On your first day at work, three different clients approach you. Based on questions posed to the various clients, you have determined their risk levels as follows; Client 1 is aggressive, Client 2 is balanced and Client 3 is conservative. Client 1 is 25 years old, Client 2 is 45 years old and Client 3 is 55 years old. The retirement age in Wonderland is 65 years. a. Based on the risk appetites of these clients and their ages, suggest where they are likely to fall in the investor life cycle. What are the characteristics of these investors likely to be based on the life cycle? b. Suggest with explanations an asset allocation strategy that will be suitable for your clients. Assume that the asset classes available are short-term liquid instruments, bonds and stocks/mutual funds. c. Your third client has noticed that the returns on your "Venturesome Lions' fund has turned out to be 76.25% this year. On the other hand, the return on your 'Chickens' fund has recorded a year-to-date gain of 22.56%. Your third client has suggested that you put more of her assets into the 'Venturesome Lion' fund. What will be your advice to Client 3? d. All clients decide to invest GHS 1000 today. Subsequently, they have decided to invest GHS 200 a month till retirement. Assume that the interest rate is 10%. What will you recommend to investors in general based on your computations? e. A popular investment banker recently stated that security selection is the key factor that drives portfolio risk and return. To what extent do you agree with this assertion?

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Client Risk Tolerance and Life Cycle a Investor Life Cycle Client 1 Aggressive Likely in the accumulation phase At 25 with a long time horizon until retirement 40 years Client 1 can afford to take on ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started