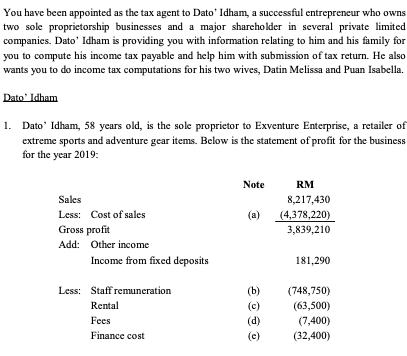

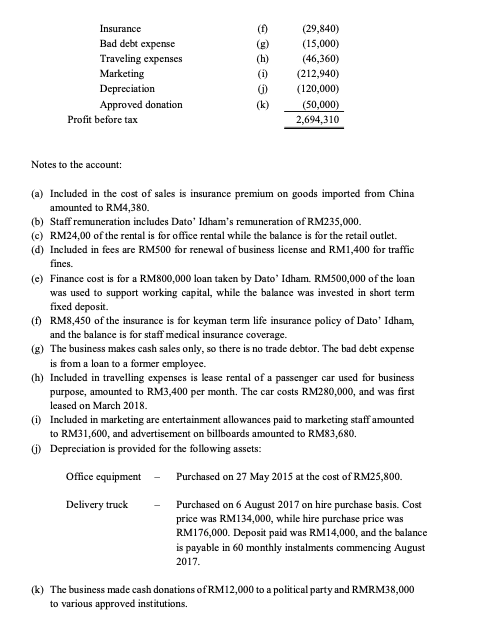

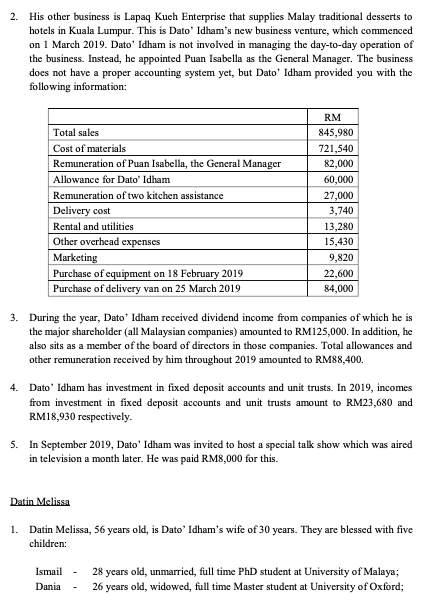

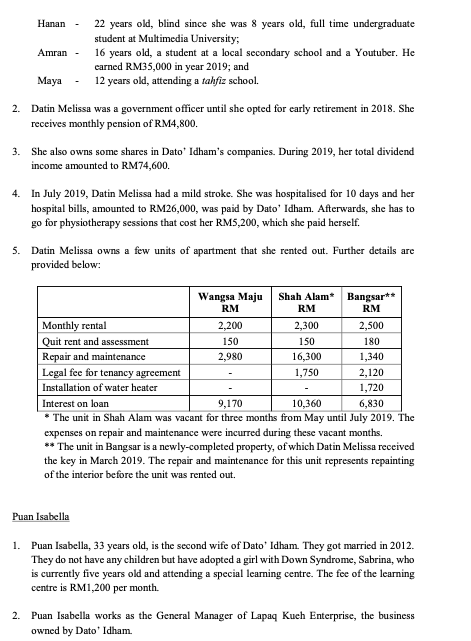

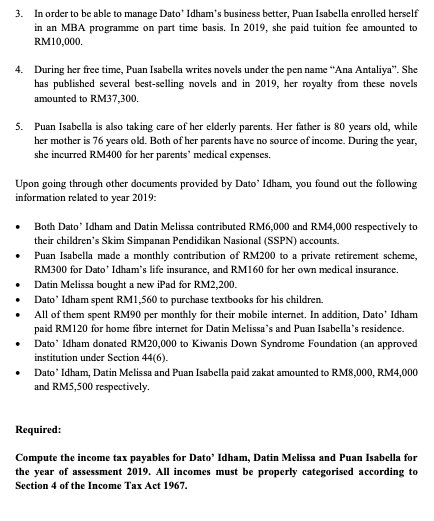

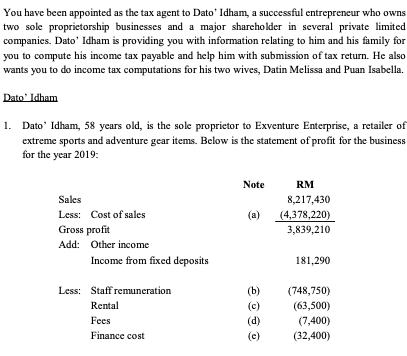

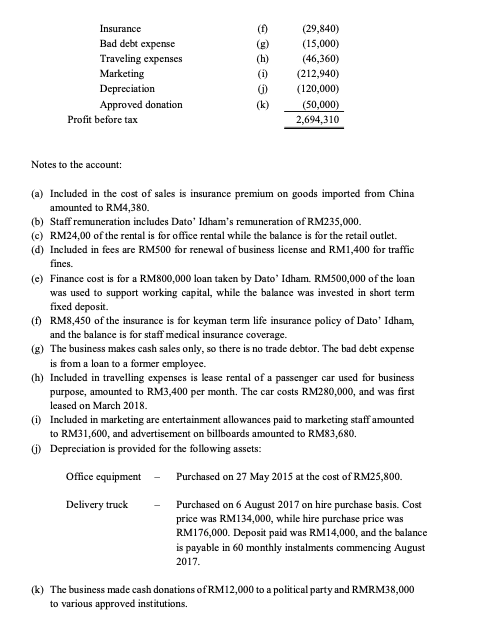

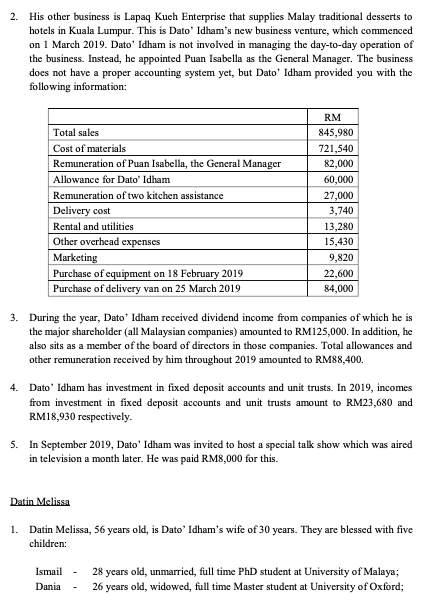

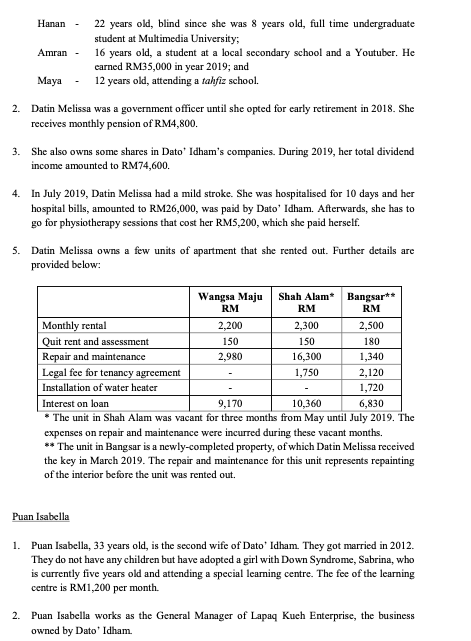

You have been appointed as the tax agent to Dato' Idham, a successful entrepreneur who owns two sole proprietorship businesses and a major shareholder in several private limited companies. Dato' Idham is providing you with information relating to him and his family for you to compute his income tax payable and help him with submission of tax return. He also wants you to do income tax computations for his two wives, Datin Melissa and Puan Isabella. Dato' Idham 1. Dato' Idham, 58 years old, is the sole proprietor to Exventure Enterprise, a retailer of extreme sports and adventure gear items. Below is the statement of profit for the business for the year 2019: Note RM 8,217,430 (4,378,220) 3,839,210 Sales Less: Cost of sales Gross profit Add: Other income Income from fixed deposits (a) 181,290 Less: Staff remuneration Rental Fees Finance cost (b) (c) (d) (c) (748,750) (63,500) (7,400) (32,400) (f) Insurance Bad debt expense Traveling expenses Marketing Depreciation Approved donation Profit before tax (h) (1) (1) (k) (29,840) (15,000) (46,360) (212,940) (120,000) (50,000) 2,694,310 Notes to the account: (a) Included in the cost of sales is insurance premium on goods imported from China amounted to RM4,380. (b) Staff remuneration includes Dato' Idham's remuneration of RM235,000. (C) RM24,00 of the rental is for office rental while the balance is for the retail outlet. (d) Included in fees are RM500 for renewal of business license and RM1,400 for traffic fines (e) Finance cost is for a RM800,000 loan taken by Dato' Idham. RM500,000 of the loan was used to support working capital, while the balance was invested in short term fixed deposit (H) RM8,450 of the insurance is for keyman term life insurance policy of Dato' Idham, and the balance is for staff medical insurance coverage. (g) The business makes cash sales only, so there is no trade debtor. The bad debt expense is from a loan to a former employee. (h) Included in travelling expenses is lease rental of a passenger car used for business purpose, amounted to RM3,400 per month. The car costs RM280,000, and was first leased on March 2018 (1) Included in marketing are entertainment allowances paid to marketing staff amounted to RM31,600, and advertisement on billboards amounted to RM83,680. (1) Depreciation is provided for the following assets: Office equipment Purchased on 27 May 2015 at the cost of RM25,800. Delivery truck Purchased on 6 August 2017 on hire purchase basis. Cost price was RM134,000, while hire purchase price was RM176,000. Deposit paid was RM14,000, and the balance is payable in 60 monthly instalments commencing August 2017. (k) The business made cash donations of RM12,000 to a political party and RMRM38,000 to various approved institutions. 2. His other business is Lapaq Kuch Enterprise that supplies Malay traditional desserts to hotels in Kuala Lumpur. This is Dato' Idham's new business venture, which commenced on 1 March 2019. Dato' Idham is not involved in managing the day-to-day operation of the business. Instead, he appointed Puan Isabella as the General Manager. The business does not have a proper accounting system yet, but Dato* Idham provided you with the following information: Total sales Cost of materials Remuneration of Puan Isabella, the General Manager Allowance for Dato' Idham Remuneration of two kitchen assistance Delivery cost Rental and utilities Other overhead expenses Marketing Purchase of equipment on 18 February 2019 Purchase of delivery van on 25 March 2019 RM 845,980 721,540 82,000 60,000 27,000 3,740 13,280 15,430 9,820 22,600 84,000 3. During the year, Dato' Idham received dividend income from companies of which he is the major shareholder (all Malaysian companies) amounted to RM125,000. In addition, he also sits as a member of the board of directors in those companies. Total allowances and other remuneration received by him throughout 2019 amounted to RM88,400. 4. Dato' Idham has investment in fixed deposit accounts and unit trusts. In 2019, incomes from investment in fixed deposit accounts and unit trusts amount to RM23,680 and RM18,930 respectively. 5. In September 2019, Dato' Idham was invited to host a special talk show which was aired in television a month later. He was paid RM8,000 for this. Datin Melissa 1. Datin Melissa, 56 years old, is Dato' Idham's wife of 30 years. They are blessed with five children: Ismail Dania 28 years old, unmarried, full time PhD student at University of Malaya; 26 years old, widowed, full time Master student at University of Oxford; Hanan 22 years old, blind since she was 8 years old, full time undergraduate student at Multimedia University; Amran - 16 years old, a student at a local secondary school and a Youtuber. He carned RM35,000 in year 2019; and Maya 12 years old, attending a tahfiz school. 2. Datin Melissa was a government officer until she opted for early retirement in 2018. She receives monthly pension of RM4,800. 3. She also owns some shares in Dato' Idham's companies. During 2019, her total dividend income amounted to RM74,600. 4. In July 2019, Datin Melissa had a mild stroke. She was hospitalised for 10 days and her hospital bills, amounted to RM26,000, was paid by Dato' Idham. Afterwards, she has to go for physiotherapy sessions that cost her RM5,200, which she paid herself. 5. Datin Melissa owns a few units of apartment that she rented out. Further details are provided below: 2,500 Wangsa Maju Shah Alam Bangsar** RM RM RM Monthly rental 2,200 2,300 Quit rent and assessment 150 150 180 Repair and maintenance 2,980 16,300 1,340 Legal fee for tenancy agreement 1,750 2,120 Installation of water heater 1,720 Interest on loan 9,170 10,360 6,830 * The unit in Shah Alam was vacant for three months from May until July 2019. The expenses on repair and maintenance were incurred during these vacant months. ** The unit in Bangsar is a newly-completed property, of which Datin Melissa received the key in March 2019. The repair and maintenance for this unit represents repainting of the interior before the unit was rented out. Puan Isabella 1. Puan Isabella, 33 years old, is the second wife of Dato' Idham. They got married in 2012. They do not have any children but have adopted a girl with Down Syndrome, Sabrina, who is currently five years old and attending a special learning centre. The fee of the learning centre is RM1,200 per month. 2. Puan Isabella works as the General Manager of Lapaq Kuch Enterprise, the business owned by Dato' Idham. 3. In order to be able to manage Dato' Idham's business better, Puan Isabella enrolled herself in an MBA programme on part time basis. In 2019, she paid tuition fee amounted to RM10,000. 4. During her free time, Puan Isabella writes novels under the pen name "Ana Antaliya". She has published several best-selling novels and in 2019, her royalty from these novels amounted to RM37,300. 5. Puan Isabella is also taking care of her elderly parents. Her father is 80 years old, while her mother is 76 years old. Both of her parents have no source of income. During the year, she incurred RM400 for her parents' medical expenses. Upon going through other documents provided by Dato' Idham, you found out the following information related to year 2019: Both Dato' Idham and Datin Melissa contributed RM6,000 and RM4,000 respectively to their children's Skim Simpanan Pendidikan Nasional (SSPN) accounts. Puan Isabella made a monthly contribution of RM200 to a private retirement scheme, RM300 for Dato' Idham's life insurance, and RM160 for her own medical insurance. Datin Melissa bought a new iPad for RM2,200. Dato' Idham spent RM1,560 to purchase textbooks for his children. All of them spent RM90 per monthly for their mobile internet. In addition, Dato' Idham paid RM120 for home fibre internet for Datin Melissa's and Puan Isabella's residence. Dato' Idham donated RM20,000 to Kiwanis Down Syndrome Foundation (an approved institution under Section 44(6). Dato' Idham, Datin Melissa and Puan Isabella paid zakat amounted to RM8,000, RM4,000 and RM5,500 respectively. Required: Compute the income tax payables for Dato' Idham, Datin Melissa and Puan Isabella for the year of assessment 2019. All incomes must be properly categorised according to Section 4 of the Income Tax Act 1967. You have been appointed as the tax agent to Dato' Idham, a successful entrepreneur who owns two sole proprietorship businesses and a major shareholder in several private limited companies. Dato' Idham is providing you with information relating to him and his family for you to compute his income tax payable and help him with submission of tax return. He also wants you to do income tax computations for his two wives, Datin Melissa and Puan Isabella. Dato' Idham 1. Dato' Idham, 58 years old, is the sole proprietor to Exventure Enterprise, a retailer of extreme sports and adventure gear items. Below is the statement of profit for the business for the year 2019: Note RM 8,217,430 (4,378,220) 3,839,210 Sales Less: Cost of sales Gross profit Add: Other income Income from fixed deposits (a) 181,290 Less: Staff remuneration Rental Fees Finance cost (b) (c) (d) (c) (748,750) (63,500) (7,400) (32,400) (f) Insurance Bad debt expense Traveling expenses Marketing Depreciation Approved donation Profit before tax (h) (1) (1) (k) (29,840) (15,000) (46,360) (212,940) (120,000) (50,000) 2,694,310 Notes to the account: (a) Included in the cost of sales is insurance premium on goods imported from China amounted to RM4,380. (b) Staff remuneration includes Dato' Idham's remuneration of RM235,000. (C) RM24,00 of the rental is for office rental while the balance is for the retail outlet. (d) Included in fees are RM500 for renewal of business license and RM1,400 for traffic fines (e) Finance cost is for a RM800,000 loan taken by Dato' Idham. RM500,000 of the loan was used to support working capital, while the balance was invested in short term fixed deposit (H) RM8,450 of the insurance is for keyman term life insurance policy of Dato' Idham, and the balance is for staff medical insurance coverage. (g) The business makes cash sales only, so there is no trade debtor. The bad debt expense is from a loan to a former employee. (h) Included in travelling expenses is lease rental of a passenger car used for business purpose, amounted to RM3,400 per month. The car costs RM280,000, and was first leased on March 2018 (1) Included in marketing are entertainment allowances paid to marketing staff amounted to RM31,600, and advertisement on billboards amounted to RM83,680. (1) Depreciation is provided for the following assets: Office equipment Purchased on 27 May 2015 at the cost of RM25,800. Delivery truck Purchased on 6 August 2017 on hire purchase basis. Cost price was RM134,000, while hire purchase price was RM176,000. Deposit paid was RM14,000, and the balance is payable in 60 monthly instalments commencing August 2017. (k) The business made cash donations of RM12,000 to a political party and RMRM38,000 to various approved institutions. 2. His other business is Lapaq Kuch Enterprise that supplies Malay traditional desserts to hotels in Kuala Lumpur. This is Dato' Idham's new business venture, which commenced on 1 March 2019. Dato' Idham is not involved in managing the day-to-day operation of the business. Instead, he appointed Puan Isabella as the General Manager. The business does not have a proper accounting system yet, but Dato* Idham provided you with the following information: Total sales Cost of materials Remuneration of Puan Isabella, the General Manager Allowance for Dato' Idham Remuneration of two kitchen assistance Delivery cost Rental and utilities Other overhead expenses Marketing Purchase of equipment on 18 February 2019 Purchase of delivery van on 25 March 2019 RM 845,980 721,540 82,000 60,000 27,000 3,740 13,280 15,430 9,820 22,600 84,000 3. During the year, Dato' Idham received dividend income from companies of which he is the major shareholder (all Malaysian companies) amounted to RM125,000. In addition, he also sits as a member of the board of directors in those companies. Total allowances and other remuneration received by him throughout 2019 amounted to RM88,400. 4. Dato' Idham has investment in fixed deposit accounts and unit trusts. In 2019, incomes from investment in fixed deposit accounts and unit trusts amount to RM23,680 and RM18,930 respectively. 5. In September 2019, Dato' Idham was invited to host a special talk show which was aired in television a month later. He was paid RM8,000 for this. Datin Melissa 1. Datin Melissa, 56 years old, is Dato' Idham's wife of 30 years. They are blessed with five children: Ismail Dania 28 years old, unmarried, full time PhD student at University of Malaya; 26 years old, widowed, full time Master student at University of Oxford; Hanan 22 years old, blind since she was 8 years old, full time undergraduate student at Multimedia University; Amran - 16 years old, a student at a local secondary school and a Youtuber. He carned RM35,000 in year 2019; and Maya 12 years old, attending a tahfiz school. 2. Datin Melissa was a government officer until she opted for early retirement in 2018. She receives monthly pension of RM4,800. 3. She also owns some shares in Dato' Idham's companies. During 2019, her total dividend income amounted to RM74,600. 4. In July 2019, Datin Melissa had a mild stroke. She was hospitalised for 10 days and her hospital bills, amounted to RM26,000, was paid by Dato' Idham. Afterwards, she has to go for physiotherapy sessions that cost her RM5,200, which she paid herself. 5. Datin Melissa owns a few units of apartment that she rented out. Further details are provided below: 2,500 Wangsa Maju Shah Alam Bangsar** RM RM RM Monthly rental 2,200 2,300 Quit rent and assessment 150 150 180 Repair and maintenance 2,980 16,300 1,340 Legal fee for tenancy agreement 1,750 2,120 Installation of water heater 1,720 Interest on loan 9,170 10,360 6,830 * The unit in Shah Alam was vacant for three months from May until July 2019. The expenses on repair and maintenance were incurred during these vacant months. ** The unit in Bangsar is a newly-completed property, of which Datin Melissa received the key in March 2019. The repair and maintenance for this unit represents repainting of the interior before the unit was rented out. Puan Isabella 1. Puan Isabella, 33 years old, is the second wife of Dato' Idham. They got married in 2012. They do not have any children but have adopted a girl with Down Syndrome, Sabrina, who is currently five years old and attending a special learning centre. The fee of the learning centre is RM1,200 per month. 2. Puan Isabella works as the General Manager of Lapaq Kuch Enterprise, the business owned by Dato' Idham. 3. In order to be able to manage Dato' Idham's business better, Puan Isabella enrolled herself in an MBA programme on part time basis. In 2019, she paid tuition fee amounted to RM10,000. 4. During her free time, Puan Isabella writes novels under the pen name "Ana Antaliya". She has published several best-selling novels and in 2019, her royalty from these novels amounted to RM37,300. 5. Puan Isabella is also taking care of her elderly parents. Her father is 80 years old, while her mother is 76 years old. Both of her parents have no source of income. During the year, she incurred RM400 for her parents' medical expenses. Upon going through other documents provided by Dato' Idham, you found out the following information related to year 2019: Both Dato' Idham and Datin Melissa contributed RM6,000 and RM4,000 respectively to their children's Skim Simpanan Pendidikan Nasional (SSPN) accounts. Puan Isabella made a monthly contribution of RM200 to a private retirement scheme, RM300 for Dato' Idham's life insurance, and RM160 for her own medical insurance. Datin Melissa bought a new iPad for RM2,200. Dato' Idham spent RM1,560 to purchase textbooks for his children. All of them spent RM90 per monthly for their mobile internet. In addition, Dato' Idham paid RM120 for home fibre internet for Datin Melissa's and Puan Isabella's residence. Dato' Idham donated RM20,000 to Kiwanis Down Syndrome Foundation (an approved institution under Section 44(6). Dato' Idham, Datin Melissa and Puan Isabella paid zakat amounted to RM8,000, RM4,000 and RM5,500 respectively. Required: Compute the income tax payables for Dato' Idham, Datin Melissa and Puan Isabella for the year of assessment 2019. All incomes must be properly categorised according to Section 4 of the Income Tax Act 1967