Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been approached by the owners of a retail store - eMart Limited, a local e- commerce food distributor for a potential share

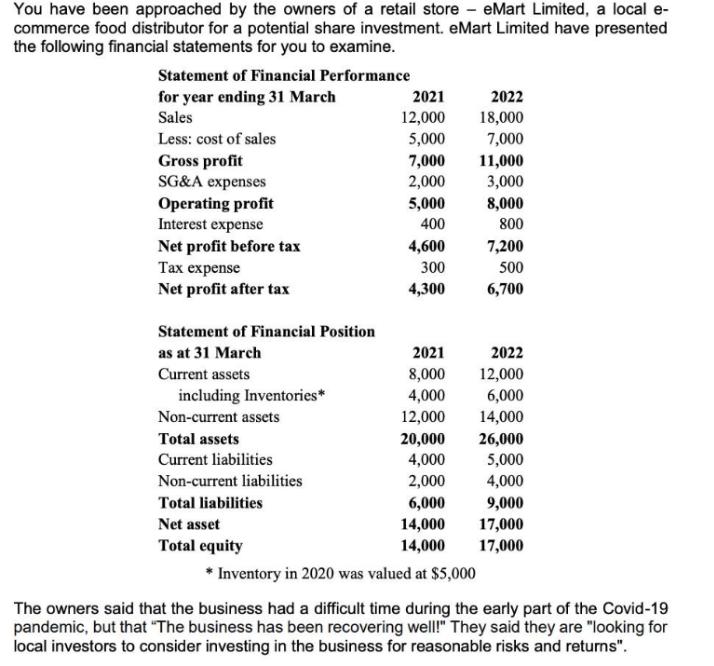

You have been approached by the owners of a retail store - eMart Limited, a local e- commerce food distributor for a potential share investment. eMart Limited have presented the following financial statements for you to examine. Statement of Financial Performance for year ending 31 March Sales Less: cost of sales Gross profit SG&A expenses Operating profit Interest expense Net profit before tax Tax expense Net profit after tax Statement of Financial Position as at 31 March Current assets including Inventories* Non-current assets Total assets Current liabilities Non-current liabilities 2021 12,000 5,000 7,000 2,000 5,000 400 4,600 300 4,300 Total liabilities Net asset Total equity 2021 8,000 4,000 12,000 20,000 4,000 2,000 6,000 14,000 14,000 * Inventory in 2020 was valued at $5,000 2022 18,000 7,000 11,000 3,000 8,000 800 7,200 500 6,700 2022 12,000 6,000 14,000 26,000 5,000 4,000 9,000 17,000 17,000 The owners said that the business had a difficult time during the early part of the Covid-19 pandemic, but that "The business has been recovering well!" They said they are "looking for local investors to consider investing in the business for reasonable risks and returns". Calculate the gearing ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the gearing ratio we need to determine the tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started