Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been approached by your friend Fred, a TRU student, to explore business opportunities in the tourism industry. Adventure guided tours are becoming

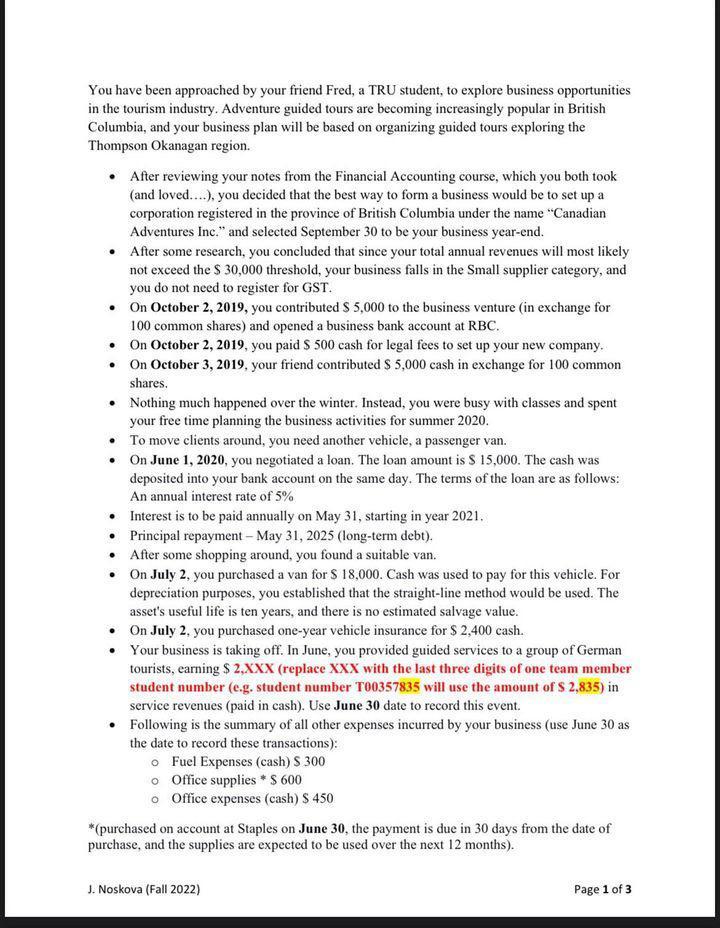

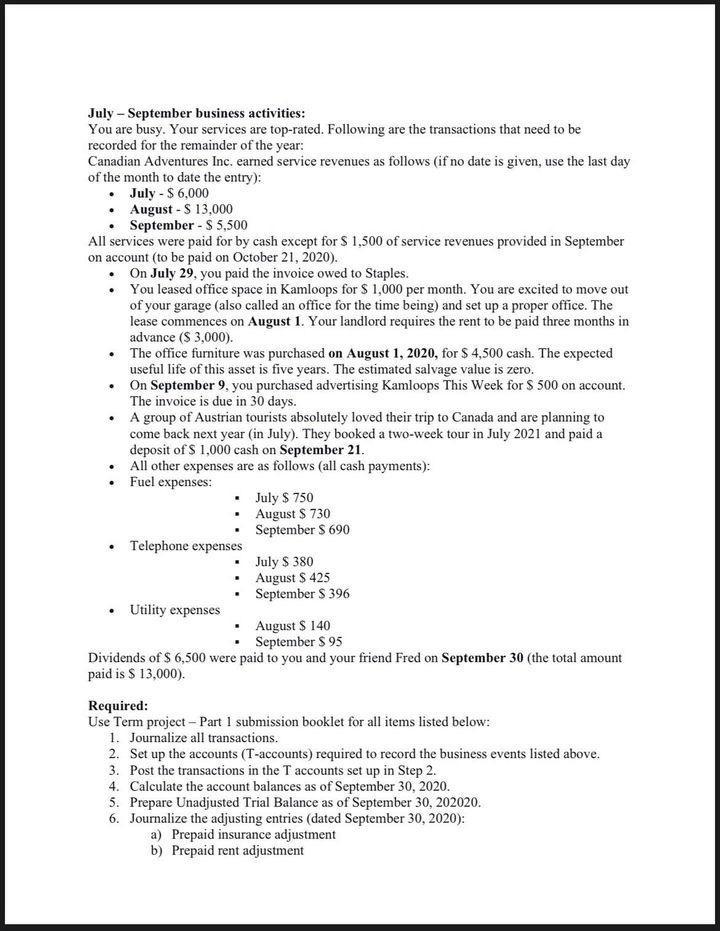

You have been approached by your friend Fred, a TRU student, to explore business opportunities in the tourism industry. Adventure guided tours are becoming increasingly popular in British Columbia, and your business plan will be based on organizing guided tours exploring the Thompson Okanagan region. After reviewing your notes from the Financial Accounting course, which you both took (and loved....), you decided that the best way to form a business would be to set up a corporation registered in the province of British Columbia under the name "Canadian Adventures Inc." and selected September 30 to be your business year-end. After some research, you concluded that since your total annual revenues will most likely not exceed the $ 30,000 threshold, your business falls in the Small supplier category, and you do not need to register for GST. On October 2, 2019, you contributed $ 5,000 to the business venture (in exchange for 100 common shares) and opened a business bank account at RBC. On October 2, 2019, you paid $ 500 cash for legal fees to set up your new company. On October 3, 2019, your friend contributed $ 5,000 cash in exchange for 100 common shares. Nothing much happened over the winter. Instead, you were busy with classes and spent your free time planning the business activities for summer 2020. To move clients around, you need another vehicle, a passenger van. On June 1, 2020, you negotiated a loan. The loan amount is $ 15,000. The cash was deposited into your bank account on the same day. The terms of the loan are as follows: An annual interest rate of 5% Interest is to be paid annually on May 31, starting in year 2021. Principal repayment - May 31, 2025 (long-term debt). After some shopping around, you found a suitable van. On July 2, you purchased a van for $ 18,000. Cash was used to pay for this vehicle. For depreciation purposes, you established that the straight-line method would be used. The asset's useful life is ten years, and there is no estimated salvage value. On July 2, you purchased one-year vehicle insurance for $ 2,400 cash. Your business is taking off. In June, you provided guided services to a group of German tourists, earning $ 2,XXX (replace XXX with the last three digits of one team member student number (e.g. student number T00357835 will use the amount of $ 2,835) in service revenues (paid in cash). Use June 30 date to record this event. Following is the summary of all other expenses incurred by your business (use June 30 as the date to record these transactions): Fuel Expenses (cash) S 300 o Office supplies * $ 600 o Office expenses (cash) $ 450 *(purchased on account at Staples on June 30, the payment is due in 30 days from the date of purchase, and the supplies are expected to be used over the next 12 months). J. Noskova (Fall 2022) Page 1 of 3 July-September business activities: You are busy. Your services are top-rated. Following are the transactions that need to be recorded for the remainder of the year: Canadian Adventures Inc. earned service revenues as follows (if no date is given, use the last day of the month to date the entry): July - $ 6,000 August $ 13,000 September - $ 5,500 All services were paid for by cash except for $ 1.500 of service revenues provided in September on account (to be paid on October 21, 2020). On July 29, you paid the invoice owed to Staples. You leased office space in Kamloops for $ 1,000 per month. You are excited to move out of your garage (also called an office for the time being) and set up a proper office. The lease commences on August 1. Your landlord requires the rent to be paid three months in advance ($ 3,000). The office furniture was purchased on August 1, 2020, for $ 4,500 cash. The expected useful life of this asset is five years. The estimated salvage value is zero. On September 9, you purchased advertising Kamloops This Week for $ 500 on account. The invoice is due in 30 days. A group of Austrian tourists absolutely loved their trip to Canada and are planning to come back next year (in July). They booked a two-week tour in July 2021 and paid a deposit of $ 1,000 cash on September 21. . . All other expenses are as follows (all cash payments): Fuel expenses: Telephone expenses Utility expenses . July $ 750 August $ 730 September $ 690 July $ 380 August $ 425 September $ 396 August $ 140 September $ 95 Dividends of $ 6,500 were paid to you and your friend Fred on September 30 (the total amount paid is $ 13,000). Required: Use Term project - Part 1 submission booklet for all items listed below: 1. Journalize all transactions. 2. Set up the accounts (T-accounts) required to record the business events listed above. 3. Post the transactions in the T accounts set up in Step 2. 4. Calculate the account balances as of September 30, 2020. 5. Prepare Unadjusted Trial Balance as of September 30, 202020. 6. Journalize the adjusting entries (dated September 30, 2020): a) Prepaid insurance adjustment b) Prepaid rent adjustment

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer Journalizing the transactions October 2 2019 Dr Cash 10000 Cr Common Shares Canadian Adventures Inc 10000 October 2 2019 Dr Legal fees expense ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started