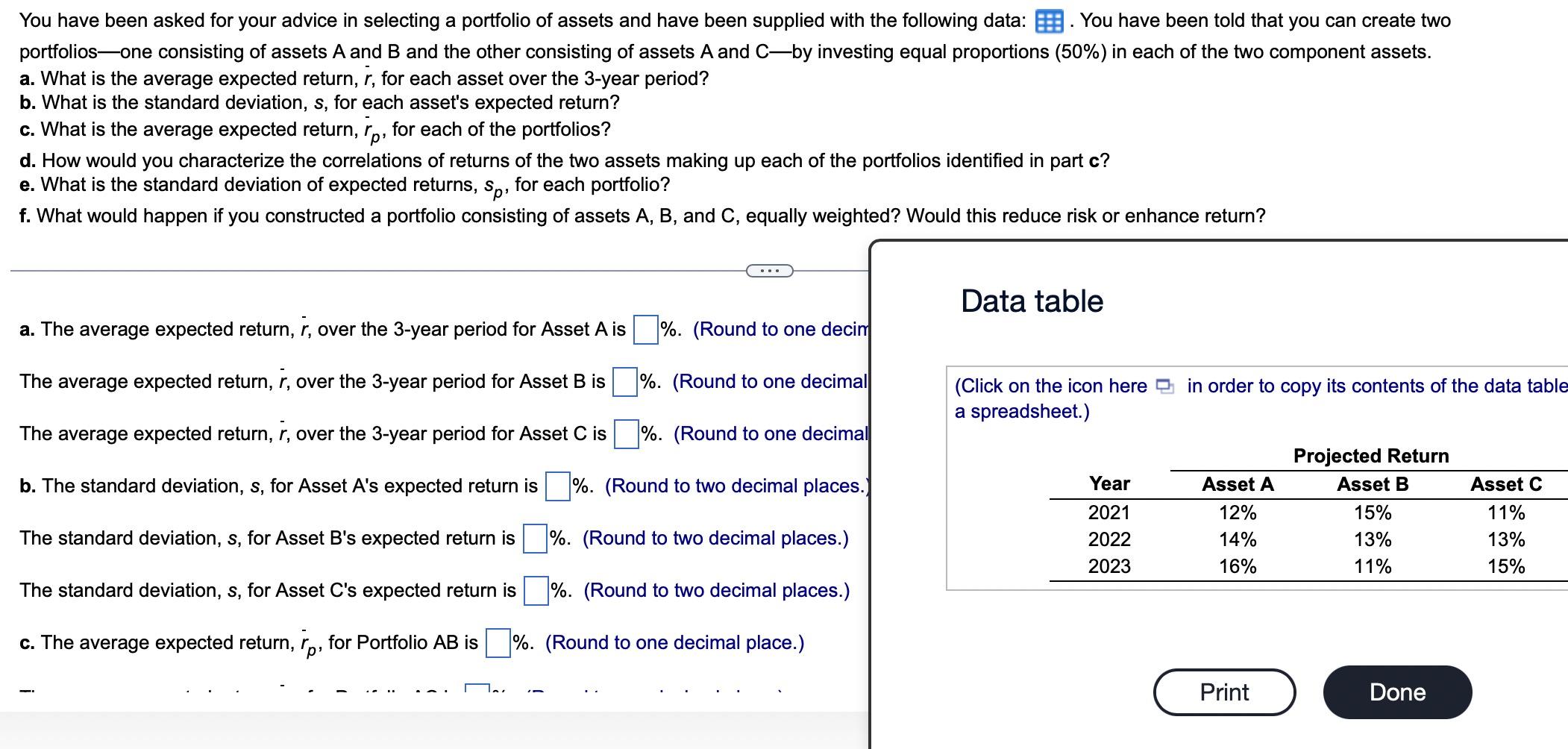

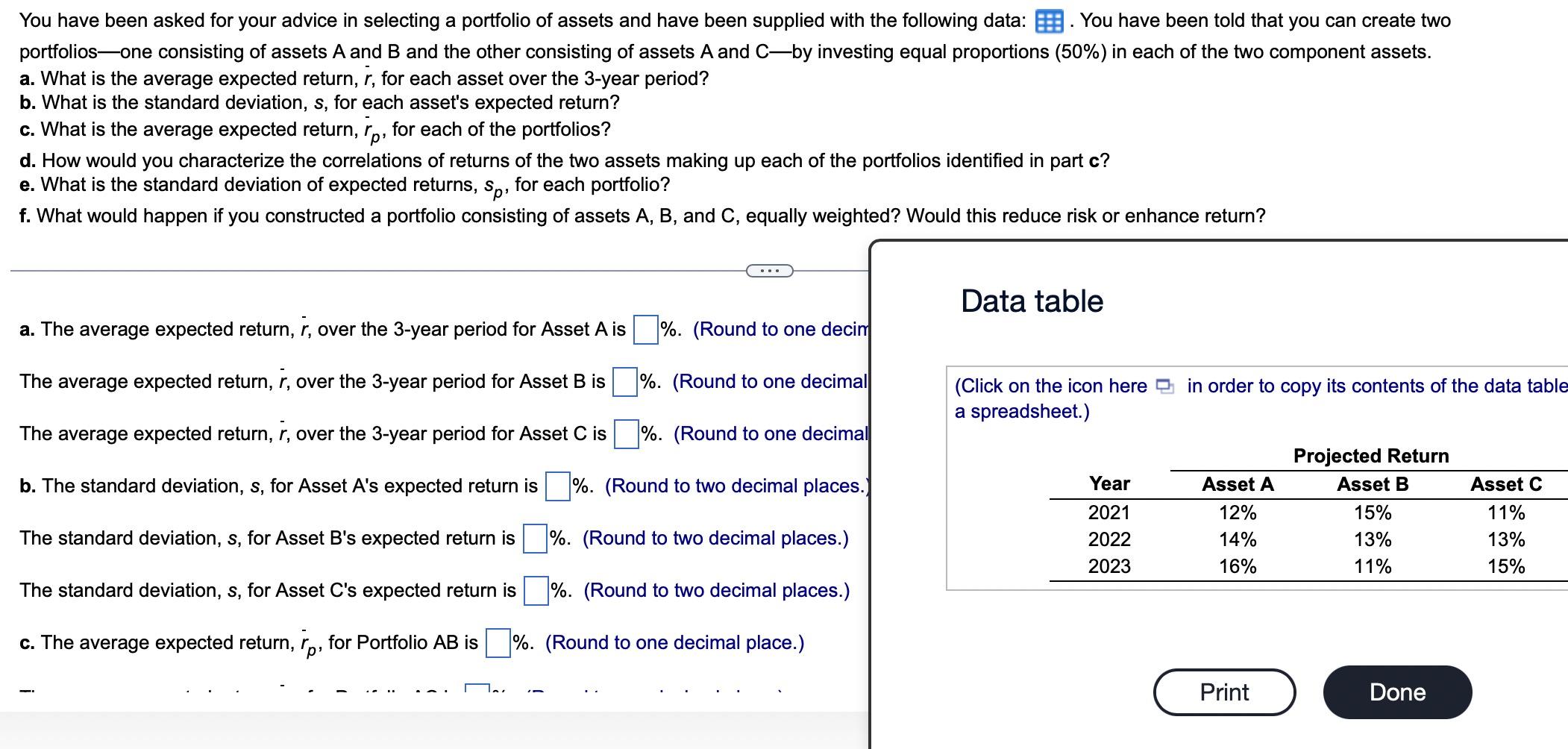

You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data: LOADING... . You have been told that you can create two portfoliosone consisting of assets A and B and the other consisting of assets A and Cby investing equal proportions (50%) in each of the two component assets. a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, rp, for each of the portfolios? d. How would you characterize the correlations of returns of the two assets making up each of the portfolios identified in part c? e. What is the standard deviation of expected returns, sp, for each portfolio? f. What would happen if you constructed a portfolio consisting of assets A, B, and C, equally weighted? Would this reduce risk or enhance return?

You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data: LOADING... . You have been told that you can create two portfoliosone consisting of assets A and B and the other consisting of assets A and Cby investing equal proportions (50%) in each of the two component assets. a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, rp, for each of the portfolios? d. How would you characterize the correlations of returns of the two assets making up each of the portfolios identified in part c? e. What is the standard deviation of expected returns, sp, for each portfolio? f. What would happen if you constructed a portfolio consisting of assets A, B, and C, equally weighted? Would this reduce risk or enhance return?

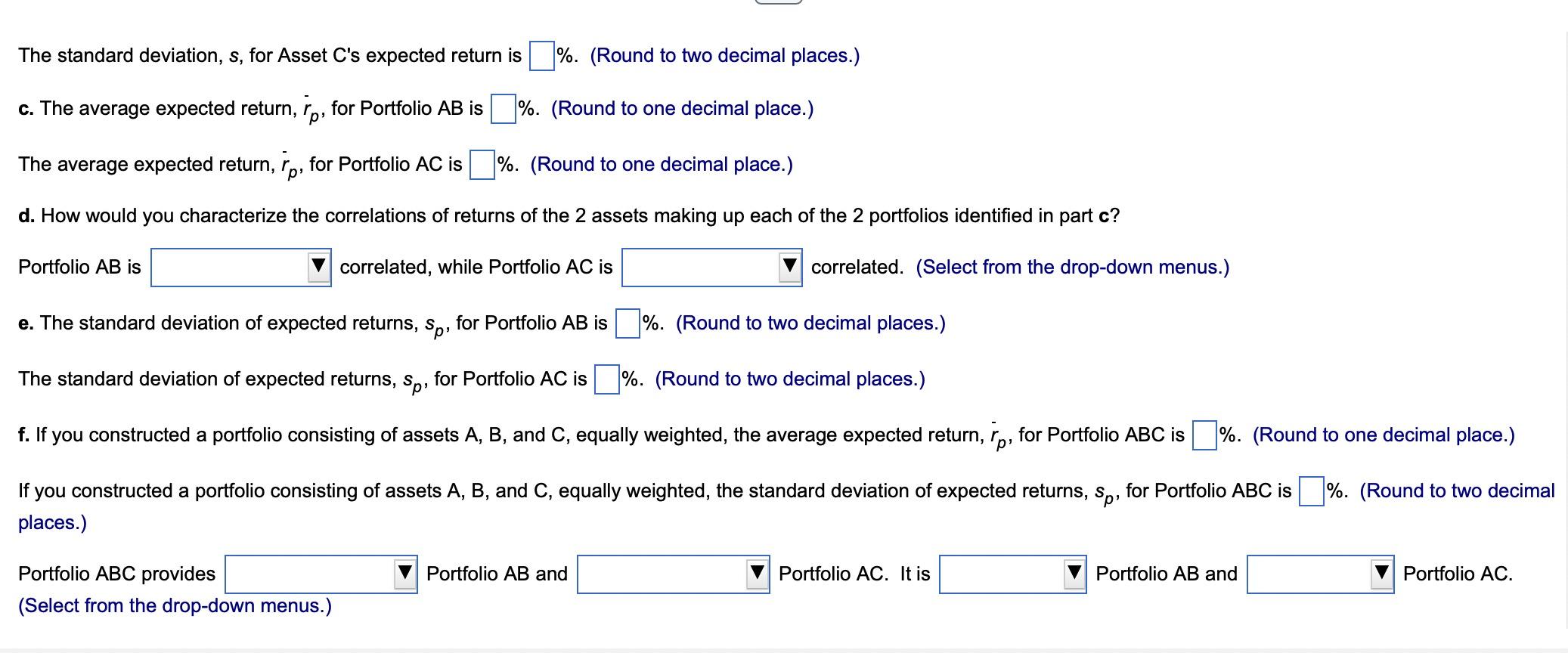

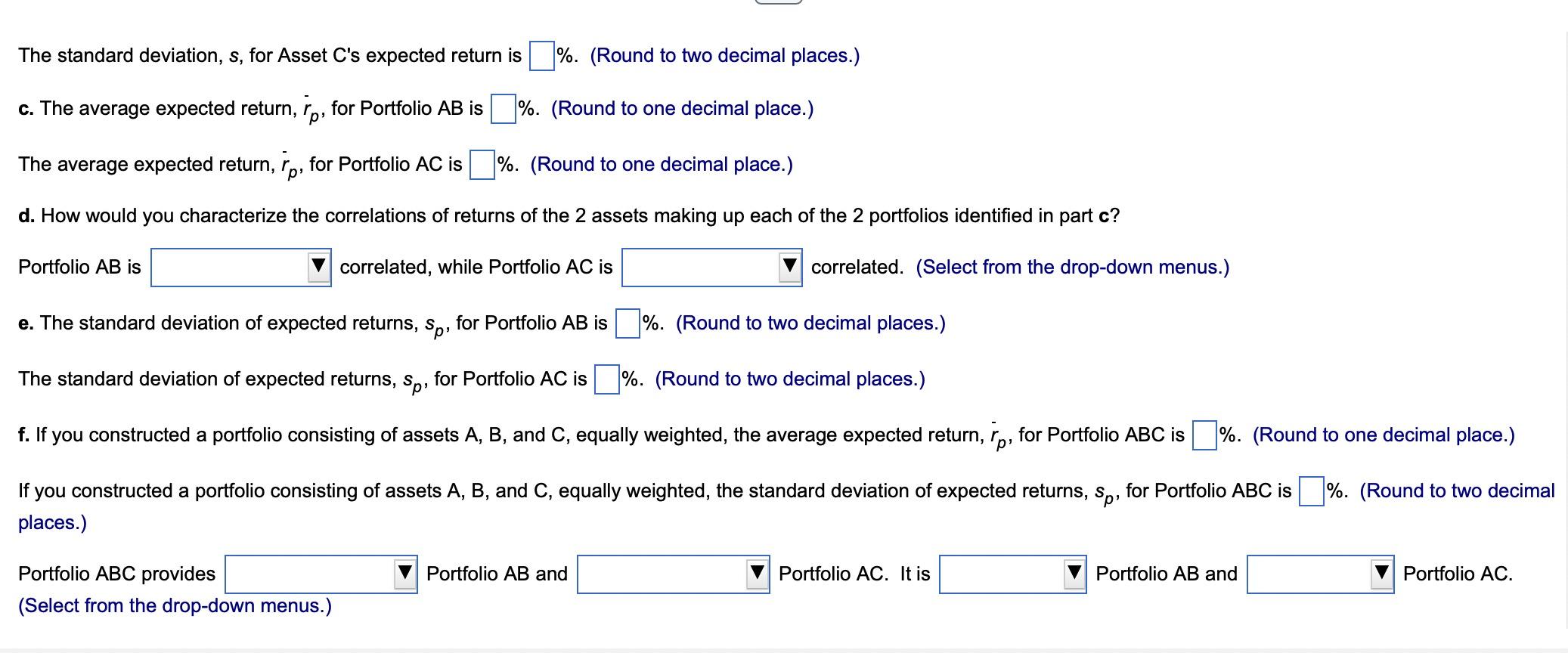

You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data: portfolios-one consisting of assets A and B and the other consisting of assets A and C-by investing equal proportions (50\%) in each of the two component assets. a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, rp, for each of the portfolios? d. How would you characterize the correlations of returns of the two assets making up each of the portfolios identified in part c? e. What is the standard deviation of expected returns, sp, for each portfolio? f. What would happen if you constructed a portfolio consisting of assets A,B, and C, equally weighted? Would this reduce risk or enhance return? The standard deviation, s, for Asset C's expected return is \%. (Round to two decimal places.) c. The average expected return, rp, for Portfolio AB is \%. (Round to one decimal place.) The average expected return, rp, for Portfolio AC is \%. (Round to one decimal place.) d. How would you characterize the correlations of returns of the 2 assets making up each of the 2 portfolios identified in part c? Portfolio AB is correlated, while Portfolio AC is correlated. (Select from the drop-down menus.) e. The standard deviation of expected returns, sp, for Portfolio AB is \%. (Round to two decimal places.) The standard deviation of expected returns, sp, for Portfolio AC is \%. (Round to two decimal places.) f. If you constructed a portfolio consisting of assets A,B, and C, equally weighted, the average expected return, rp, for Portfolio ABC is %. (Round to one decimal place.) If you constructed a portfolio consisting of assets A,B, and C, equally weighted, the standard deviation of expected returns, sp, for Portfolio ABC is %. (Round to two decimal places.) Portfolio ABC provides Portfolio AB and Portfolio AC. It is Portfolio AB and Portfolio AC. (Select from the drop-down menus.) You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data: portfolios-one consisting of assets A and B and the other consisting of assets A and C-by investing equal proportions (50\%) in each of the two component assets. a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, rp, for each of the portfolios? d. How would you characterize the correlations of returns of the two assets making up each of the portfolios identified in part c? e. What is the standard deviation of expected returns, sp, for each portfolio? f. What would happen if you constructed a portfolio consisting of assets A,B, and C, equally weighted? Would this reduce risk or enhance return? The standard deviation, s, for Asset C's expected return is \%. (Round to two decimal places.) c. The average expected return, rp, for Portfolio AB is \%. (Round to one decimal place.) The average expected return, rp, for Portfolio AC is \%. (Round to one decimal place.) d. How would you characterize the correlations of returns of the 2 assets making up each of the 2 portfolios identified in part c? Portfolio AB is correlated, while Portfolio AC is correlated. (Select from the drop-down menus.) e. The standard deviation of expected returns, sp, for Portfolio AB is \%. (Round to two decimal places.) The standard deviation of expected returns, sp, for Portfolio AC is \%. (Round to two decimal places.) f. If you constructed a portfolio consisting of assets A,B, and C, equally weighted, the average expected return, rp, for Portfolio ABC is %. (Round to one decimal place.) If you constructed a portfolio consisting of assets A,B, and C, equally weighted, the standard deviation of expected returns, sp, for Portfolio ABC is %. (Round to two decimal places.) Portfolio ABC provides Portfolio AB and Portfolio AC. It is Portfolio AB and Portfolio AC. (Select from the drop-down menus.)

You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data: LOADING... . You have been told that you can create two portfoliosone consisting of assets A and B and the other consisting of assets A and Cby investing equal proportions (50%) in each of the two component assets. a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, rp, for each of the portfolios? d. How would you characterize the correlations of returns of the two assets making up each of the portfolios identified in part c? e. What is the standard deviation of expected returns, sp, for each portfolio? f. What would happen if you constructed a portfolio consisting of assets A, B, and C, equally weighted? Would this reduce risk or enhance return?

You have been asked for your advice in selecting a portfolio of assets and have been supplied with the following data: LOADING... . You have been told that you can create two portfoliosone consisting of assets A and B and the other consisting of assets A and Cby investing equal proportions (50%) in each of the two component assets. a. What is the average expected return, r, for each asset over the 3-year period? b. What is the standard deviation, s, for each asset's expected return? c. What is the average expected return, rp, for each of the portfolios? d. How would you characterize the correlations of returns of the two assets making up each of the portfolios identified in part c? e. What is the standard deviation of expected returns, sp, for each portfolio? f. What would happen if you constructed a portfolio consisting of assets A, B, and C, equally weighted? Would this reduce risk or enhance return?