Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been asked to analyze the following two mutually exclusive projects for a client. The client's cost of capital is 15% (this is

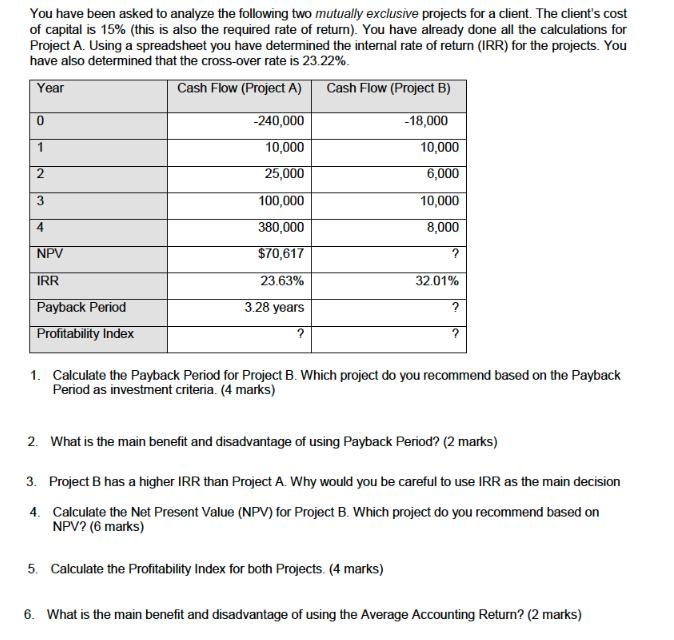

You have been asked to analyze the following two mutually exclusive projects for a client. The client's cost of capital is 15% (this is also the required rate of return). You have already done all the calculations for Project A. Using a spreadsheet you have determined the internal rate of return (IRR) for the projects. You have also determined that the cross-over rate is 23.22%. Year 0 1 2 3 4 NPV IRR Payback Period Profitability Index Cash Flow (Project A) Cash Flow (Project B) -240,000 -18,000 10,000 10,000 25,000 6,000 100,000 10,000 380,000 8,000 $70,617 23.63% 32.01% 3.28 years ? ? 1. Calculate the Payback Period for Project B. Which project do you recommend based on the Payback Period as investment criteria. (4 marks) 2. What is the main benefit and disadvantage of using Payback Period? (2 marks) 3. Project B has a higher IRR than Project A. Why would you be careful to use IRR as the main decision 4. Calculate the Net Present Value (NPV) for Project B. Which project do you recommend based on NPV? (6 marks) 5. Calculate the Profitability Index for both Projects. (4 marks) 6. What is the main benefit and disadvantage of using the Average Accounting Return? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started