Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been asked to assess the capital structure for Galaxy Inc., a publicly traded firm that operates in the bottled water and beverage

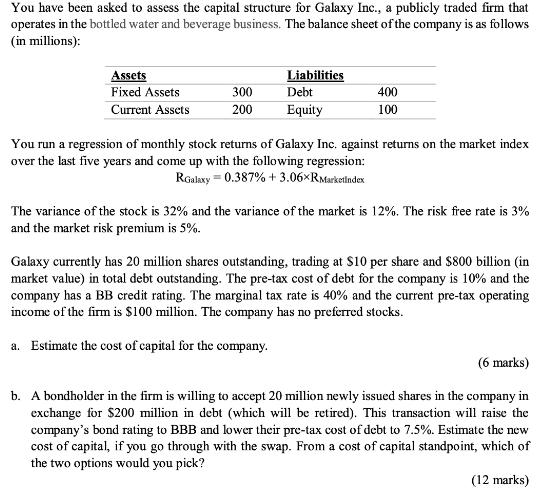

You have been asked to assess the capital structure for Galaxy Inc., a publicly traded firm that operates in the bottled water and beverage business. The balance sheet of the company is as follows (in millions): Assets Fixed Assets Current Assets 300 200 Liabilities Debt Equity 400 100 You run a regression of monthly stock returns of Galaxy Inc. against returns on the market index over the last five years and come up with the following regression: RGalaxy = 0.387% + 3.06 RMarketindex The variance of the stock is 32% and the variance of the market is 12%. The risk free rate is 3% and the market risk premium is 5%. Galaxy currently has 20 million shares outstanding, trading at $10 per share and $800 billion (in market value) in total debt outstanding. The pre-tax cost of debt for the company is 10% and the company has a BB credit rating. The marginal tax rate is 40% and the current pre-tax operating income of the firm is $100 million. The company has no preferred stocks. a. Estimate the cost of capital for the company. (6 marks) b. A bondholder in the firm is willing to accept 20 million newly issued shares in the company in exchange for $200 million in debt (which will be retired). This transaction will raise the company's bond rating to BBB and lower their pre-tax cost of debt to 7.5%. Estimate the new cost of capital, if you go through with the swap. From a cost of capital standpoint, which of the two options would you pick? (12 marks)

Step by Step Solution

★★★★★

3.27 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To estimate the cost of capital for Galaxy Inc we need to find the cost of equity and the cost of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started