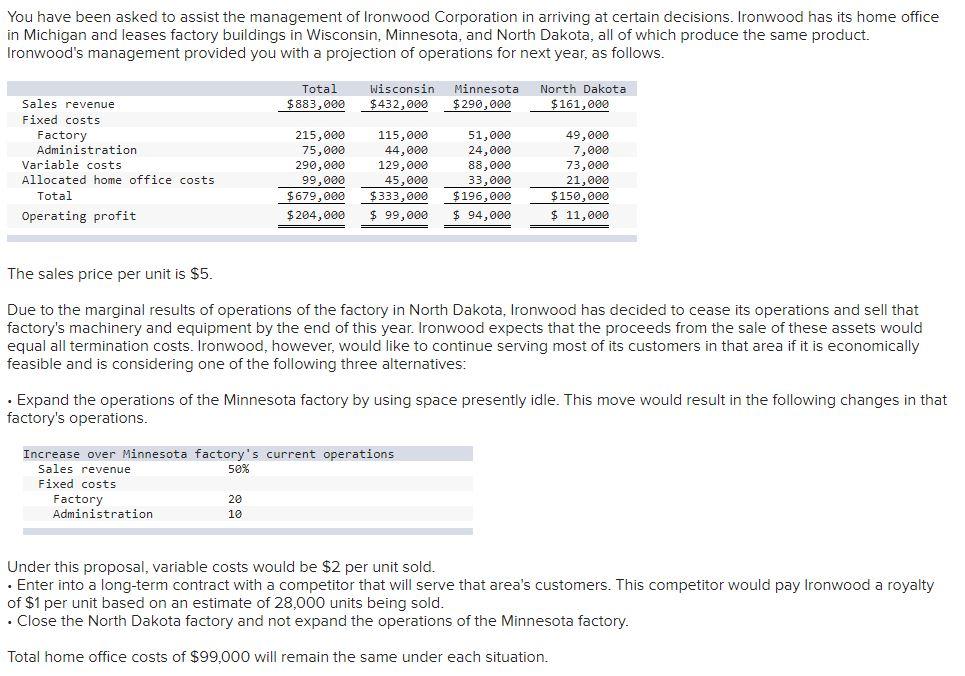

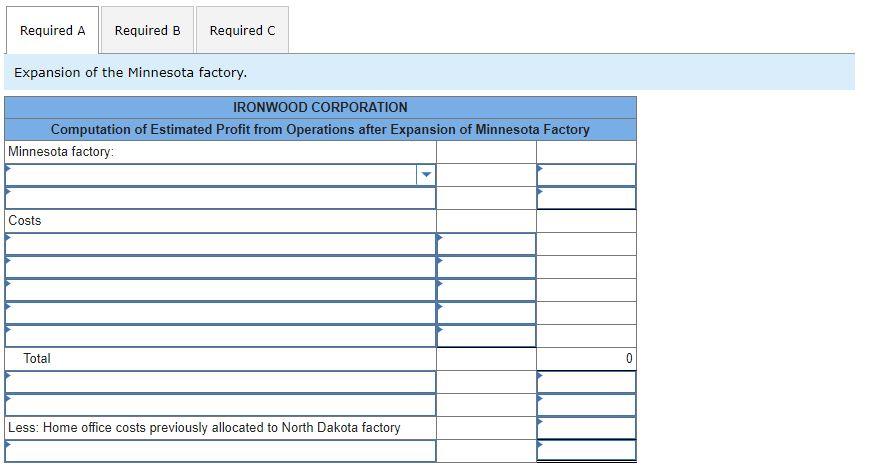

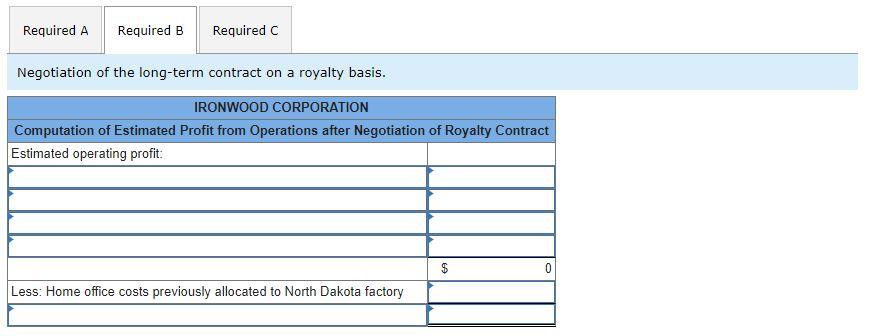

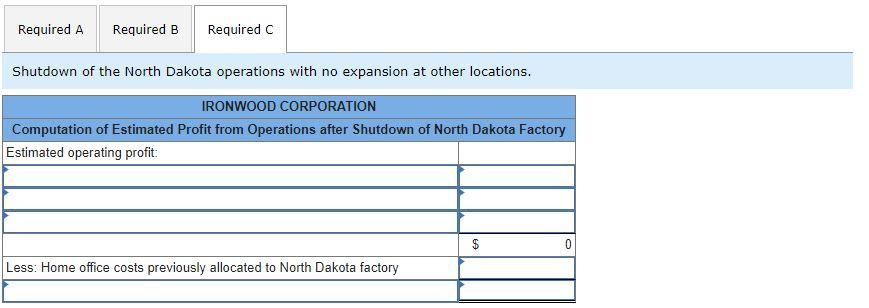

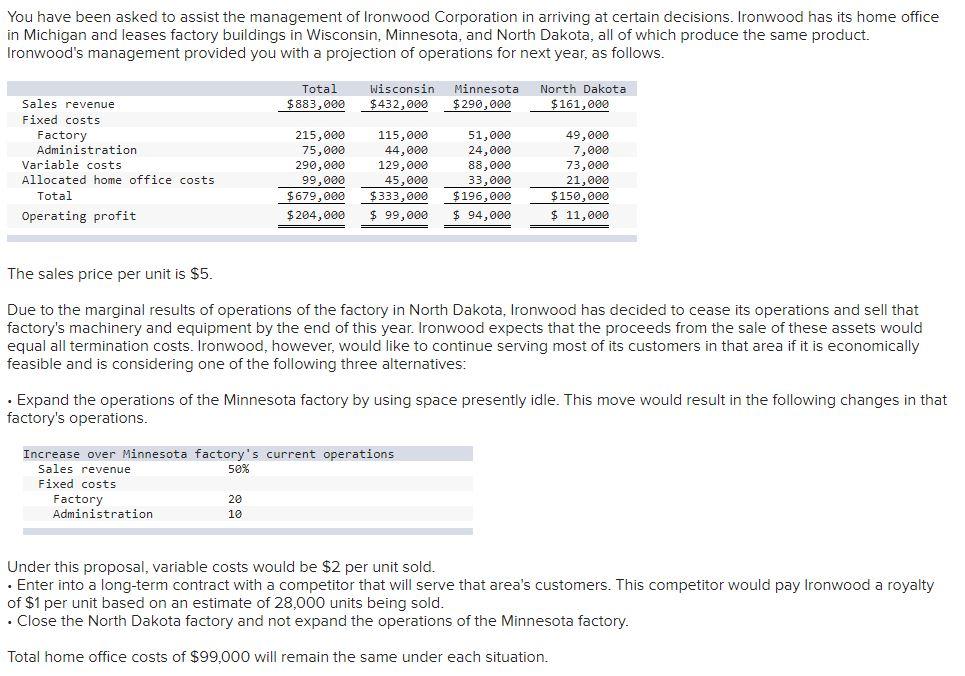

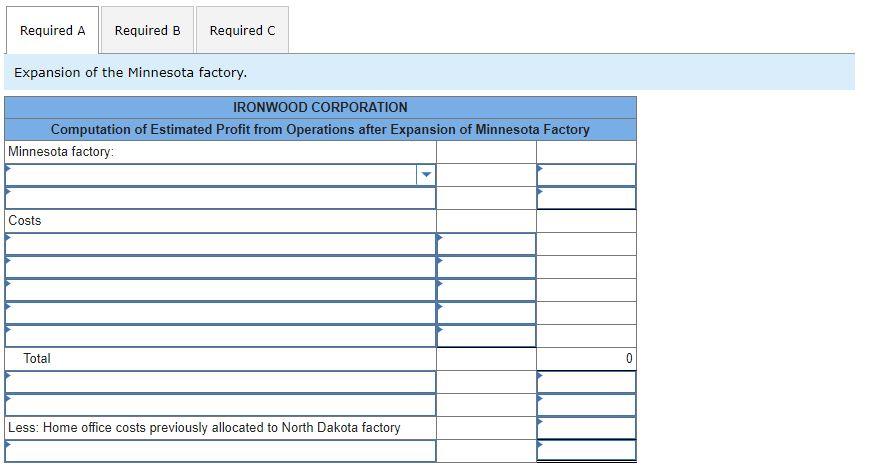

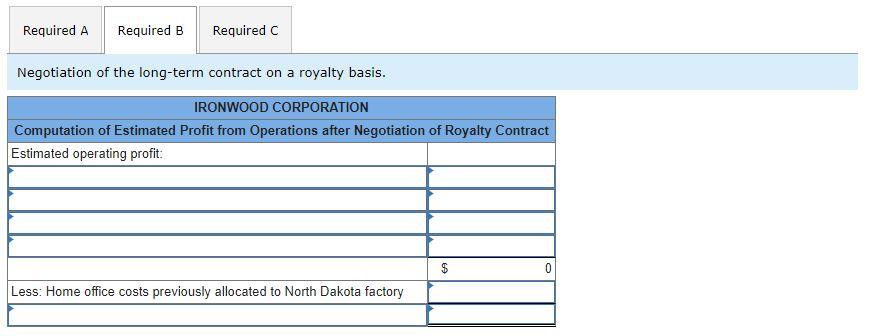

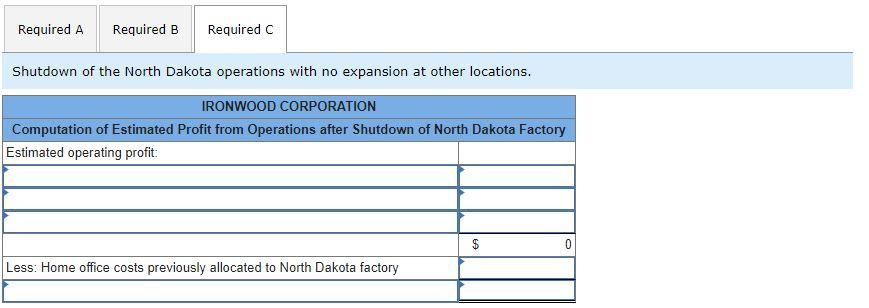

You have been asked to assist the management of Ironwood Corporation in arriving at certain decisions, Ironwood has its home office in Michigan and leases factory buildings in Wisconsin, Minnesota, and North Dakota, all of which produce the same product. Ironwood's management provided you with a projection of operations for next year, as follows. Total $883,000 Wisconsin $432,000 Minnesota $ 290,000 North Dakota $ 161,000 Sales revenue Fixed costs Factory Administration Variable costs Allocated home office costs Total Operating profit 215,000 75,000 290,000 99,000 $679,000 $ 204,000 115,000 44,000 129,000 45,000 $333,000 $ 99,000 51,000 24,000 88,000 33,000 $196,000 $ 94,000 49,000 7,000 73,000 21,009 $150,000 $ 11,000 The sales price per unit is $5. Due to the marginal results of operations of the factory in North Dakota, Ironwood has decided to cease its operations and sell that factory's machinery and equipment by the end of this year. Ironwood expects that the proceeds from the sale of these assets would equal all termination costs. Ironwood, however, would like to continue serving most of its customers in that area if it is economically feasible and is considering one of the following three alternatives: Expand the operations of the Minnesota factory by using space presently idle. This move would result in the following changes in that factory's operations. Increase over Minnesota factory's current operations Sales revenue 50% Fixed costs Factory 20 Administration 10 Under this proposal, variable costs would be $2 per unit sold. Enter into a long-term contract with a competitor that will serve that area's customers. This competitor would pay Ironwood a royalty of $1 per unit based on an estimate of 28,000 units being sold. . Close the North Dakota factory and not expand the operations of the Minnesota factory. Total home office costs of $99,000 will remain the same under each situation. Required A Required B Required C Expansion of the Minnesota factory. IRONWOOD CORPORATION Computation of Estimated Profit from Operations after Expansion of Minnesota Factory Minnesota factory: Costs Total 0 Less: Home office costs previously allocated to North Dakota factory Required A Required B Required C Negotiation of the long-term contract on a royalty basis. IRONWOOD CORPORATION Computation of Estimated Profit from Operations after Negotiation of Royalty Contract Estimated operating profit: 0 Less: Home office costs previously allocated to North Dakota factory Required A Required B Required C Shutdown of the North Dakota operations with no expansion at other locations. IRONWOOD CORPORATION Computation of Estimated Profit from Operations after Shutdown of North Dakota Factory Estimated operating profit: $ 0 Less: Home office costs previously allocated to North Dakota factory