Answered step by step

Verified Expert Solution

Question

1 Approved Answer

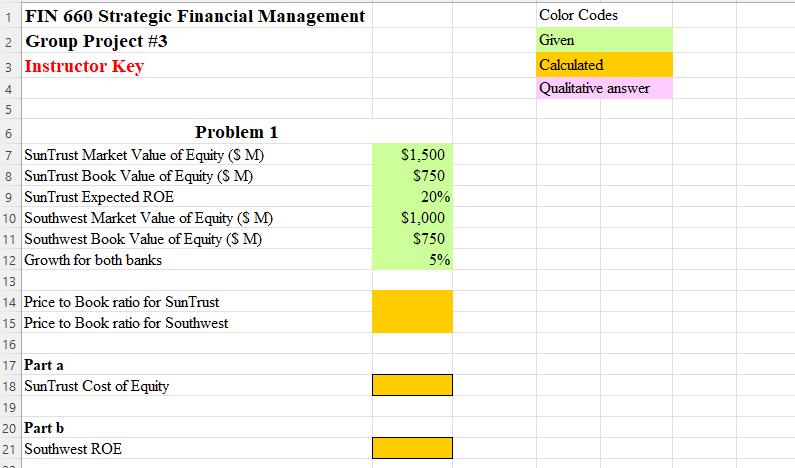

You have been asked to compare two banks - Suntrust Banks and Southwest Banks.Suntrust has a market value of equity of $ 1.5 billion, a

- You have been asked to compare two banks - Suntrust Banks and Southwest Banks. Suntrust has a market value of equity of $ 1.5 billion, a book value of equity of $ 750 million, and is expected to earn 20% as its returnon equity. SouthwestBanks has a market value of equity of $ 1.00 billion and a book value of equity of $ 750 million. Both firms are in stable growth, growing at 5% a year,and the same cost of equity.

- Assuming that Suntrust is correctly valued by the market, estimate the cost of equity for the bank.

- Using the cost of equity estimated in part a, estimate the return on equity that Southwest Banks is expected to earn in the future. (You can assume that Southwest Banks is correctly priced as well.)

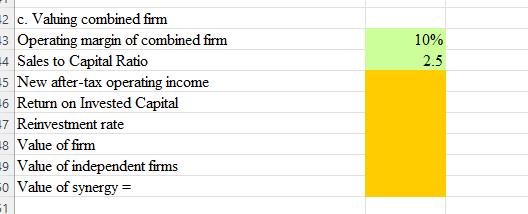

- You have been asked to assess the value of synergy in an acquisition of Nuevos Fashion, a children's apparel firm, by Fitch and Spitzer, a general apparel firm. You are supplied with the following information on the two firms.

- Nuevos Fashion earned an after-tax operating margin of 8% on its revenues of $ 1,000 million last year, and its sales tocapital ratio was 2. The cost of capital is 10%.

- Fitch and Spitzer earnedan after-tax operatingmargin of 10% on its revenues of $2,250 million and its sales to capital ratio was 2.5. The dollar cost of capitalis 10%.

- Value NuevosFashion as an independent firm.

You can assume that both firms would be in stable growth as independent companies, growing 5% a year.

- Value Fitch and Spitzer as an independent firm.

- Now assume that the primary motive behind the merger is Fitch and Spitzer's belief that they can run Nuevos more efficiently and increase its sales to capital ratio and margin to match their own. Assuming that the growth rate remains unchanged at 5%, estimate the value ofcontrol in this merger.

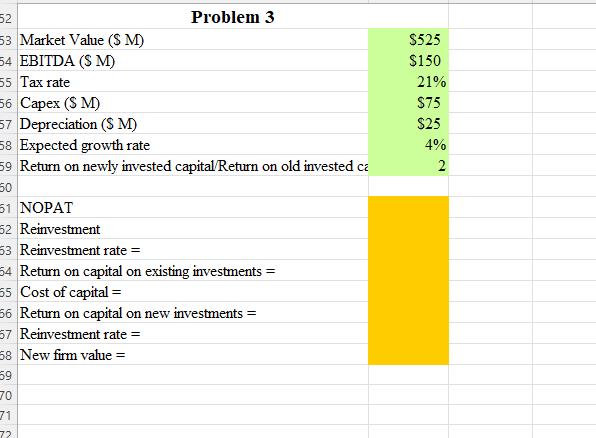

- You have been called in by LaPlace Instruments, a manufacturer of medical equipment, to provide some advice on value creation. The firm has a market value of $ 525 million and you believe that.

- The firm reported EBITDA of 150 million in the most recent financial year and paid 21% of its income as taxes. The firm also had capital expenditures of $ 75 million, depreciation of $ 25 million, and no working capital needs during the year. The firm has an expected growth rate of 4%. You believe that the firm can double its return on capital on new investments but cannot do much to improve its return on capital on existing investments.

- Estimate the value of the firm with this change, assuming that the stable growth rate remains 4%?

1 FIN 660 Strategic Financial Management 2 Group Project #3 3 Instructor Key 4 in 5 Problem 1 7 SunTrust Market Value of Equity (SM) 8 SunTrust Book Value of Equity (SM) 1.0 6 9 SunTrust Expected ROE 10 Southwest Market Value of Equity (S M) 11 Southwest Book Value of Equity (SM) 12 Growth for both banks 13 14 Price to Book ratio for SunTrust 15 Price to Book ratio for Southwest 16 17 Part a 18 SunTrust Cost of Equity 19 20 Part b 21 Southwest ROE $1,500 $750 20% $1,000 $750 5% II Color Codes Given Calculated Qualitative answer

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION To determine the cost of equity for Suntrust Banks we can use the market value of equity 15 billion the book value of equity 750 million and the expected return on equity 20 The formula for e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started