Ferrell Inc. recently reported net income of $6 million. It has 230,000 shares of common stock, which currently trades at $57 a share. Ferrell

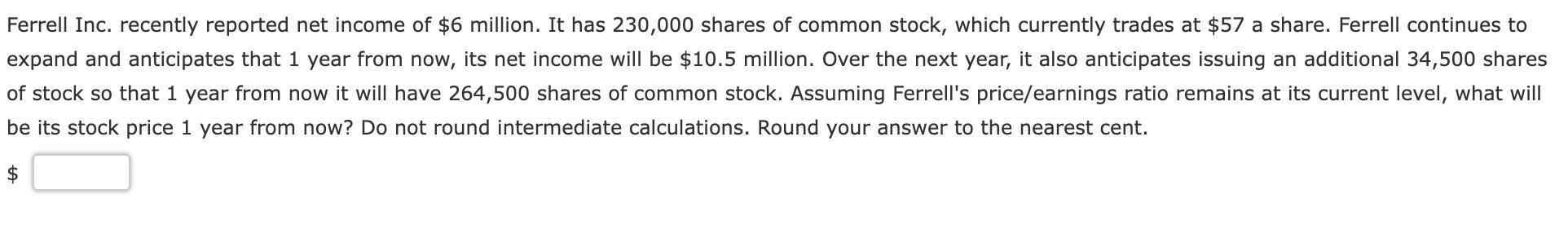

Ferrell Inc. recently reported net income of $6 million. It has 230,000 shares of common stock, which currently trades at $57 a share. Ferrell continues to expand and anticipates that 1 year from now, its net income will be $10.5 million. Over the next year, it also anticipates issuing an additional 34,500 shares of stock so that 1 year from now it will have 264,500 shares of common stock. Assuming Ferrell's price/earnings ratio remains at its current level, what will be its stock price 1 year from now? Do not round intermediate calculations. Round your answer to the nearest cent. $

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

WN1 WN2 Main Answer 1 2 Recent EPS Recently Reported Net Income Sha...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started