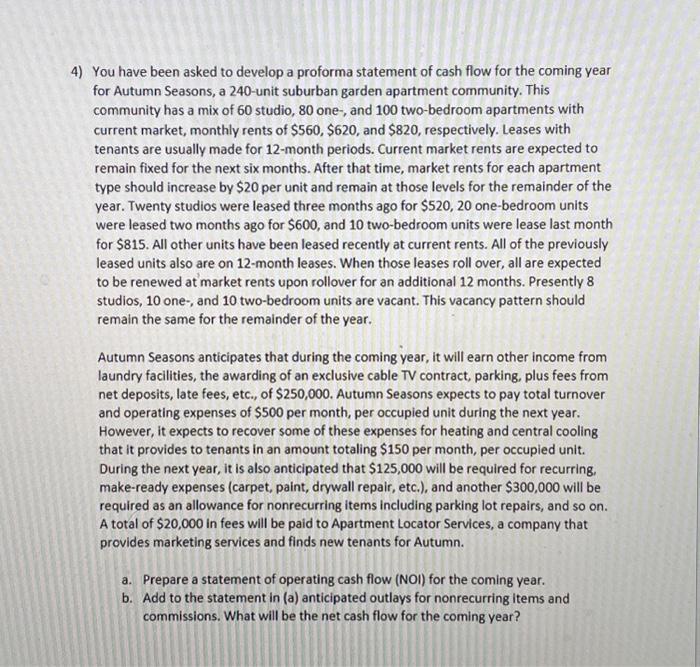

You have been asked to develop a proforma statement of cash flow for the coming year for Autumn Seasons, a 240-unit suburban garden apartment community. This community has a mix of 60 studio, 80 one-, and 100 two-bedroom apartments with current market, monthly rents of $560,$620, and $820, respectively. Leases with tenants are usually made for 12 -month periods. Current market rents are expected to remain fixed for the next six months. After that time, market rents for each apartment type should increase by $20 per unit and remain at those levels for the remainder of the year. Twenty studios were leased three months ago for $520,20 one-bedroom units were leased two months ago for $600, and 10 two-bedroom units were lease last month for $815. All other units have been leased recently at current rents. All of the previously leased units also are on 12-month leases. When those leases roll over, all are expected to be renewed at market rents upon rollover for an additional 12 months. Presently 8 studios, 10 one-, and 10 two-bedroom units are vacant. This vacancy pattern should remain the same for the remainder of the year. Autumn Seasons anticipates that during the coming year, it will earn other income from laundry facilities, the awarding of an exclusive cable TV contract, parking, plus fees from net deposits, late fees, etc., of $250,000. Autumn Seasons expects to pay total turnover and operating expenses of $500 per month, per occupied unit during the next year. However, it expects to recover some of these expenses for heating and central cooling that it provides to tenants in an amount totaling $150 per month, per occupied unit. During the next year, it is also anticipated that $125,000 will be required for recurring, make-ready expenses (carpet, paint, drywall repair, etc.), and another $300,000 will be required as an allowance for nonrecurring items including parking lot repairs, and so on. A total of $20,000 in fees will be paid to Apartment Locator Services, a company that provides marketing services and finds new tenants for Autumn. a. Prepare a statement of operating cash flow (NOI) for the coming year. b. Add to the statement in (a) anticipated outlays for nonrecurring items and commissions. What will be the net cash flow for the coming year