Answered step by step

Verified Expert Solution

Question

1 Approved Answer

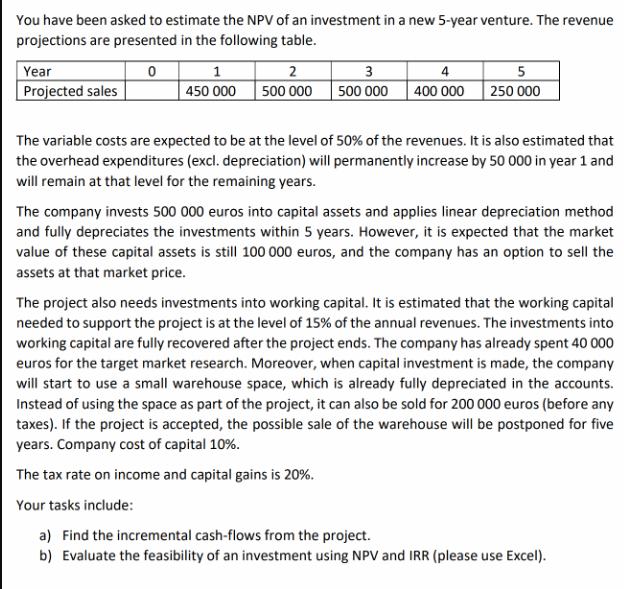

You have been asked to estimate the NPV of an investment in a new 5-year venture. The revenue projections are presented in the following

You have been asked to estimate the NPV of an investment in a new 5-year venture. The revenue projections are presented in the following table. 0 Year Projected sales 1 2 450 000 500 000 3 500 000 4 400 000 5 250 000 The variable costs are expected to be at the level of 50% of the revenues. It is also estimated that the overhead expenditures (excl. depreciation) will permanently increase by 50 000 in year 1 and will remain at that level for the remaining years. The tax rate on income and capital gains is 20%. Your tasks include: The company invests 500 000 euros into capital assets and applies linear depreciation method and fully depreciates the investments within 5 years. However, it is expected that the market value of these capital assets is still 100 000 euros, and the company has an option to sell the assets at that market price. The project also needs investments into working capital. It is estimated that the working capital needed to support the project is at the level of 15% of the annual revenues. The investments into working capital are fully recovered after the project ends. The company has already spent 40 000 euros for the target market research. Moreover, when capital investment is made, the company will start to use a small warehouse space, which is already fully depreciated in the accounts. Instead of using the space as part of the project, it can also be sold for 200 000 euros (before any taxes). If the project is accepted, the possible sale of the warehouse will be postponed for five years. Company cost of capital 10%. a) Find the incremental cash-flows from the project. b) Evaluate the feasibility of an investment using NPV and IRR (please use Excel).

Step by Step Solution

★★★★★

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Incremental cashflows from the project The incremental cashflows from the project are the difference between the cash flows that will occur if the p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started