Answered step by step

Verified Expert Solution

Question

1 Approved Answer

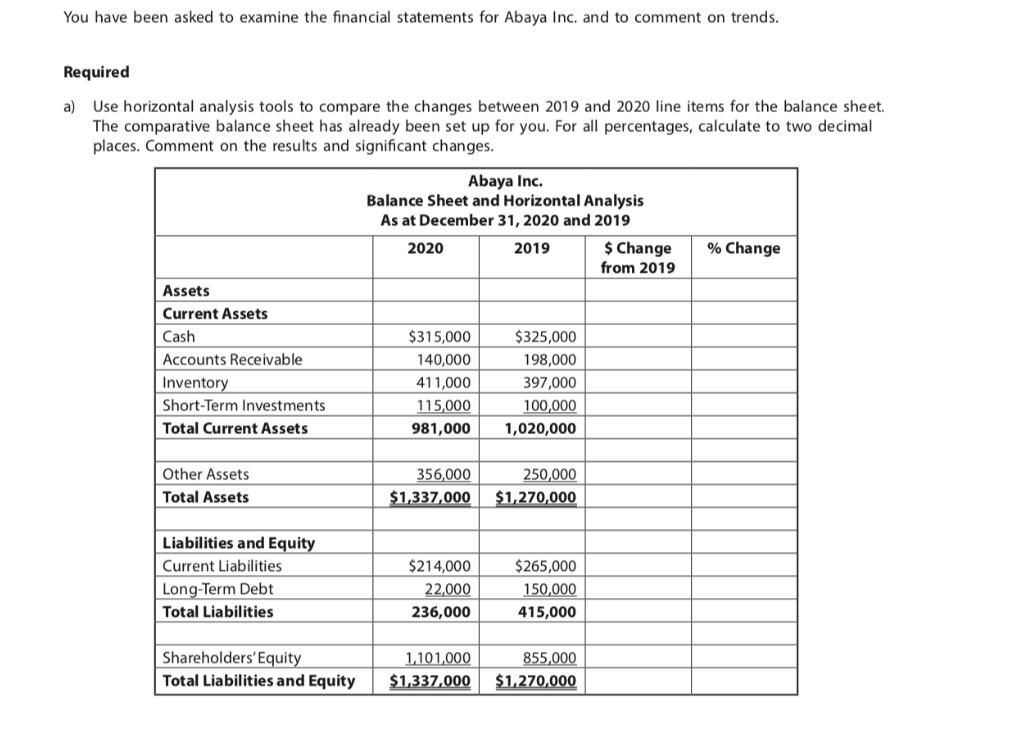

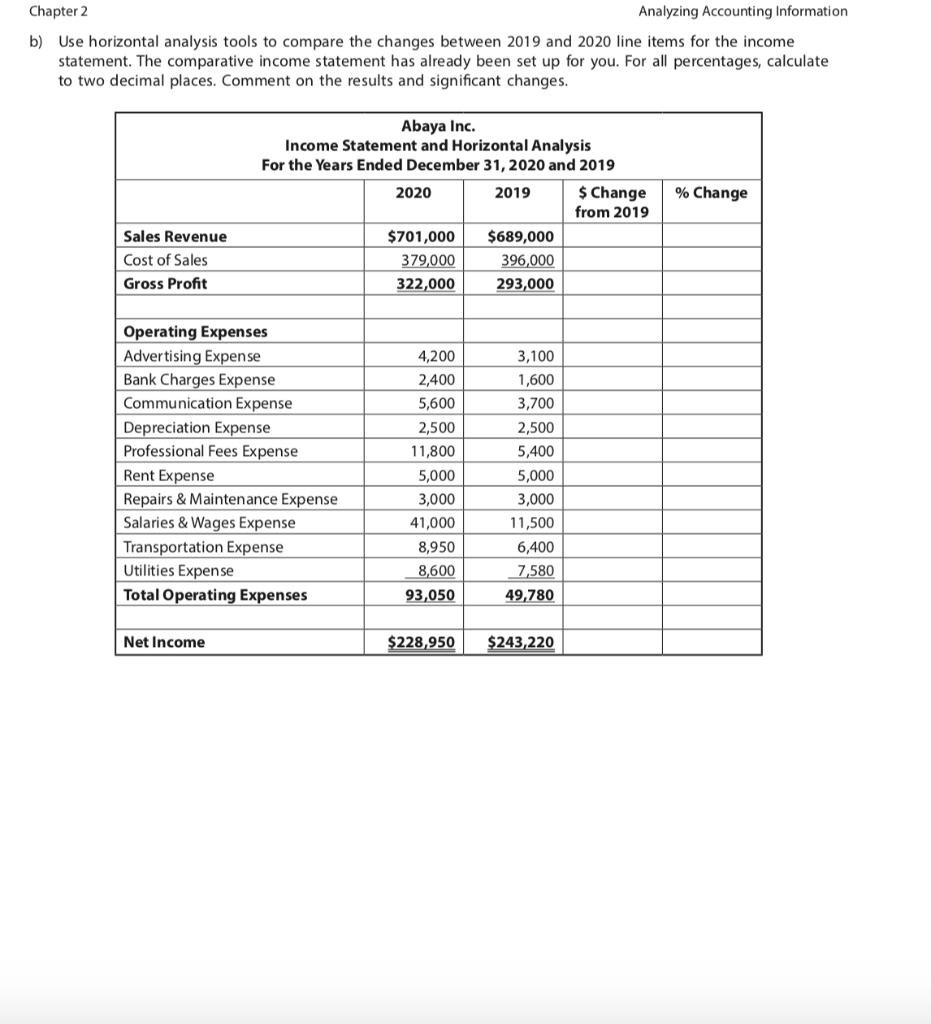

You have been asked to examine the financial statements for Abaya Inc. and to comment on trends. Required a) Use horizontal analysis tools to

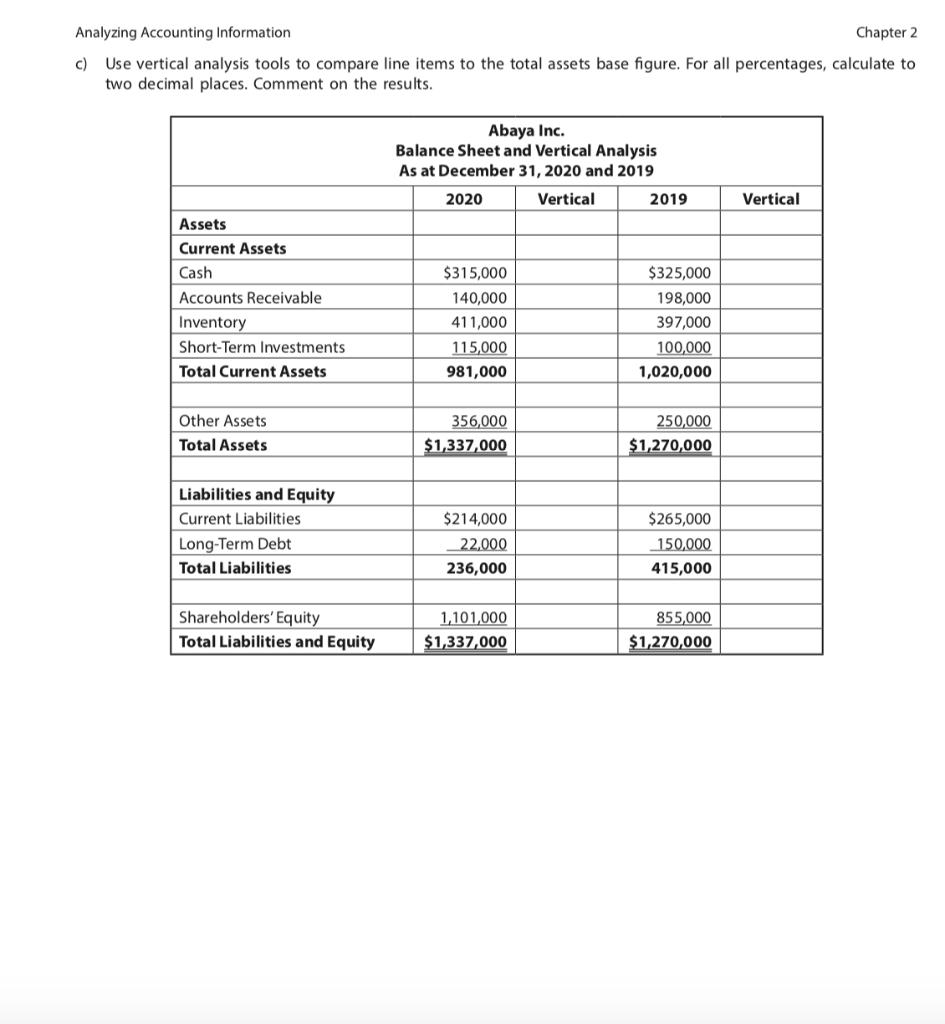

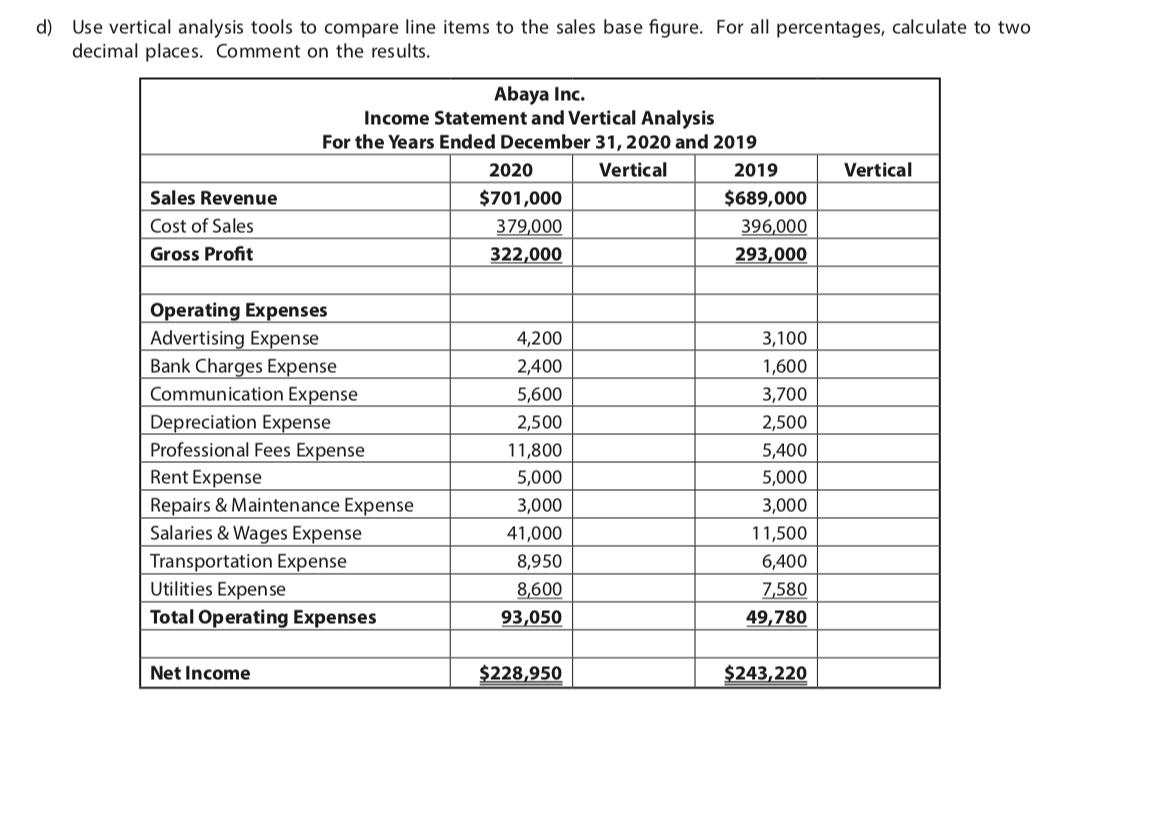

You have been asked to examine the financial statements for Abaya Inc. and to comment on trends. Required a) Use horizontal analysis tools to compare the changes between 2019 and 2020 line items for the balance sheet. The comparative balance sheet has already been set up for you. For all percentages, calculate to two decimal places. Comment on the results and significant changes. Assets Current Assets Cash Accounts Receivable Inventory Short-Term Investments Total Current Assets Other Assets Total Assets Liabilities and Equity Current Liabilities Long-Term Debt Total Liabilities Shareholders' Equity Total Liabilities and Equity Abaya Inc. Balance Sheet and Horizontal Analysis As at December 31, 2020 and 2019 2020 2019 $315,000 140,000 411,000 115,000 981,000 356,000 $1,337,000 $214,000 22,000 236,000 1,101,000 $1,337,000 $325,000 198,000 397,000 100,000 1,020,000 250,000 $1,270,000 $265,000 150,000 415,000 855,000 $1,270,000 $ Change from 2019 % Change Chapter 2 Analyzing Accounting Information b) Use horizontal analysis tools to compare the changes between 2019 and 2020 line items for the income statement. The comparative income statement has already been set up for you. For all percentages, calculate to two decimal places. Comment on the results and significant changes. Sales Revenue Cost of Sales Gross Profit Abaya Inc. Income Statement and Horizontal Analysis For the Years Ended December 31, 2020 and 2019 2019 Operating Expenses Advertising Expense Bank Charges Expense Communication Expense Depreciation Expense Professional Fees Expense Rent Expense Repairs & Maintenance Expense Salaries & Wages Expense Transportation Expense Utilities Expense Total Operating Expenses Net Income 2020 $701,000 379,000 322,000 4,200 2,400 5,600 2,500 11,800 5,000 3,000 41,000 8,950 8,600 93,050 $689,000 396,000 293,000 3,100 1,600 3,700 2,500 5,400 5,000 3,000 11,500 6,400 7,580 49,780 $228,950 $243,220 $ Change from 2019 % Change Analyzing Accounting Information Chapter 2 c) Use vertical analysis tools to compare line items to the total assets base figure. For all percentages, calculate to two decimal places. Comment on the results. Assets Current Assets Cash Accounts Receivable Inventory Short-Term Investments. Total Current Assets Other Assets Total Assets Liabilities and Equity Current Liabilities Long-Term Debt Total Liabilities Shareholders' Equity Total Liabilities and Equity Abaya Inc. Balance Sheet and Vertical Analysis As at December 31, 2020 and 2019 2020 Vertical $315,000 140,000 411,000 115,000 981,000 356,000 $1,337,000 $214,000 22,000 236,000 1,101,000 $1,337,000 2019 $325,000 198,000 397,000 100,000 1,020,000 250,000 $1,270,000 $265,000 150,000 415,000 855,000 $1,270,000 Vertical d) Use vertical analysis tools to compare line items to the sales base figure. For all percentages, calculate to two decimal places. Comment on the results. Sales Revenue Cost of Sales Gross Profit Abaya Inc. Income Statement and Vertical Analysis For the Years Ended December 31, 2020 and 2019 Vertical Operating Expenses Advertising Expense Bank Charges Expense Communication Expense Depreciation Expense Professional Fees Expense Rent Expense Repairs & Maintenance Expense Salaries & Wages Expense Transportation Expense Utilities Expense Total Operating Expenses Net Income 2020 $701,000 379,000 322,000 4,200 2,400 5,600 2,500 11,800 5,000 3,000 41,000 8,950 8,600 93,050 $228,950 2019 $689,000 396,000 293,000 3,100 1,600 3,700 2,500 5,400 5,000 3,000 11,500 6,400 7,580 49,780 $243,220 Vertical

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

J R S P T 3 0 Assets Current Assets Cash Accounts Receivable other Assels Tatal 315000 325000 100 30...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started