Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been asked to give an economical assessment based on ownership cost and operating cost ($/hr) of a loader with the purchase price

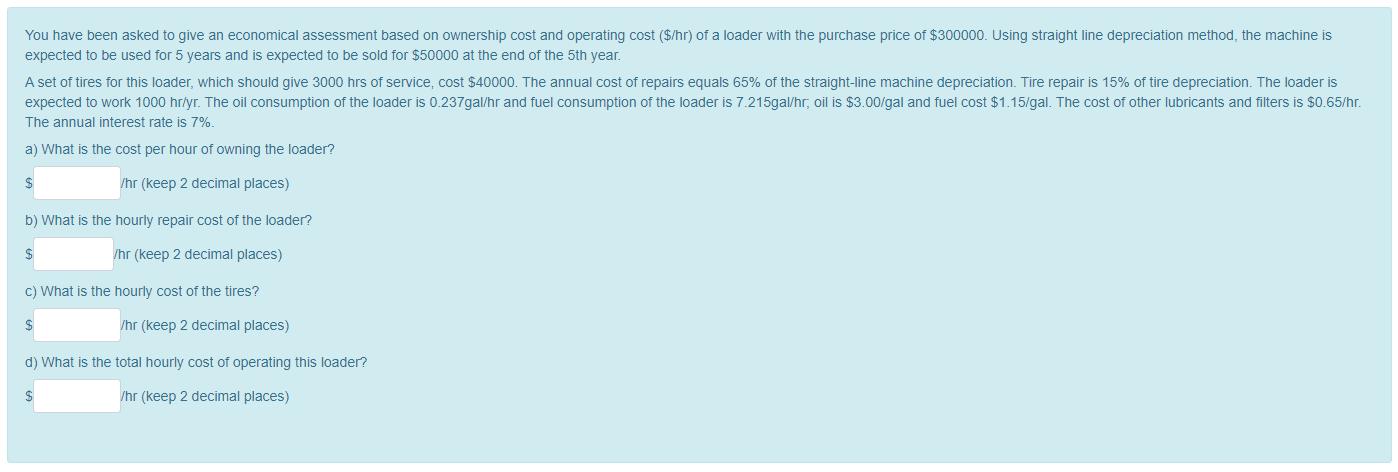

You have been asked to give an economical assessment based on ownership cost and operating cost ($/hr) of a loader with the purchase price of $300000. Using straight line depreciation method, the machine is expected to be used for 5 years and is expected to be sold for $50000 at the end of the 5th year. A set of tires for this loader, which should give 3000 hrs of service, cost $40000. The annual cost of repairs equals 65% of the straight-line machine depreciation. Tire repair is 15% of tire depreciation. The loader is expected to work 1000 hriyr. The oil consumption of the loader is 0.237gal/hr and fuel consumption of the loader is 7.215gal/hr, oil is $3.00/gal and fuel cost $1.15/gal. The cost of other lubricants and filters is $0.65/hr. The annual interest rate is 7%. a) What is the cost per hour of owning the loader? /hr (keep 2 decimal places) b) What is the hourly repair cost of the loader? /hr (keep 2 decimal places) c) What is the hourly cost of the tires? /hr (keep 2 decimal places) d) What is the total hourly cost of operating this loader? /hr (keep 2 decimal places)

Step by Step Solution

★★★★★

3.50 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Statement showing computation g Cost per houe f perating the Loader in PARTICULARS AMOUNT Wouki...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started