Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been asked to help a manufacturing company decide whether it should invest in a new 3 year project. To help with your analysis,

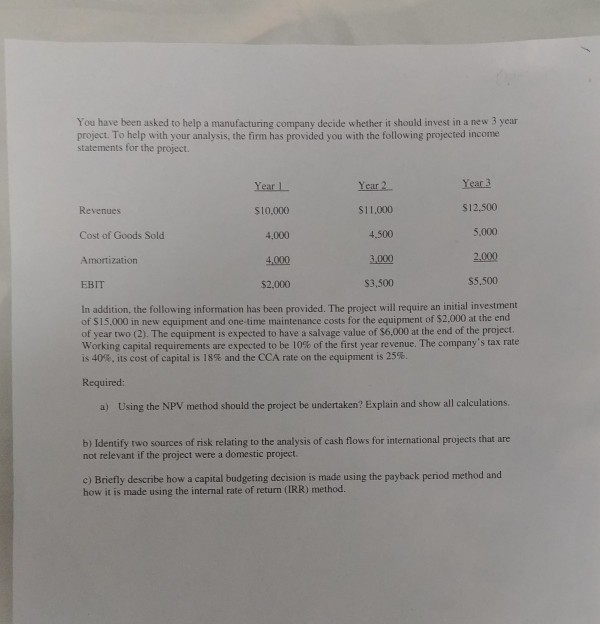

You have been asked to help a manufacturing company decide whether it should invest in a new 3 year project. To help with your analysis, the firm has provided you with the following projected income statements for the project. Year 3 Year I Year 2 $12.500 Revenues $11,000 $10,000 5,000 4,500 Cost of Goods Sold 4,000 2.000 3,000 Amortization 4.000 $5,500 $3,500 $2,000 EBIT In addition, the following information has been provided. The project will require an initial investment of $15,000 in new equipment and one-time maintenance costs for the equipment of $2,000 at the end of year two (2). The equipment is expected to have a salvage value of $6,000 at the end of the project Working capital requirements are expected to be 10% of the first year revenue. The company's tax rate is 40%, its cost of capital is 18% and the CCA rate on the equipment is 25%. Required: a) Using the NPV method should the project be undertaken? Explain and show all calculations. b) Identify two sources of risk relating to the analysis of cash flows for international projects that are not relevant if the project were a domestic project. c) Briefly describe how a capital budgeting decision is made using the payback period method and how it is made using the internal rate of return (IRR) method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started