Answered step by step

Verified Expert Solution

Question

1 Approved Answer

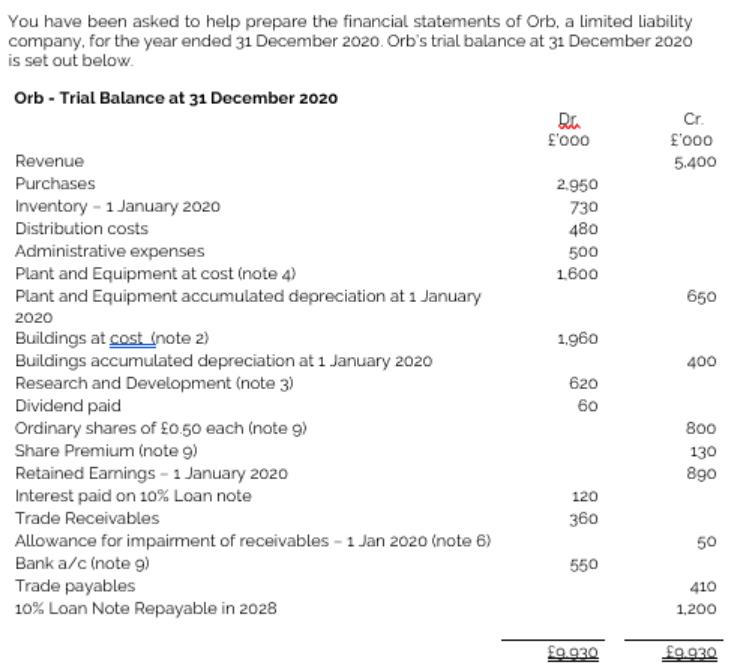

You have been asked to help prepare the financial statements of Orb, a limited liability company, for the year ended 31 December 2020. Orb's

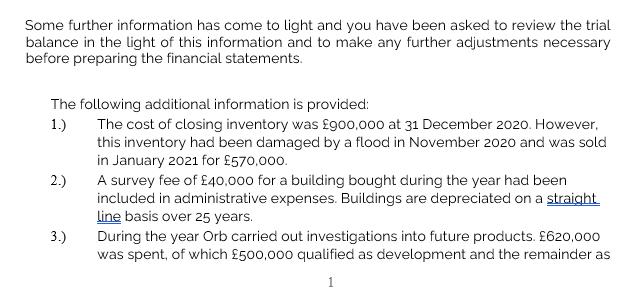

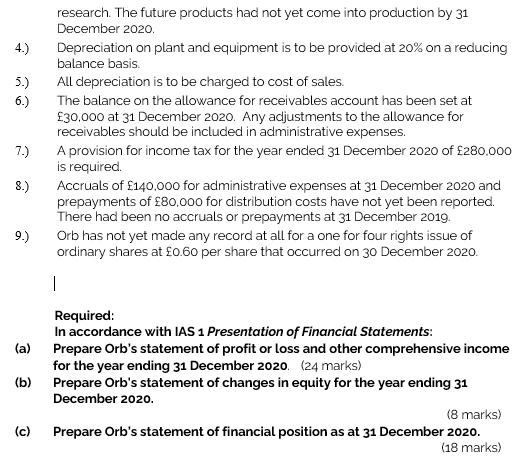

You have been asked to help prepare the financial statements of Orb, a limited liability company, for the year ended 31 December 2020. Orb's trial balance at 31 December 2020 is set out below. Orb - Trial Balance at 31 December 2020 Cr. 'o00 000,3 Revenue 5.400 Purchases 2.950 Inventory - 1 January 2020 730 Distribution costs 480 Administrative expenses Plant and Equipment at cost (note 4) Plant and Equipment accumulated depreciation at 1 January 500 1600 650 2020 Buildings at cost (note 2) Buildings accumulated depreciation at 1 January 2020 Research and Development (note 3) Dividend paid Ordinary shares of 0.50 each (note g) Share Premium (note 9) Retained Earnings - 1 January 2020 Interest paid on 10% Loan note 1,960 400 620 60 800 130 890 120 Trade Receivables 360 Allowance for impairment of receivables - 1 Jan 2020 (note 6) Bank a/c (note g) Trade payables 10% Loan Note Repayable in 2028 50 550 410 1,200 g 930 Some further information has come to light and you have been asked to review the trial balance in the light of this information and to make any further adjustments necessary before preparing the financial statements. The following additional information is provided: 1.) The cost of closing inventory was 900,000 at 31 December 2020. However, this inventory had been damaged by a flood in November 2020 and was sold in January 2021 for 570,000. A survey fee of 40,000 for a building bought during the year had been included in administrative expenses. Buildings are depreciated on a straight Line basis over 25 years. During the year Orb carried out investigations into future products. 620,000 was spent, of which 500,000 qualified as development and the remainder as 2.) 3.) 1 research. The future products had not yet come into production by 31 December 2020. 4.) Depreciation on plant and equipment is to be provided at 20% on a reducing balance basis. % on 5.) All depreciation is to be charged to cost of sales. 6.) The balance on the allowance for receivables account has been set at 30.000 at 31 December 2020. Any adjustments to the allowance for receivables should be included in administrative expenses. A provision for income tax for the year ended 31 December 2020 of 280.000 7.) is required. Accruals of 140.000 for administrative expenses at 31 December 2020 and prepayments of 80,000 for distribution costs have not yet been reported. There had been no accruals or prepayments at 31 December 2019. Orb has not yet made any record at all for a one for four rights issue of ordinary shares at 0.60 per share that occurred on 30 December 2020. 8.) 9.) Required: In accordance with IAS 1 Presentation of Financial Statements: Prepare Orb's statement of profit or loss and other comprehensive income for the year ending 31 December 2020. (24 marks) Prepare Orb's statement of changes in equity for the year ending 31 December 2020. (a) (b) (8 marks) (c) Prepare Orb's statement of financial position as at 31 December 2020. (18 marks)

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Statement of profit and loss account and other comprehensive income For the year ended 31 December 2020 000 Revenue 5400 Less cost of sales 3380 Gross ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started