Answered step by step

Verified Expert Solution

Question

1 Approved Answer

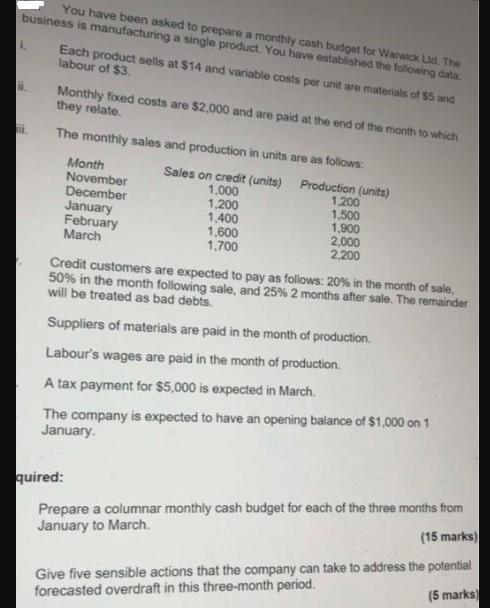

You have been asked to prepare a monthly cash budget for Warwick Ltd. The business is manufacturing a single product. You have established the

You have been asked to prepare a monthly cash budget for Warwick Ltd. The business is manufacturing a single product. You have established the following data: 11. i. i. Each product sells at $14 and variable costs per unit are materials of $5 and labour of $3. Monthly fixed costs are $2,000 and are paid at the end of the month to which they relate. The monthly sales and production in units are as follows: Sales on credit (units) Production (units) 1,000 1,200 1,400 1,600 1,700 Month November December January February March 1,200 1,500 1,900 2,000 2,200 Credit customers are expected to pay as follows: 20% in the month of sale, 50% in the month following sale, and 25% 2 months after sale. The remainder will be treated as bad debts. Suppliers of materials are paid in the month of production. Labour's wages are paid in the month of production. A tax payment for $5,000 is expected in March. The company is expected to have an opening balance of $1,000 on 1 January. quired: Prepare a columnar monthly cash budget for each of the three months from January to March. (15 marks) Give five sensible actions that the company can take to address the potential forecasted overdraft in this three-month period. (5 marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the monthly cash budget for Warwick Ltd we need to consider the sales production costs and payment terms provided Heres a columnar monthly ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started