Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been asked to provide advice on income protection for single mum, Emily and her twin boys, Nathan and Max age 12. Emily

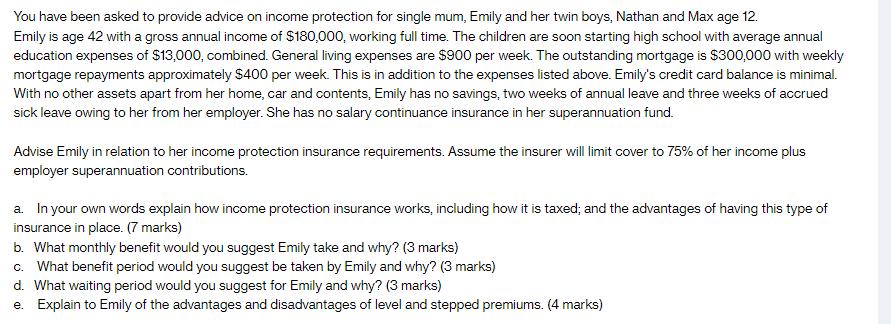

You have been asked to provide advice on income protection for single mum, Emily and her twin boys, Nathan and Max age 12. Emily is age 42 with a gross annual income of $180,000, working full time. The children are soon starting high school with average annual education expenses of $13,000, combined. General living expenses are $900 per week. The outstanding mortgage is $300,000 with weekly mortgage repayments approximately $400 per week. This is in addition to the expenses listed above. Emily's credit card balance is minimal. With no other assets apart from her home, car and contents, Emily has no savings, two weeks of annual leave and three weeks of accrued sick leave owing to her from her employer. She has no salary continuance insurance in her superannuation fund. Advise Emily in relation to her income protection insurance requirements. Assume the insurer will limit cover to 75% of her income plus employer superannuation contributions. a. In your own words explain how income protection insurance works, including how it is taxed; and the advantages of having this type of insurance in place. (7 marks) b. What monthly benefit would you suggest Emily take and why? (3 marks) c. What benefit period would you suggest be taken by Emily and why? (3 marks) d. What waiting period would you suggest for Emily and why? (3 marks) e. Explain to Emily of the advantages and disadvantages of level and stepped premiums. (4 marks)

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a Explanation of Income Protection Insurance Income protection insurance is a type of coverage that provides financial support to individuals in the event they are unable to work due to illness or inj...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started