Answered step by step

Verified Expert Solution

Question

1 Approved Answer

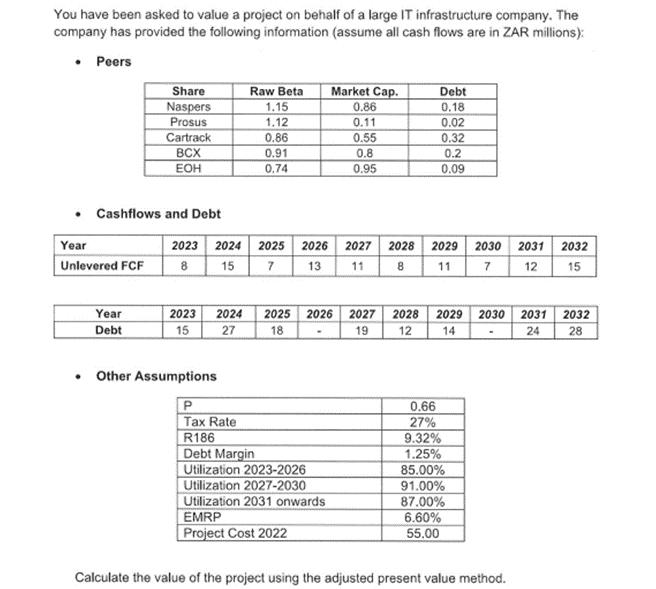

You have been asked to value a project on behalf of a large IT infrastructure company. The company has provided the following information (assume

You have been asked to value a project on behalf of a large IT infrastructure company. The company has provided the following information (assume all cash flows are in ZAR millions): Peers Year Unlevered FCF Share Naspers Prosus Cashflows and Debt Year Debt Cartrack BCX EOH 2023 2024 8 15 Raw Beta 1.15 1.12 0.86 0.91 0.74 Other Assumptions 2023 2024 2025 15 27 18 P Tax Rate R186 Debt Margin Market Cap. 0.86 0.11 0.55 0.8 0.95 Utilization 2023-2026 Utilization 2027-2030 Utilization 2031 onwards EMRP Project Cost 2022 2025 2026 2027 2028 2029 2030 2031 2032 7 13 11 8 11 7 12 15 2026 2027 19 Debt 0.18 0.02 0.32 0.2 0.09 0.66 27% 2028 2029 12 14 9.32% 1.25% 85.00% 91.00% 87.00% 6.60% 55.00 2030 Calculate the value of the project using the adjusted present value method. 2031 2032 24 28

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

First lets calculate the unlevered free cash flows FCFs for the project 2023 R8 million 2024 R15 mil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started