Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been assigned 2 competitor companies whose financial statements you will analyze. You MUST analyze the companies you are assigned to. If you

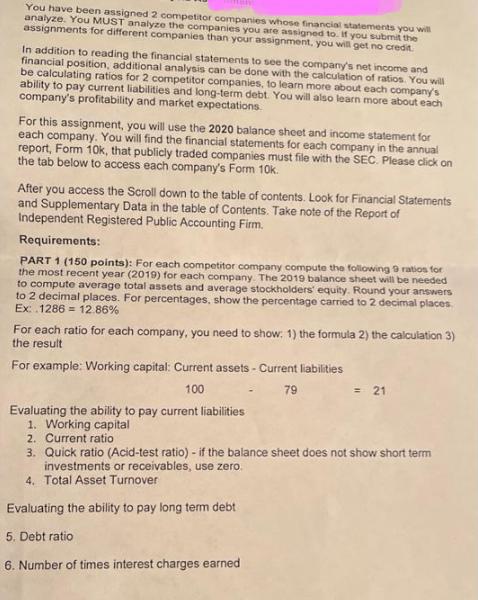

You have been assigned 2 competitor companies whose financial statements you will analyze. You MUST analyze the companies you are assigned to. If you submit the assignments for different companies than your assignment, you will get no credit. In addition to reading the financial statements to see the company's net income and financial position, additional analysis can be done with the calculation of ratios. You will be calculating ratios for 2 competitor companies, to learn more about each company's ability to pay current liabilities and long-term debt. You will also learn more about each company's profitability and market expectations For this assignment, you will use the 2020 balance sheet and income statement for each company. You will find the financial statements for each company in the annual report, Form 10k, that publicly traded companies must file with the SEC. Please click on the tab below to access each company's Form 10k. After you access the Scroll down to the table of contents. Look for Financial Statements and Supplementary Data in the table of Contents. Take note of the Report of Independent Registered Public Accounting Firm. Requirements: PART 1 (150 points): For each competitor company compute the following 9 ration for the most recent year (2019) for each company. The 2019 balance sheet will be needed to compute average total assets and average stockholders' equity. Round your answers to 2 decimal places. For percentages, show the percentage carried to 2 decimal places Ex 1286 = 12.86% For each ratio for each company, you need to show. 1) the formula 2) the calculation 3) the result For example: Working capital: Current assets - Current liabilities 100 79 = 21 Evaluating the ability to pay current liabilities 1. Working capital 2. Current ratio 3. Quick ratio (Acid-test ratio) - if the balance sheet does not show short term investments or receivables, use zero. 4. Total Asset Turnover Evaluating the ability to pay long term debt 5. Debt ratio 6. Number of times interest charges earned

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

RATIO ANALYSIS 2020 RATIOS Formula Dollar Tree Dollar General LIQUIDITY 1 Working Capital current assets current liabilities 132050 120343600 2 Current ratio current assets current liabilities 135 121 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started