Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been assigned to value a local office building. This building contains 15,000 SF of rentable area. Based on the information below, determine

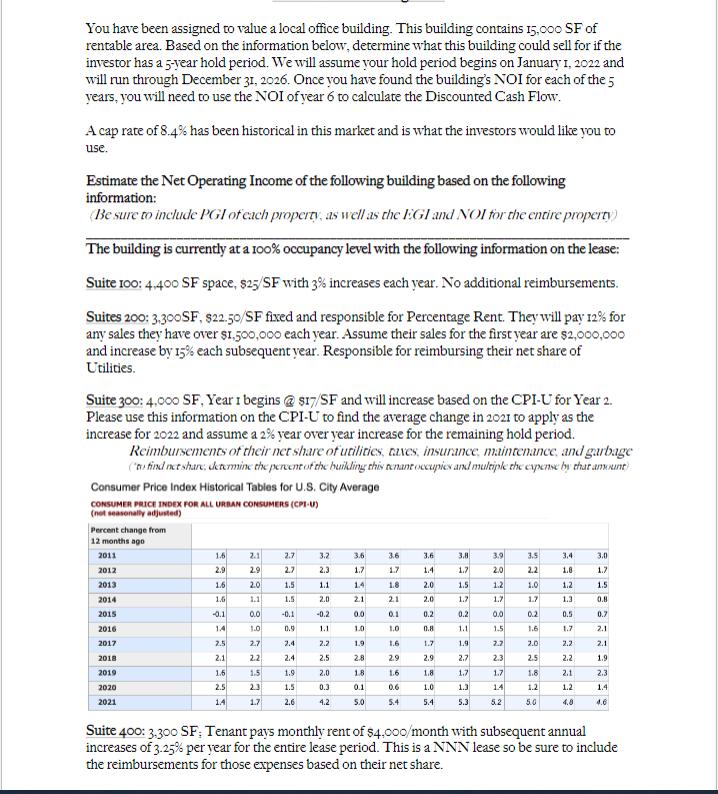

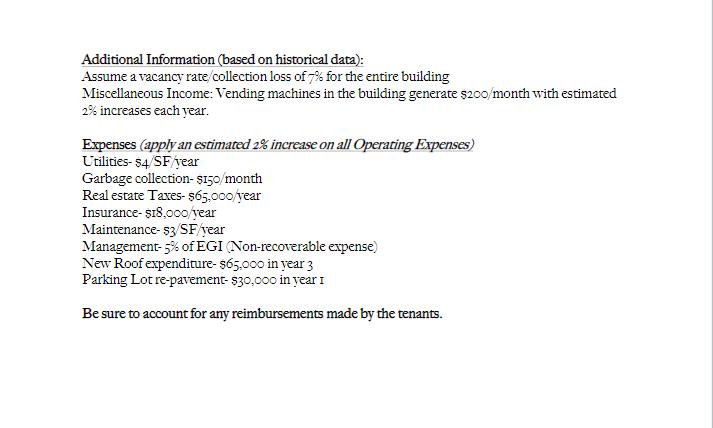

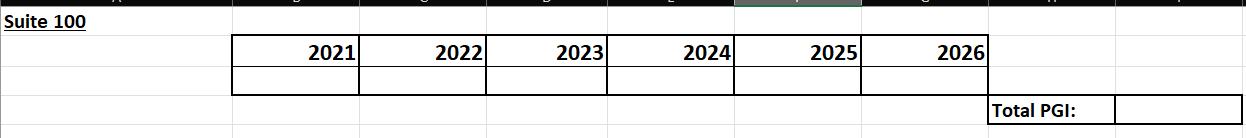

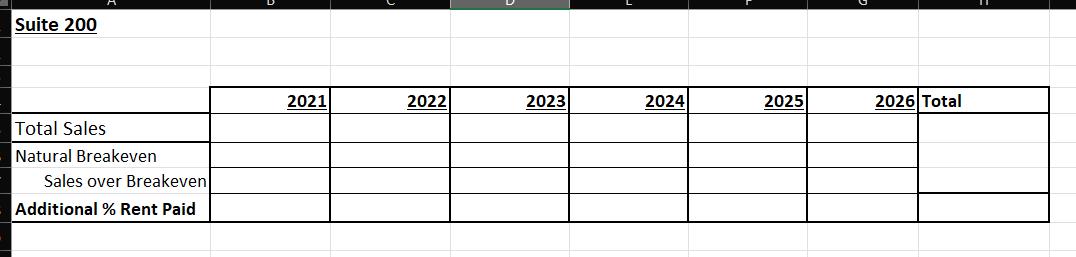

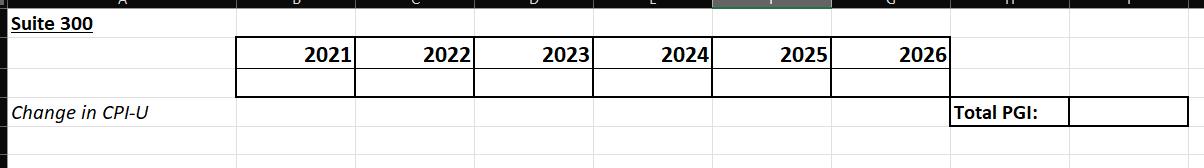

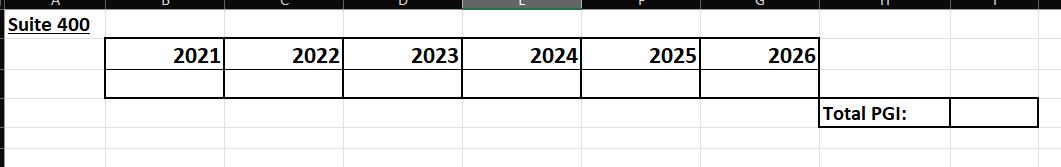

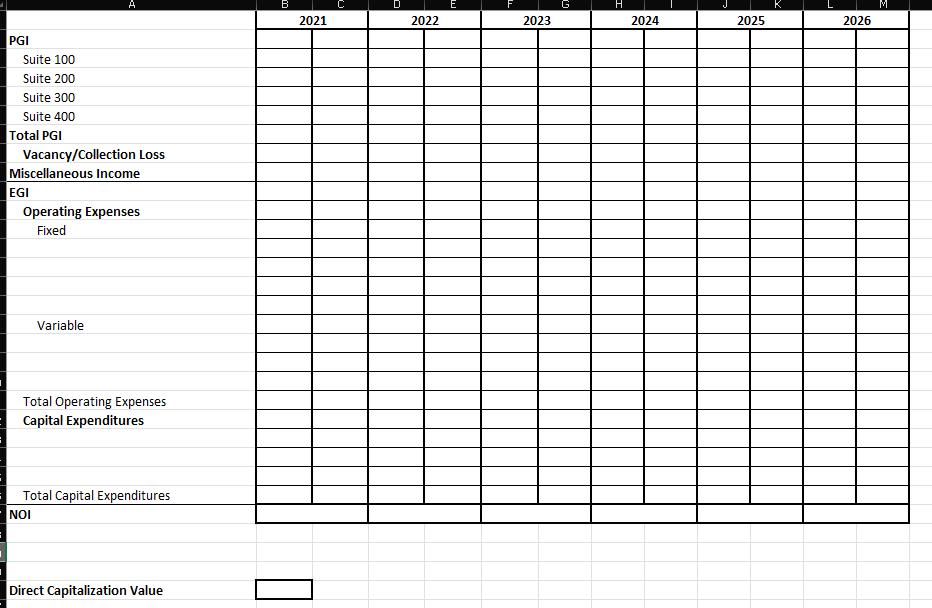

You have been assigned to value a local office building. This building contains 15,000 SF of rentable area. Based on the information below, determine what this building could sell for if the investor has a 5-year hold period. We will assume your hold period begins on January 1, 2022 and will run through December 31, 2026. Once you have found the building's NOI for each of the 5 years, you will need to use the NOI of year 6 to calculate the Discounted Cash Flow. A cap rate of 8.4% has been historical in this market and is what the investors would like you to use. Estimate the Net Operating Income of the following building based on the following information: (Be sure to include PGI of each property, as well as the EGI and NOI for the entire property) The building is currently at a 100% occupancy level with the following information on the lease: Suite 100: 4.400 SF space, $25/SF with 3% increases each year. No additional reimbursements. Suites 200: 3.300SF, $22.50/SF fixed and responsible for Percentage Rent. They will pay 12% for any sales they have over $1,500,000 each year. Assume their sales for the first year are $2,000,000 and increase by 15% each subsequent year. Responsible for reimbursing their net share of Utilities. Suite 300: 4,000 SF, Year 1 begins @ $17/SF and will increase based on the CPI-U for Year 2. Please use this information on the CPI-U to find the average change in 2021 to apply as the increase for 2022 and assume a 2% year over year increase for the remaining hold period. Reimbursements of their net share of utilities, taxes, insurance, maintenance, and garbage (to find not share, determine the percent of the building this tenant occupies and multiple the expense by that amount Consumer Price Index Historical Tables for U.S. City Average CONSUMER PRICE INDEX FOR ALL URBAN CONSUMERS (CPI-U) (not seasonally adjusted) Percent change from 12 months ago 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 1.6 2.9 1.6 1.6 -0.1 1.4 2.5 2.1 1.6 2.5 1.4 2.1 2.9 2.0 1.1 0.0 1.0 27 2.2 1.5 2.3 1.7 2.7 2.7 1.5 1.5 -0.1 0.9 2.4 2.4 1.9 1.5 2.6 3.2 2.3 1.1 2.0 -0.2 1.1 2.5 2.0 0.3 4.2 3.6 97 1.7 13 1.4 2.1 0.0 90 1.0 1.9 2.8 1.8 0.1 5.0 1.7 1.8 21 0.1 1.0 1.6 2.9 1.6 0.6 5.4 3.6 1.4 2.0 2.0 0.2 0.8 1.7 2.9 1.8 1.0 5.4 3.8 1.7 1.5 1.7 0.2 1.1 1.9 2.7 1.7 1.3 5.3 232382238 3.9 2.0 1.2 1.7 0.0 1.5 1.7 14 5.2 3.5 SEEEEEEEEEE 2.2 1.0 1.7 0.2 1.6 2.0 2.5 1.8 1.2 5.0 3.4 331332333 1.8 0.5 1.7 2.2 2.2 1.2 4.8 3.0 1.7 1.5 0.8 0.7 2.1 1.9 2.3 1.4 4.6 Suite 400: 3,300 SF; Tenant pays monthly rent of $4,000/month with subsequent annual increases of 3.25% per year for the entire lease period. This is a NNN lease so be sure to include the reimbursements for those expenses based on their net share. Additional Information (based on historical data): Assume a vacancy rate/collection loss of 7% for the entire building Miscellaneous Income: Vending machines in the building generate $200/month with estimated 2% increases each year. Expenses (apply an estimated 2% increase on all Operating Expenses) Utilities- $4/SF/year Garbage collection-$150/month Real estate Taxes- $65,000/year Insurance-$18,000/year Maintenance- $3/SF/year Management-5% of EGI (Non-recoverable expense) New Roof expenditure- $65,000 in year 3 Parking Lot re-pavement-$30,000 in year I Be sure to account for any reimbursements made by the tenants. Suite 100 2021 2022 2023 2024 2025 2026 Total PGI: Suite 200 Total Sales Natural Breakeven Sales over Breakeven Additional % Rent Paid 2021 2022 2023 2024 2025 2026 Total Suite 300 Change in CPI-U 2021 2022 2023 2024 2025 2026 Total PGI: Suite 400 2021 2022 2023 2024 2025 2026 Total PGI: PGI Suite 100 Suite 200 Suite 300 Suite 400 Total PGI Vacancy/Collection Loss Miscellaneous Income EGI A Operating Expenses Fixed Variable Total Operating Expenses Capital Expenditures Total Capital Expenditures Direct Capitalization Value B 2021 C 2022 E 2023 GO H 2024 2025 2026 M

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepbystep workings to value the office building based on the given information Suite 100 2022 4400 SF x 24SF 105600 2023 4400 SF x 2475SF 3 increase 108800 2024 4400 SF x 2550SF 3 increa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started