Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have been brought in as a consultant by a leading publicly-quoted supermarket chain to advise on how to improve their financial performance -

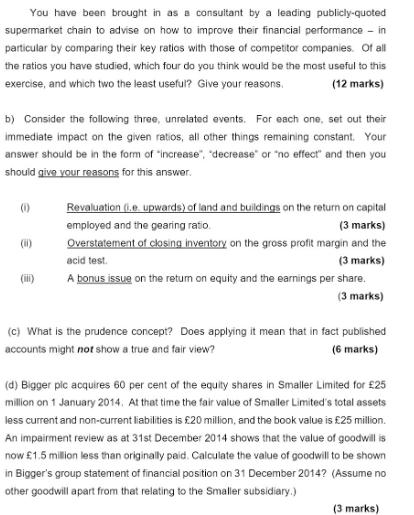

You have been brought in as a consultant by a leading publicly-quoted supermarket chain to advise on how to improve their financial performance - in particular by comparing their key ratios with those of competitor companies. Of all the ratios you have studied, which four do you think would be the most useful to this exercise, and which two the least useful? Give your reasons. (12 marks) b) Consider the following three, unrelated events. For each one, set out their immediate impact on the given ratios, all other things remaining constant. Your answer should be in the form of "increase", "decrease" or "no effect" and then you should give your reasons for this answer. () (1) Revaluation (i.e. upwards) of land and buildings on the return on capital employed and the gearing ratio. (3 marks) Overstatement of closing inventory on the gross profit margin and the acid test. (3 marks) A bonus issue on the return on equity and the earnings per share. (3 marks) (c) What is the prudence concept? Does applying it mean that in fact published accounts might not show a true and fair view? (6 marks) (d) Bigger pic acquires 60 per cent of the equity shares in Smaller Limited for 25 million on 1 January 2014. At that time the fair value of Smaller Limited's total assets less current and non-current liabilities is 20 million, and the book value is 25 million. An impairment review as at 31st December 2014 shows that the value of goodwill is now 1.5 million less than originally paid. Calculate the value of goodwill to be shown in Bigger's group statement of financial position on 31 December 2014? (Assume no other goodwill apart from that relating to the Smaller subsidiary.) (3 marks)

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a The four most useful ratios for comparing financial performance with competitor companies are Return on Equity ROE This ratio measures the profitability of a company by showing how much profit it ge...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started