You have been contacted by XXX Corporation to assist them with the closeout of their year-end. Their family accountant of 35 years decided that he

You have been contacted by XXX Corporation to assist them with the closeout of their year-end. Their family accountant of 35 years decided that he wanted to start retirement a little early this year. You are inheriting an adjusted trial balance which needs to be properly presented into a set of GAAP financials. Here is what we know:

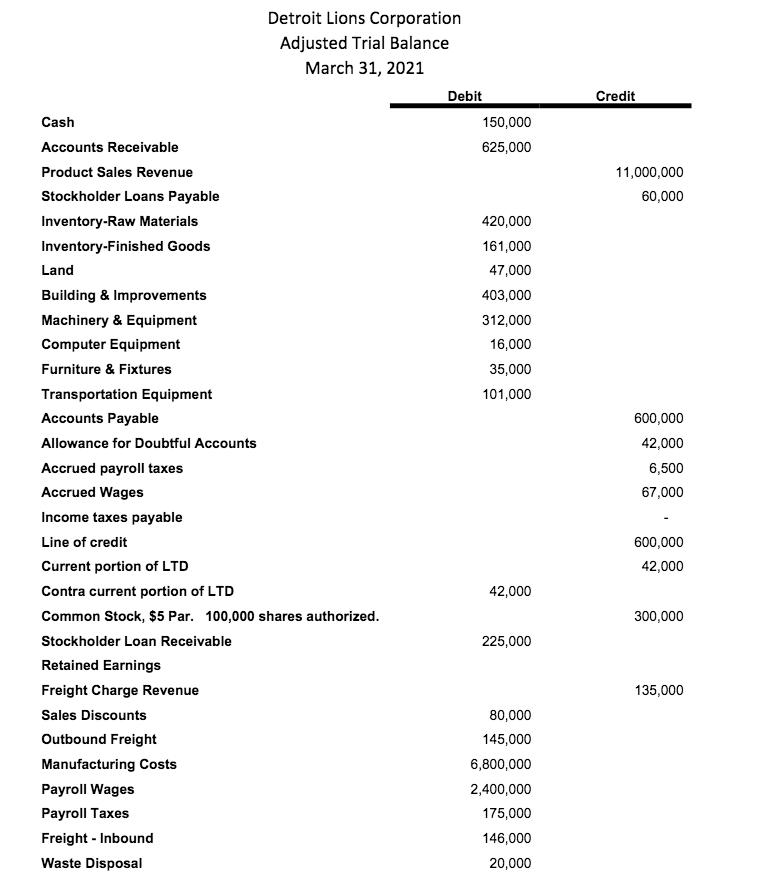

- You can assume that all account balances are accurate.

- This is the first year of operations.

- You will need to record a tax accrual. Assume a flat tax rate of 25%.

- The family accountant left you a love note indicating that the company had recently issued 100, shares of $10 par value stock in exchange for a tract of land.

- No footnote disclosures are needed.

- No dividends were paid this year.

- The loss on disposal of assets was the result of an asset being discarded. No cash proceeds were received on this transaction.

- You can feel free to add any accounts that you deem necessary.

MAKE THE INCOME STATEMENT

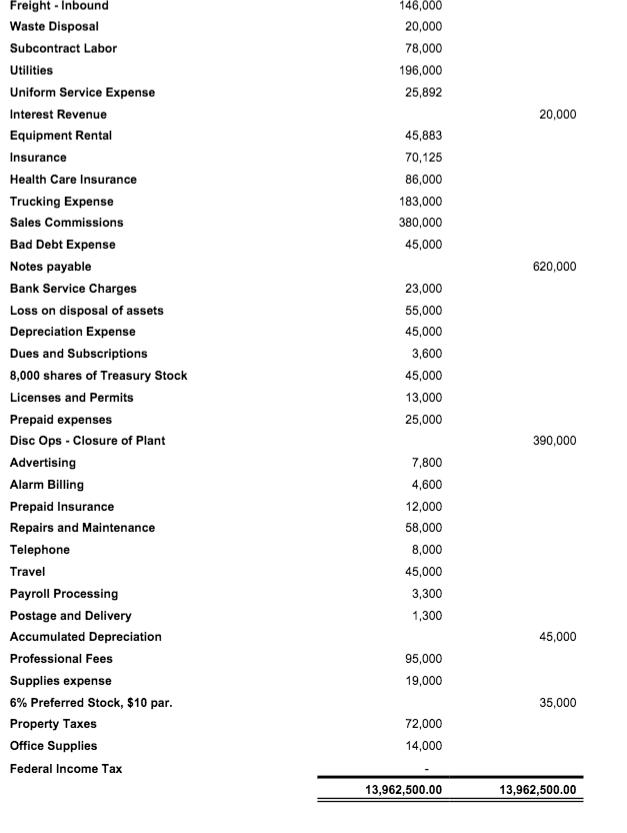

Cash Accounts Receivable Product Sales Revenue Stockholder Loans Payable Inventory-Raw Materials Inventory-Finished Goods Land Building & Improvements Machinery & Equipment Computer Equipment Furniture & Fixtures Detroit Lions Corporation Adjusted Trial Balance March 31, 2021 Transportation Equipment Accounts Payable Allowance for Doubtful Accounts Accrued payroll taxes Accrued Wages Income taxes payable Line of credit Current portion of LTD Contra current portion of LTD Common Stock, $5 Par. 100,000 shares authorized. Stockholder Loan Receivable Retained Earnings Freight Charge Revenue Sales Discounts Outbound Freight Manufacturing Costs Payroll Wages Payroll Taxes Freight - Inbound Waste Disposal Debit 150,000 625,000 420,000 161,000 47,000 403,000 312,000 16,000 35,000 101,000 42,000 225,000 80,000 145,000 6,800,000 2,400,000 175,000 146,000 20,000 Credit 11,000,000 60,000 600,000 42,000 6,500 67,000 600,000 42,000 300,000 135,000

Step by Step Solution

3.47 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

To create the income statement we need to summarize the revenues and expenses for the year We can start with the adjusted trial balance provided and m...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started